- United States

- /

- Professional Services

- /

- NasdaqGM:WLDN

Willdan Group (WLDN) Valuation After E3’s Amazon-Funded Data Center Power Study Elevates Its Energy Planning Role

Reviewed by Simply Wall St

Willdan Group (WLDN) is back on investors radar after its E3 subsidiary released an independent study for Amazon on how utilities should price and manage surging data center driven electric load.

See our latest analysis for Willdan Group.

That Amazon backed study is landing at a time when Willdan’s 1 month share price return of 8.2 percent builds on a powerful year to date run of 175.4 percent. Its 3 year total shareholder return of 478.8 percent underlines how long term momentum has steadily compounded.

If this kind of demand side story has your attention, it could be worth exploring fast growing stocks with high insider ownership as a way to spot other fast moving opportunities before they become crowded trades.

Yet with the shares already up sharply and still trading at a sizeable discount to analyst targets and some intrinsic value estimates, is Willdan Group quietly undervalued here, or is the market already baking in years of growth?

Most Popular Narrative: 21.7% Undervalued

With Willdan Group last closing at $103.77 versus a most popular narrative fair value of $132.50, the story implies further upside driven by long term growth.

Ongoing investments and planning for grid modernization, combined with the company's strong reputation with utility commissions and government agencies, position Willdan to benefit disproportionately from federal/state decarbonization mandates and infrastructure modernization initiatives, supporting sustained revenue and EBITDA growth over the long term.

Want to see what is baked into that optimism? The narrative leans on accelerating revenue, rising margins, and a premium future earnings multiple. Curious how bold those assumptions really are? Read on to unpack the full valuation logic behind that target price.

Result: Fair Value of $132.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a higher effective tax rate and heavy reliance on policy-driven utility spending could quickly squeeze margins and derail those upbeat growth assumptions.

Find out about the key risks to this Willdan Group narrative.

Another View: Market Ratios Flash a Caution Sign

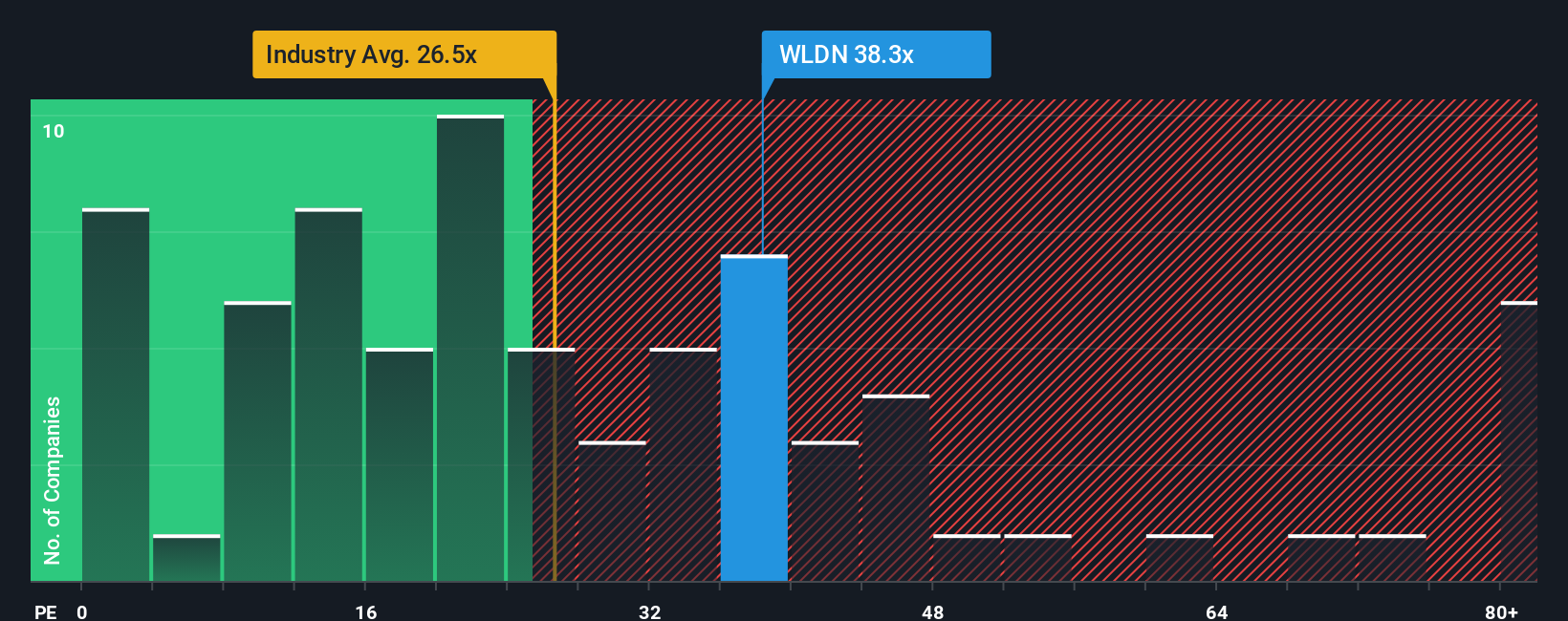

While narratives and intrinsic estimates point to upside, the market’s own yardstick looks stretched. Willdan trades on a P/E of 36.9 times, well above the Professional Services industry at 24.8 times and its fair ratio of 22.9 times. If sentiment cools, multiple compression could erase a chunk of those projected gains.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Willdan Group Narrative

If you see the story differently or want to stress test these assumptions with your own research, you can build a full narrative in minutes: Do it your way.

A great starting point for your Willdan Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s powerful Screener to work so you do not miss fresh opportunities that could reshape your portfolio.

- Tap into early stage potential with these 3625 penny stocks with strong financials that already boast solid financial foundations instead of risky story stocks.

- Capitalize on the AI transformation in healthcare by reviewing these 30 healthcare AI stocks building real solutions for diagnosis, treatment, and patient outcomes.

- Lock in reliable income streams by scanning these 13 dividend stocks with yields > 3% that combine healthy yields with supportable payout ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Willdan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WLDN

Willdan Group

Provides professional, technical, and consulting services primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)