- United States

- /

- Professional Services

- /

- NasdaqGS:UPWK

Upwork (UPWK): Examining Valuation After Launching Lifted, Its New Global Enterprise Workforce Platform

Reviewed by Simply Wall St

If you’ve been watching Upwork (UPWK) lately, there’s a new twist worth your attention. The company just announced the launch of Lifted, a purpose-built subsidiary targeting enterprise clients with an all-in-one solution for global talent sourcing, contracting, and workforce management. What stands out is how Upwork is tying together previous acquisitions and technology partnerships to fill gaps that legacy platforms have not managed effectively, especially as more companies seek flexibility and compliance in the shift to AI-driven workforces.

Following this expansion push, Upwork's momentum has been mixed. Shares are up nearly 60% over the past year, but that follows a rocky stretch, with some recent dips and a modest decline year-to-date. Other updates, such as technology partnerships and high-profile conference appearances, add intrigue, yet the stock’s long-term return has lagged the sector. There is a fresh sense that the company could be pivoting, but it is too soon to say if this changes the long-term story.

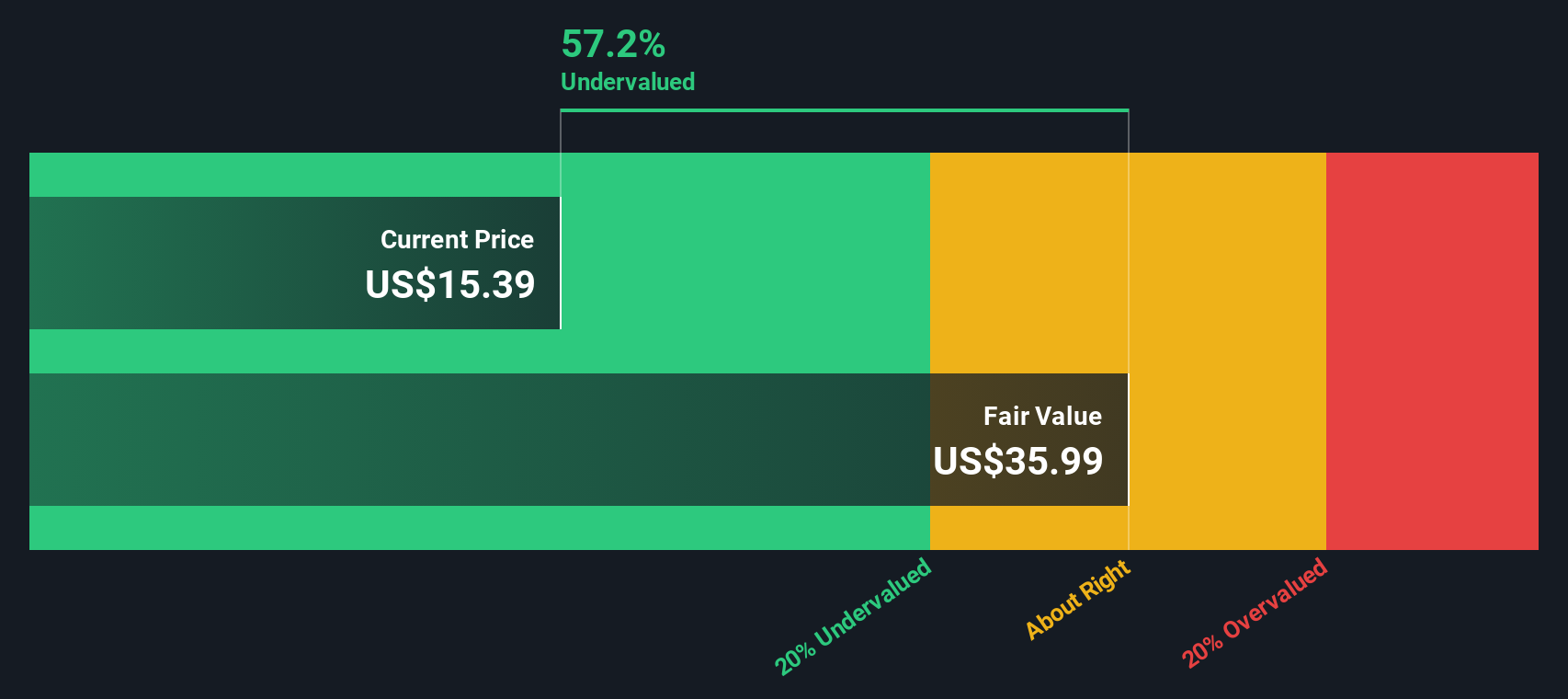

So, after this latest launch and the year’s volatility, is Upwork undervalued, or is the current share price already factoring in all the future growth these new moves might bring?

Most Popular Narrative: 17.7% Undervalued

According to community narrative, Upwork is currently valued well below what analysts believe is justified, based on their projections for future earnings and sector trends.

Upwork's accelerated investment in AI-powered talent matching and workflow automation is already increasing average spend per contract and improving user experience for both clients and freelancers. This provides a clear path to higher revenue and improved gross margins as these enhancements scale.

Want to know the secret equation fueling this "undervalued" call? There is a set of critical forecasts about Upwork's future growth, margins, and earnings that drive this bold analyst target. Curious which surprising benchmarks and shifting profit assumptions pushed this price target far above what the market expects? The most important numbers are hidden in the details of this narrative.

Result: Fair Value of $18.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, persistent macro uncertainty and slow client acquisition could challenge Upwork’s growth pace. This may potentially undermine the optimistic outlook some analysts maintain. Find out about the key risks to this Upwork narrative.Another View: What Does Our DCF Model Say?

While analyst price targets suggest Upwork is undervalued, our DCF model offers a checks-and-balances approach. It provides another perspective by assessing the company's long-term cash flow potential and reaches a similar conclusion, though through a different method. Which approach will ultimately be accurate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Upwork for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Upwork Narrative

If you see things differently or want to dig into Upwork’s latest numbers yourself, you can shape a narrative in just a few minutes: Do it your way.

A great starting point for your Upwork research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for Your Next Investing Edge?

Don’t let opportunity slip by while others seize the trends that are reshaping the market. Use the Simply Wall Street Screener to actively pick your way into standout ideas tailored to your investment style and ambition. Here are three powerful avenues you don’t want to miss:

- Unlock access to companies harnessing artificial intelligence breakthroughs and tap into cutting-edge progress with AI penny stocks.

- Pursue value with stocks trading for less than their worth and position yourself for potential upside using undervalued stocks based on cash flows.

- Charge ahead of the pack by investigating startups with high growth potential and attractive pricing through penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:UPWK

Upwork

Operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives