- United States

- /

- Commercial Services

- /

- NYSE:ABM

Is ABM Industries a Quiet Opportunity After 2024 Share Price Slide and DCF Upside?

Reviewed by Bailey Pemberton

- Wondering if ABM Industries at around $43.94 is quietly turning into a value opportunity, or if the market sees trouble ahead? This breakdown is for you.

- The stock has inched up 2.2% over the last week and 1.7% over the last month, but it is still down 14.0% year to date and 21.3% over the past year, creating an interesting gap between recent momentum and longer term underperformance.

- Recently, investors have been watching ABM's strategic moves in facility services, infrastructure, and energy efficiency. These are areas where long term contracts and recurring revenue can change how the market prices the stock. At the same time, broader swings in interest rate expectations and sentiment toward business services have added extra volatility, which helps explain why the share price has not fully reflected operational progress.

- Despite that mixed backdrop, ABM currently scores a 5/6 valuation check, suggesting the market may be underestimating the business on several fronts. Next we will walk through the main valuation approaches, before finishing with a more nuanced way to think about what the stock is really worth.

Find out why ABM Industries's -21.3% return over the last year is lagging behind its peers.

Approach 1: ABM Industries Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms.

For ABM Industries, the 2 Stage Free Cash Flow to Equity model starts with last twelve month free cash flow of about $67.8 million and uses analyst forecasts, then extrapolations, to project growth. By 2027, free cash flow is expected to reach roughly $377.4 million, and the extended projections imply free cash flow approaching the mid to high $800 million range within 10 years, as Simply Wall St extends analyst estimates further out.

