- United States

- /

- Professional Services

- /

- NasdaqGS:TASK

We Like These Underlying Return On Capital Trends At TaskUs (NASDAQ:TASK)

There are a few key trends to look for if we want to identify the next multi-bagger. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So when we looked at TaskUs (NASDAQ:TASK) and its trend of ROCE, we really liked what we saw.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for TaskUs, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.14 = US$105m ÷ (US$886m - US$117m) (Based on the trailing twelve months to June 2024).

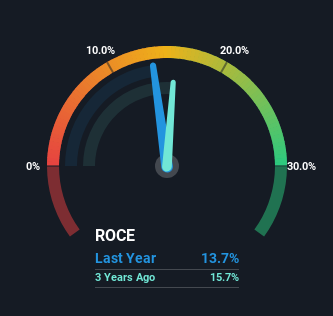

Therefore, TaskUs has an ROCE of 14%. By itself that's a normal return on capital and it's in line with the industry's average returns of 14%.

View our latest analysis for TaskUs

In the above chart we have measured TaskUs' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering TaskUs for free.

So How Is TaskUs' ROCE Trending?

TaskUs is displaying some positive trends. Over the last five years, returns on capital employed have risen substantially to 14%. The amount of capital employed has increased too, by 38%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

The Key Takeaway

To sum it up, TaskUs has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. Although the company may be facing some issues elsewhere since the stock has plunged 80% in the last three years. Still, it's worth doing some further research to see if the trends will continue into the future.

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation for TASK on our platform that is definitely worth checking out.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if TaskUs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TASK

TaskUs

Provides outsourced digital services for companies in Philippines, the United States, India, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond 2026, Beyond a Double

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.

Nedbank please contact me,l need guidance step by step, please