- United States

- /

- Banks

- /

- NasdaqGM:NBN

Three Promising Small Caps to Enhance Your Investment Portfolio

Reviewed by Simply Wall St

The United States market has remained flat over the last week, yet it has experienced a significant 37% increase over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying promising small-cap stocks can offer investors unique opportunities to enhance their portfolios by capitalizing on potential growth and innovation.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| First Ottawa Bancshares | 85.49% | 7.25% | 25.81% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Northeast Bank (NasdaqGM:NBN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Northeast Bank offers a range of banking services to individual and corporate clients in Maine, with a market capitalization of $722.58 million.

Operations: Northeast Bank generates revenue primarily from its banking segment, amounting to $152.68 million.

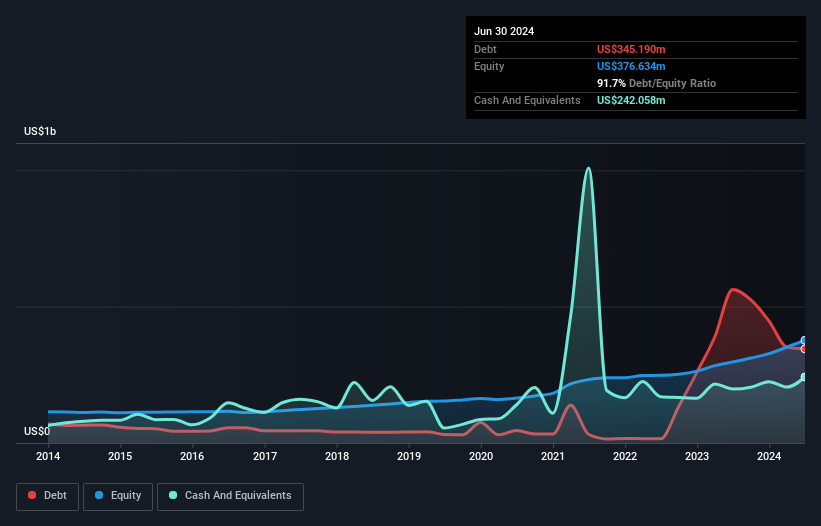

Northeast Bank, with total assets of US$3.1 billion and equity of US$376.6 million, stands out as a nimble player in the financial sector. Its total deposits are US$2.3 billion while loans reach US$2.7 billion, supported by a net interest margin of 5.2%. The bank's allowance for bad loans is at 1%, which seems insufficient given industry standards but remains within an appropriate range for non-performing loans. Impressively, earnings surged by 31% over the past year, far outpacing the broader banking industry's performance downturn of -13%. Trading at 34% below estimated fair value adds to its appeal as an investment consideration.

- Unlock comprehensive insights into our analysis of Northeast Bank stock in this health report.

Assess Northeast Bank's past performance with our detailed historical performance reports.

Willdan Group (NasdaqGM:WLDN)

Simply Wall St Value Rating: ★★★★★★

Overview: Willdan Group, Inc. offers professional, technical, and consulting services primarily in the United States with a market capitalization of approximately $664.87 million.

Operations: Willdan Group generates revenue primarily from its Energy segment, contributing $464.27 million, and its Engineering and Consulting segment, which adds $87.63 million.

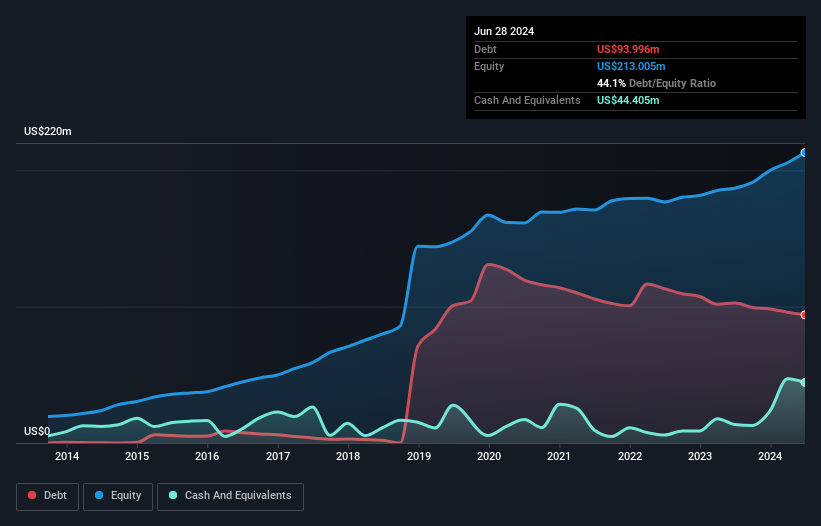

Willdan Group, a nimble player in the professional services sector, has seen its earnings skyrocket by 1855% over the past year, far outpacing the industry average of 5.9%. The company boasts a satisfactory net debt to equity ratio of 23.3%, indicating sound financial management. Recent contracts like the $102 million deal with Clark County School District highlight its capability in energy-saving projects and smart city initiatives. Despite shareholder dilution last year, Willdan's strategic moves into high-growth sectors and innovative solutions suggest robust potential for future revenue streams and operational efficiency improvements.