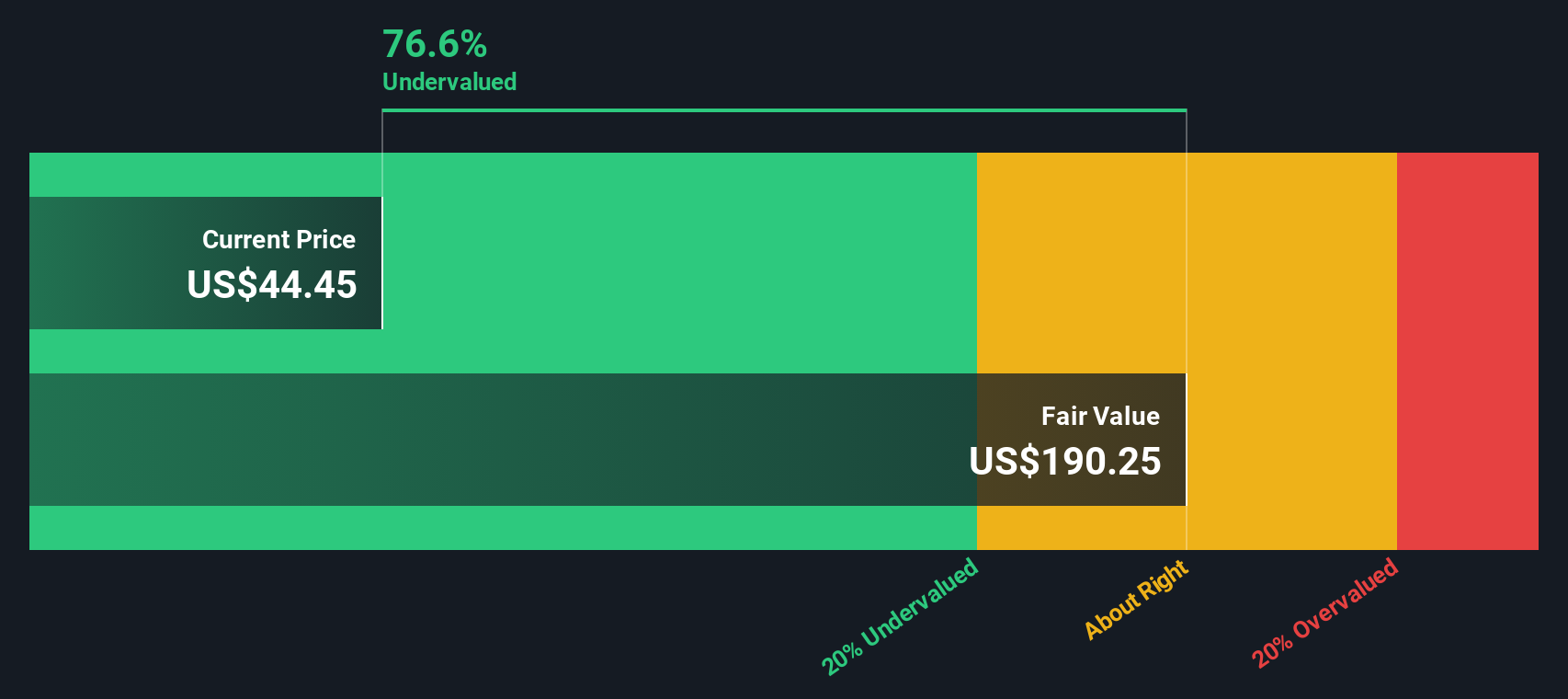

When all these future cash flows are discounted back to the present, the model arrives at an intrinsic value of about $195.94 per share. Versus a current share price near $43.94, the DCF implies the stock is around 77.6% undervalued, suggesting the market is pricing in a far weaker future than the cash flow outlook indicates.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ABM Industries is undervalued by 77.6%. Track this in your watchlist or portfolio, or discover 920 more undervalued stocks based on cash flows.

Approach 2: ABM Industries Price vs Earnings

For profitable companies like ABM Industries, the price to earnings ratio is a practical way to gauge how much investors are willing to pay today for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE multiple, while slower or uncertain growth, or higher risk, usually call for a lower, more conservative PE.

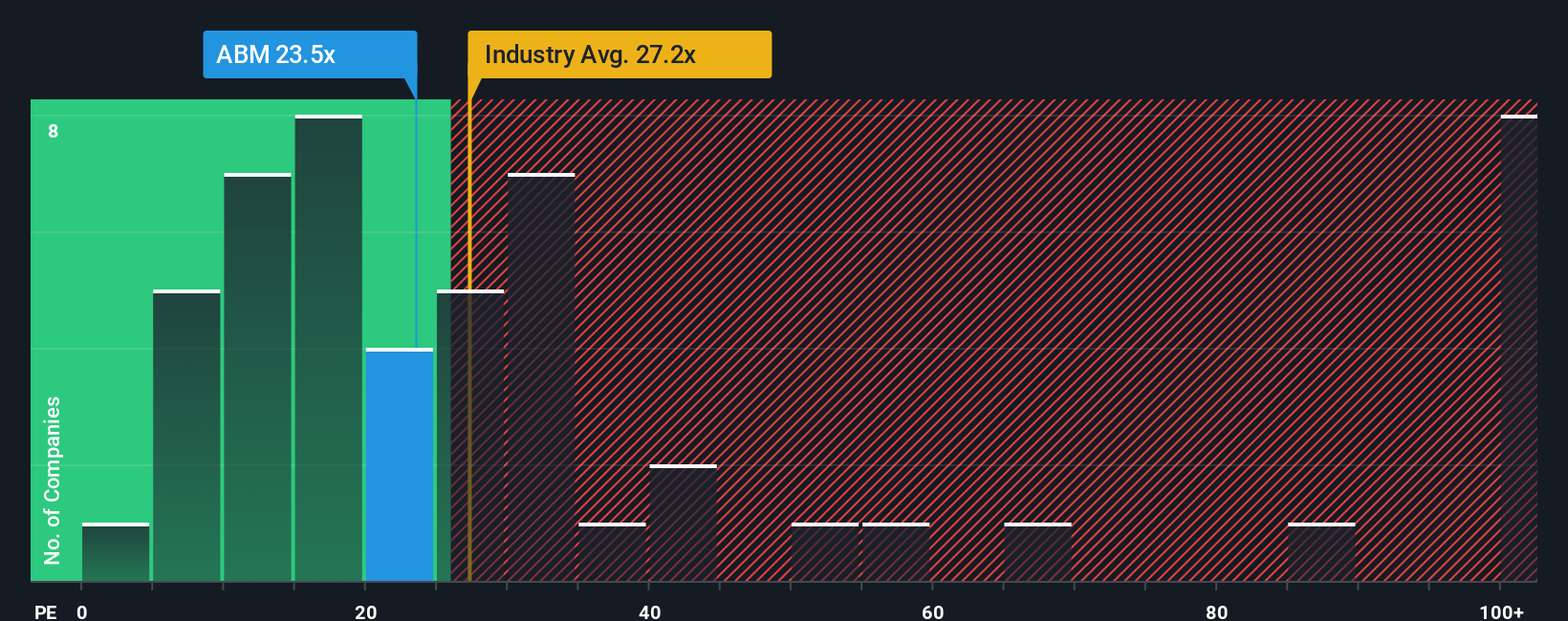

ABM currently trades at about 23.2x earnings, which is roughly in line with the broader Commercial Services industry average of 22.9x but far below the 47.9x seen across its peer group. To refine this further, Simply Wall St uses a proprietary Fair Ratio, which estimates what ABM’s PE should be, based on factors such as its earnings growth profile, profit margins, industry, market cap and risk characteristics. This Fair Ratio for ABM is 30.4x, indicating that a reasonable valuation would be somewhat higher than where the market is pricing the stock today.

