- United States

- /

- Professional Services

- /

- NasdaqCM:VRRM

How Investors Are Reacting To Verra Mobility (VRRM) Launching In-Vehicle Commerce With Stellantis Brands

Reviewed by Sasha Jovanovic

- Verra Mobility announced the launch of AutoKinex, an OEM-ready in-vehicle commerce platform enabling drivers to pay for services like tolling, parking, fueling, and EV charging directly from their car, in partnership with Stellantis for 2021 and newer Chrysler, Dodge, Jeep, and Ram vehicles in the U.S.

- This collaboration leverages Verra Mobility’s long-standing expertise in tolling, opening up new possibilities for seamless, integrated mobility and payment solutions for automakers and drivers alike.

- We'll explore how AutoKinex's integration with major Stellantis brands may shape Verra Mobility’s investment outlook going forward.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Verra Mobility Investment Narrative Recap

To be a shareholder in Verra Mobility, you need to believe in the company's ability to expand and embed its payment solutions for mobility services, connecting drivers, automakers, and city infrastructure through integrated technology platforms. The AutoKinex launch with Stellantis may serve as a meaningful short-term catalyst by reinforcing Verra Mobility’s position in connected vehicle payments, but core risks include ongoing macroeconomic headwinds in Fleet Management and the unresolved New York City contract, both of which could overshadow near-term results if not addressed. Among recent company news, the expanded partnership with rental car companies in Italy is especially relevant. Like the Stellantis collaboration, this development aligns with Verra Mobility's emphasis on digital and automated tolling, supporting recurring revenue streams and potentially complementing the catalysts arising from growing adoption of cashless payment platforms across different markets. However, despite expanding partnerships, investors should also be watching for updates on possible concentration risk if the major New York City contract negotiations do not go as planned...

Read the full narrative on Verra Mobility (it's free!)

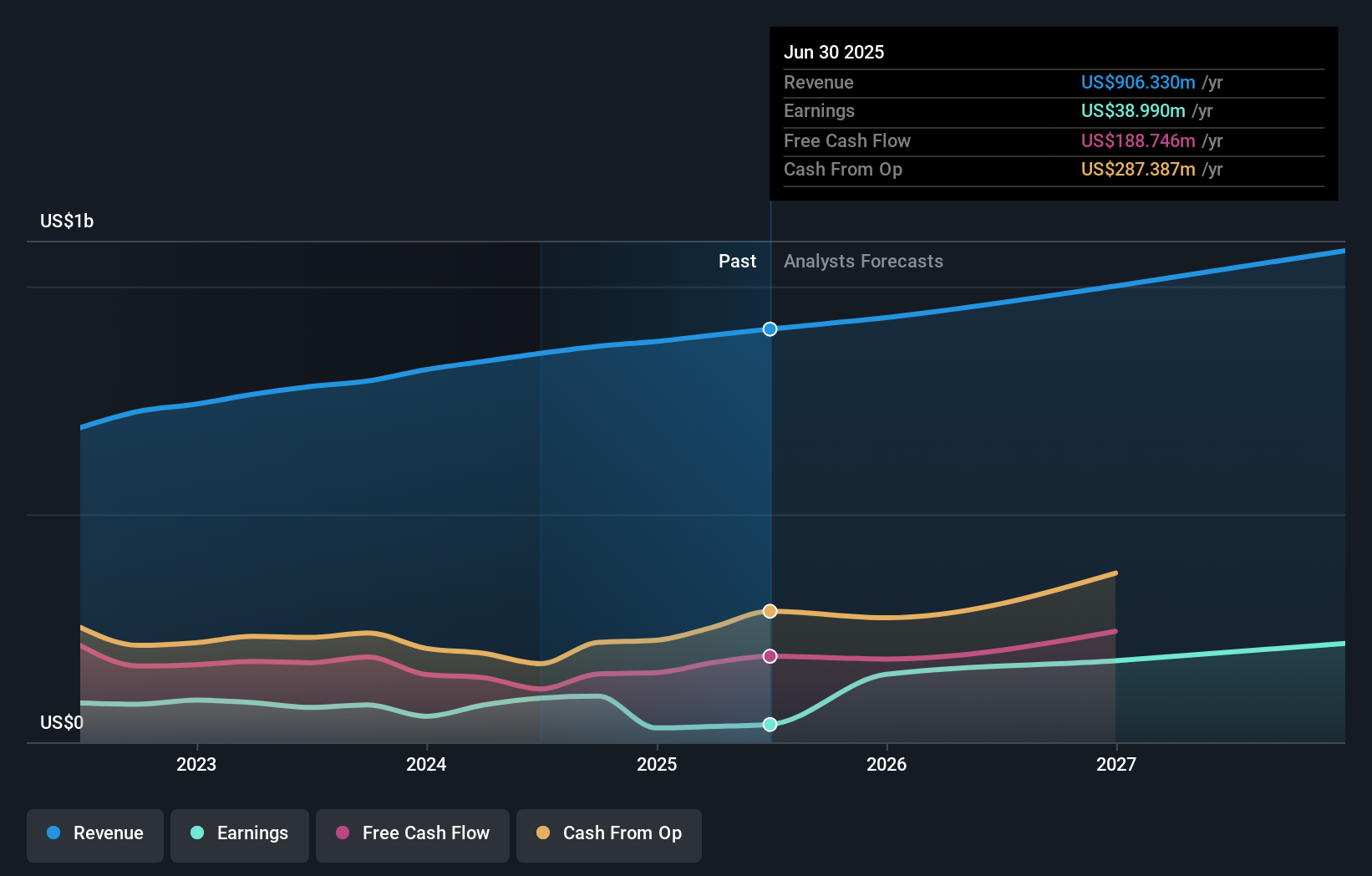

Verra Mobility's narrative projects $1.1 billion in revenue and $289.5 million in earnings by 2028. This requires 7.0% annual revenue growth and an earnings increase of $250.5 million from the current earnings of $39.0 million.

Uncover how Verra Mobility's forecasts yield a $29.83 fair value, a 37% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community shows all fair value estimates at US$29.83 with just one contributor, implying little dispersion in individual views. While confidence in digital tolling platforms is rising, concentration risks in Government Solutions remain an important factor for the company's outlook, consider reading further for a broader range of opinions.

Explore another fair value estimate on Verra Mobility - why the stock might be worth as much as 37% more than the current price!

Build Your Own Verra Mobility Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verra Mobility research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Verra Mobility research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verra Mobility's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRRM

Verra Mobility

Provides smart mobility technology solutions in the United States, Australia, Europe, and Canada.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026