- United States

- /

- Commercial Services

- /

- NYSE:ABM

Is Now the Right Time to Reconsider ABM Stock After Recent Share Price Slide?

Reviewed by Bailey Pemberton

Trying to decide what to do with ABM Industries stock? You are not alone. The last few months have been a ride for shareholders. The stock climbed 1.3% in the past week but is still down 4.2% over the last 30 days. Year to date, ABM is trailing with a 9.5% slide, and the past year has been no picnic either, with a 9.6% decline. But take a step back just a bit further, and you see a different story entirely. Over the last 3 and 5 years, ABM shares are up 19.4% and 37.1%, respectively. This longer-term growth shows that, despite recent bumps, the company has delivered steady returns for patient investors.

These market moves have come as investors reassess the risks and opportunities tied to facility services, in a world that seems increasingly aware of operational efficiency and workplace safety. While short-term price action can make anyone second-guess their strategy, it is the underlying value that often matters most in the end.

That brings us to ABM’s current valuation, which stands out for a very good reason. The company scores a 6 on our value analysis, meaning it ticks the box for being undervalued in every single one of our six valuation checks. If you are looking for a stock that might have more value than meets the eye, it is worth tuning in for a closer look at the different ways you can measure ABM’s worth. There is plenty to learn from classic and modern valuation methods alike. Stick around because the end of the article will reveal the approach we think gives the best perspective on ABM’s real value.

Why ABM Industries is lagging behind its peers

Approach 1: ABM Industries Discounted Cash Flow (DCF) Analysis

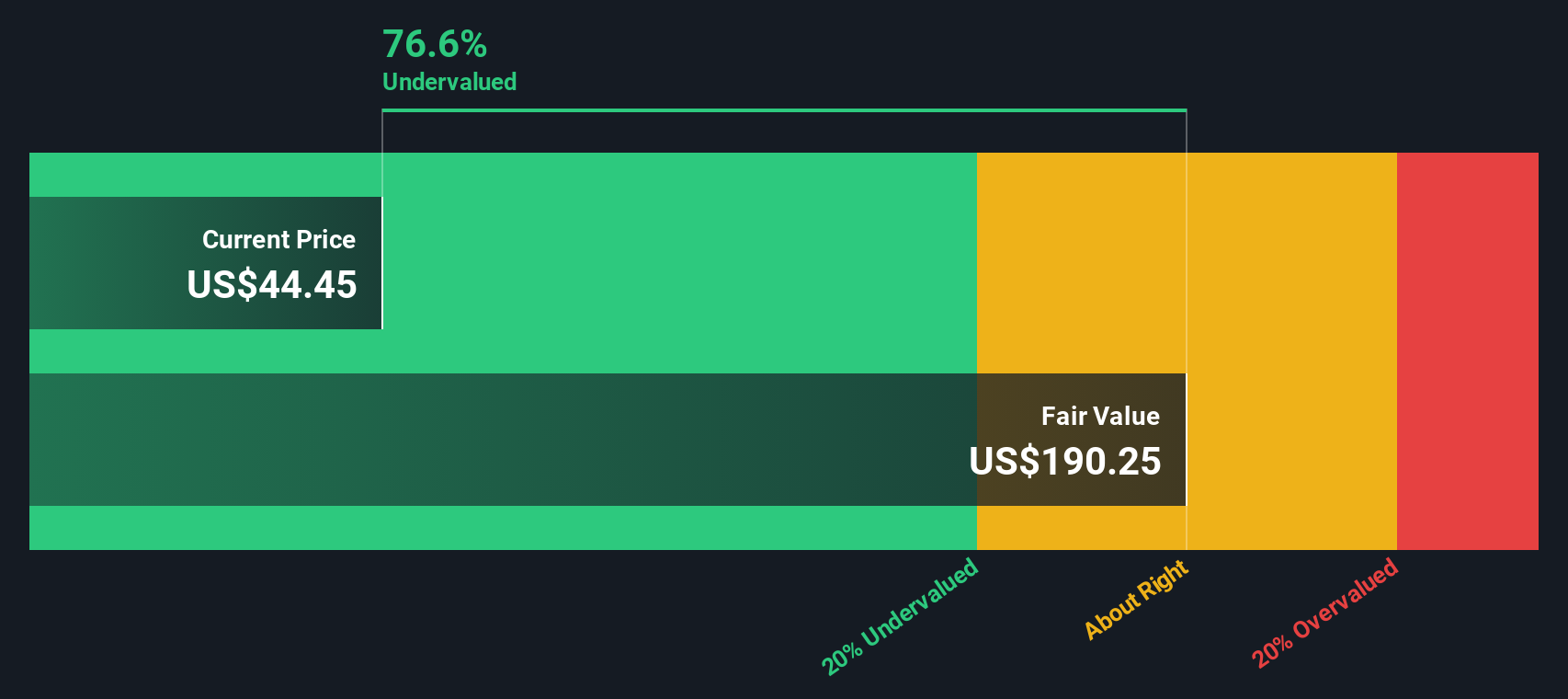

The Discounted Cash Flow (DCF) model estimates the value of ABM Industries by projecting the company’s future cash flows and then discounting those amounts back to today’s value. This approach helps investors determine what the business is truly worth based on its ability to generate cash going forward.

Currently, ABM Industries has a Free Cash Flow of $67.8 million. Analysts predict significant growth in the coming years, with projections showing Free Cash Flow rising steadily to $808.9 million over the next decade. These estimates combine both direct analyst forecasts for the next five years as well as longer-term projections extrapolated by Simply Wall St’s modeling.

Based on this DCF analysis, the estimated intrinsic value of ABM Industries is $191.51 per share. Compared to its current market price, this suggests the stock is trading at a steep discount of 75.9 percent. In other words, the stock appears significantly undervalued relative to what the company’s projected cash flows are worth today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ABM Industries is undervalued by 75.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

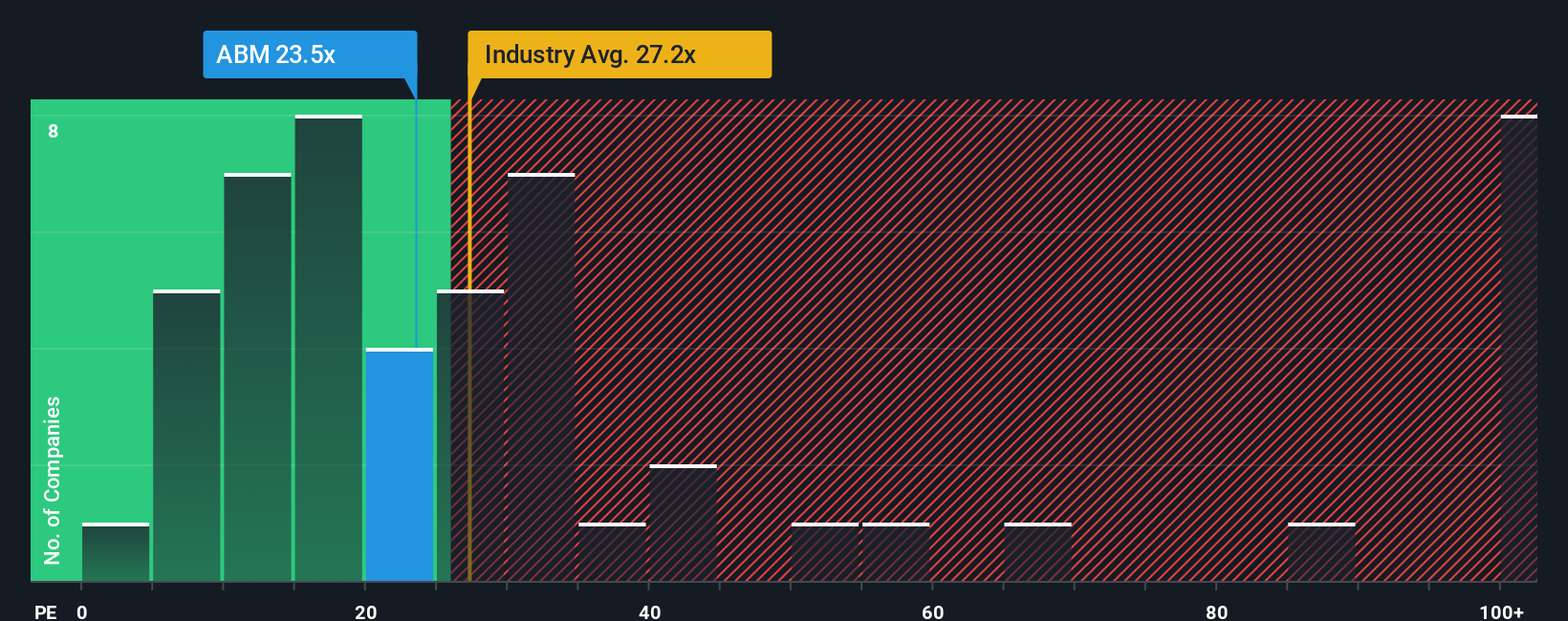

Approach 2: ABM Industries Price vs Earnings

The Price-to-Earnings (PE) ratio is often the preferred metric for valuing profitable companies like ABM Industries because it directly ties a company’s current value to its actual earnings. When a business has consistent profits, the PE ratio offers a straightforward snapshot of what investors are willing to pay for each dollar of earnings, reflecting both market expectations and company performance.

That said, an appropriate or “fair” PE ratio is not one-size-fits-all. It varies based on factors such as growth prospects and business risk. Fast-growing or lower-risk companies typically command a higher PE ratio, while slower or riskier firms trade at a discount.

Currently, ABM Industries trades at a PE ratio of 24.4x. This is slightly below the industry average PE of 28.0x and well below the average of its closest peers, which stands at 55.1x. However, instead of relying solely on these benchmarks, Simply Wall St also calculates a proprietary Fair Ratio for each stock. For ABM, the Fair Ratio is 33.5x. This measure takes a more nuanced approach by factoring in the company’s earnings growth, profit margins, market cap, risk profile, and sector dynamics.

The benefit of using the Fair Ratio is that it adjusts for what actually matters to long-term investors and avoids the pitfalls of overly simplistic peer or industry comparisons. In ABM’s case, since the stock’s current PE of 24.4x is noticeably lower than the Fair Ratio of 33.5x, the shares look attractively valued on earnings alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ABM Industries Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter and more dynamic tool for making investment decisions that goes far beyond traditional financial ratios.

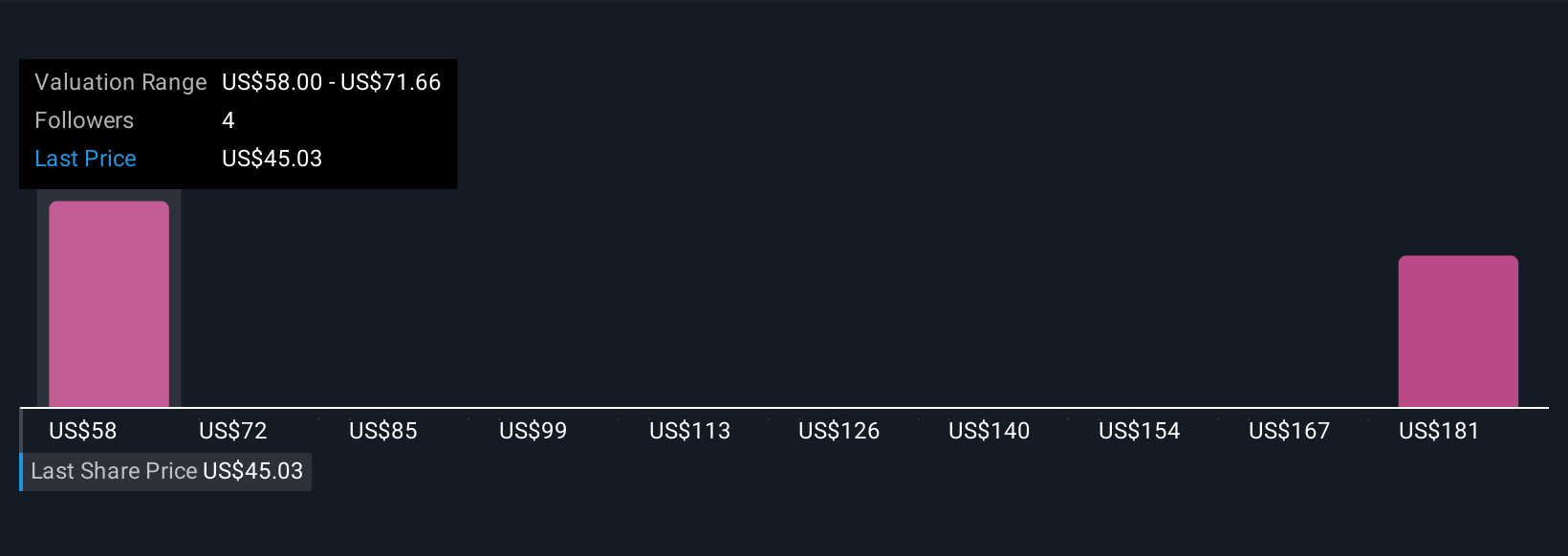

A Narrative is your personalized investment story for a company. It lets you connect your expectations about ABM Industries’ future (including things like revenue, earnings, and margin forecasts) to your own calculated fair value, all based on your perspective of what matters most in the business.

On Simply Wall St’s Community page, where millions of investors build Narratives each month, you can easily craft and update your view of ABM. This links the company’s story and real-life events directly to financial forecasts and projected fair value.

Narratives make buy and sell decisions accessible. By comparing your Fair Value to the current Price, you can instantly see whether ABM Industries looks attractively priced or not based on your own thinking, rather than only analyst consensus or historical averages.

Best of all, your Narrative updates automatically as new information, such as earnings releases or news, emerges. This helps you stay on top of what actually matters.

For example, one investor might focus on ABM’s recurring revenue and urban expansion to arrive at a higher fair value of $68.00, while another might worry about margin pressure and set a more cautious target of $54.00. Narratives let everyone invest according to the story they believe in.

Do you think there's more to the story for ABM Industries? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABM

ABM Industries

Through its subsidiaries, engages in the provision of integrated facility, infrastructure, and mobility solutions in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026