Because the Fair Ratio is tailored to ABM’s fundamentals rather than broad peer comparisons, it offers a more nuanced perspective. On that basis the shares appear modestly undervalued on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ABM Industries Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers by spelling out your assumptions for ABM Industries future revenue, earnings, margins and ultimately its fair value.

A Narrative connects three pieces together: the business story you believe, the financial forecast that flows from that story, and the fair value that drops out of those forecasts, so you can see exactly why you think the stock is cheap or expensive.

On Simply Wall St, millions of investors build and compare Narratives on the Community page, where you can quickly set your own assumptions, see the resulting fair value, and then compare that to ABM Industries current share price to decide whether it looks like a buy, hold or sell.

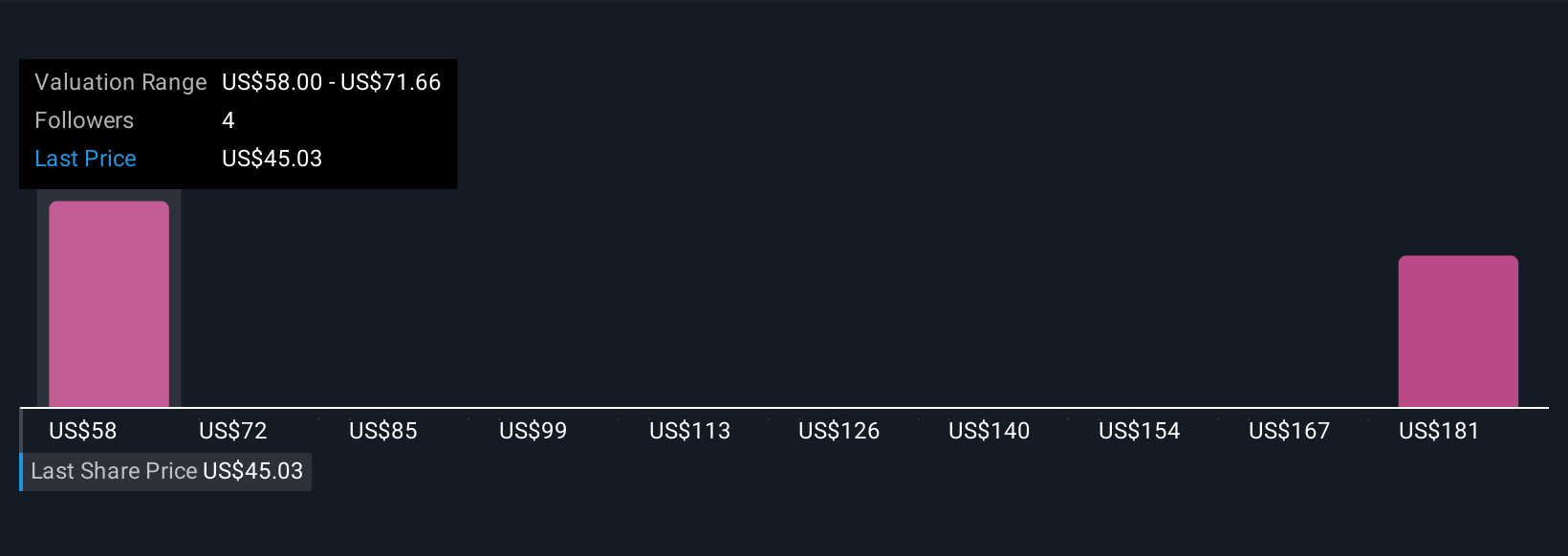

These Narratives update dynamically as new information such as earnings releases, contract wins or industry news comes in. This means your fair value view stays alive rather than frozen in time. For ABM Industries you can already see one Narrative arguing the shares could reach around $68 if growth and margin expansion play out strongly, while a more cautious Narrative pegs fair value closer to $54 based on slower growth and sustained margin pressure.

Do you think there's more to the story for ABM Industries? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABM

ABM Industries

Through its subsidiaries, engages in the provision of integrated facility, infrastructure, and mobility solutions in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026