Gibraltar Industries (NasdaqGS:ROCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Gibraltar Industries, Inc. is a company that manufactures and provides products and services for the renewable energy, residential, agtech, and infrastructure markets both in the United States and internationally with a market cap of approximately $1.98 billion.

Operations: Gibraltar Industries generates revenue from four segments: Residential ($806.50 million), Renewables ($324.95 million), Agtech ($142.62 million), and Infrastructure ($90.99 million).

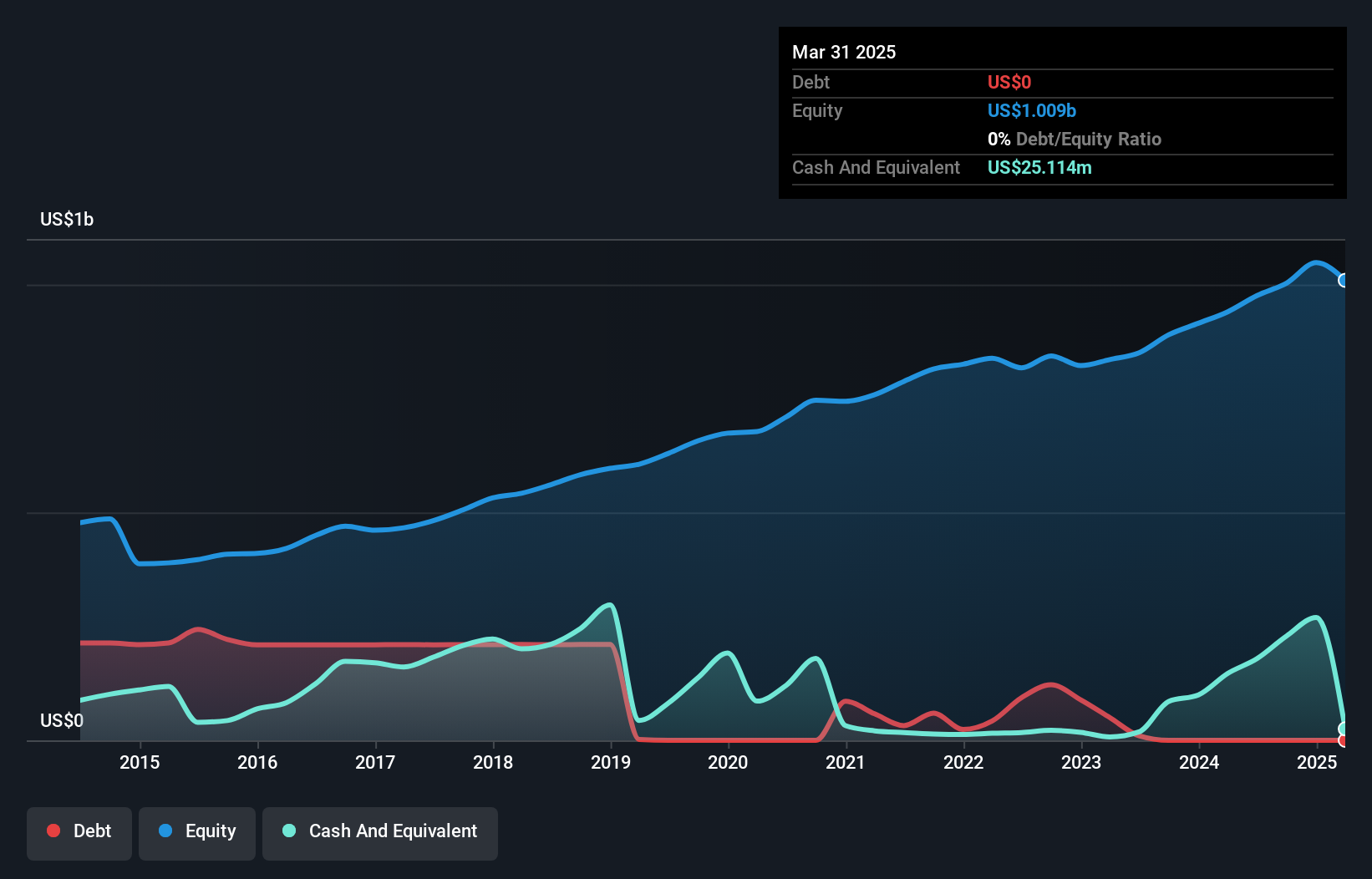

Gibraltar Industries is making waves with its focus on Agtech and renewables, despite facing headwinds like a residential market slowdown. The company reported third-quarter sales of US$361.2 million, down from US$390.74 million the previous year, while net income stood at US$34.04 million compared to US$39.28 million a year ago. Earnings per share were US$1.11, slightly lower than last year's US$1.29 for the same period. Gibraltar's strategic initiatives suggest potential for improved margins and scalability, yet challenges such as regulatory hurdles in renewables remain significant considerations for future growth prospects.

Turning Ideas Into Actions

- Investigate our full lineup of 227 US Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northeast Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NBN

Northeast Bank

Provides various banking services to individual and corporate customers in Maine.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives