- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:VSEC

VSE (NASDAQ:VSEC) Has Re-Affirmed Its Dividend Of US$0.09

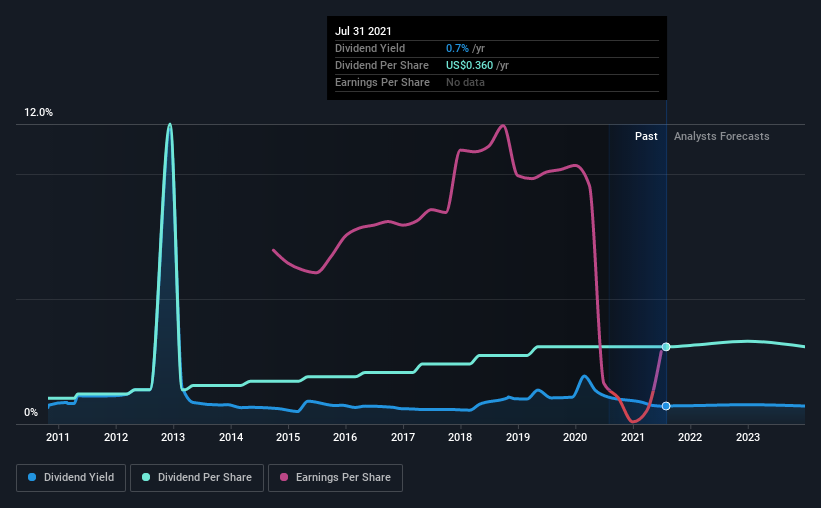

VSE Corporation (NASDAQ:VSEC) will pay a dividend of US$0.09 on the 17th of November. The dividend yield is 0.7% based on this payment, which is a little bit low compared to the other companies in the industry.

View our latest analysis for VSE

VSE's Earnings Easily Cover the Distributions

Even a low dividend yield can be attractive if it is sustained for years on end. Prior to this announcement, VSE's earnings easily covered the dividend, but free cash flows were negative. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend extends its recent trend, estimates say the dividend could reach 15%, which we would be comfortable to see continuing.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2011, the first annual payment was US$0.12, compared to the most recent full-year payment of US$0.36. This implies that the company grew its distributions at a yearly rate of about 12% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. VSE's earnings per share has shrunk at 25% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

The company has also been raising capital by issuing stock equal to 15% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

VSE's Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While VSE is earning enough to cover the payments, the cash flows are lacking. We don't think VSE is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 2 warning signs for VSE (of which 1 shouldn't be ignored!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading VSE or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:VSEC

VSE

Provides aviation aftermarket parts distribution and maintenance, repair, and overhaul services for air transportation assets for commercial and government markets.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion