- United States

- /

- Professional Services

- /

- NasdaqGS:SSNC

Will The Trust Company of Tennessee Partnership Redefine SS&C Technologies' (SSNC) Institutional Growth Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, The Trust Company of Tennessee announced it launched corporate retirement services on SS&C Technologies Holdings’ Retirement Recordkeeping platform, upgrading offerings for clients with over US$18 billion in assets.

- This milestone highlights a growing client adoption of SS&C’s platform, signaling the company's momentum in modernizing retirement and wealth management technology for large institutions.

- To better understand the impact of this onboarding and product expansion, we’ll examine how the partnership enriches SS&C’s investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

SS&C Technologies Holdings Investment Narrative Recap

To support a long-term investment in SS&C Technologies Holdings, you need confidence in the company’s push for digital modernization in retirement and wealth management, along with prudent debt management. While The Trust Company of Tennessee’s onboarding highlights client momentum and expands SS&C’s platform adoption, it does not have a material near-term impact on the most significant short-term catalyst, international expansion initiatives, or mitigate earnings sensitivity to interest rate movements, which remain a key risk. A recent announcement of a strategic partnership with Morningstar, adding over 400 wealth management firms to SS&C’s Black Diamond platform, stands out as more directly relevant to growth catalysts. This further strengthens SS&C’s position in digitizing client operations, echoing the broader product adoption underscored by the Tennessee client engagement. By contrast, investors should also be aware of the company’s $6.4 billion net debt position if interest rates…

Read the full narrative on SS&C Technologies Holdings (it's free!)

SS&C Technologies Holdings is projected to achieve $7.0 billion in revenue and $1.2 billion in earnings by 2028. This outlook is based on a 4.8% annual revenue growth rate, with earnings increasing by $393.6 million from the current $806.4 million.

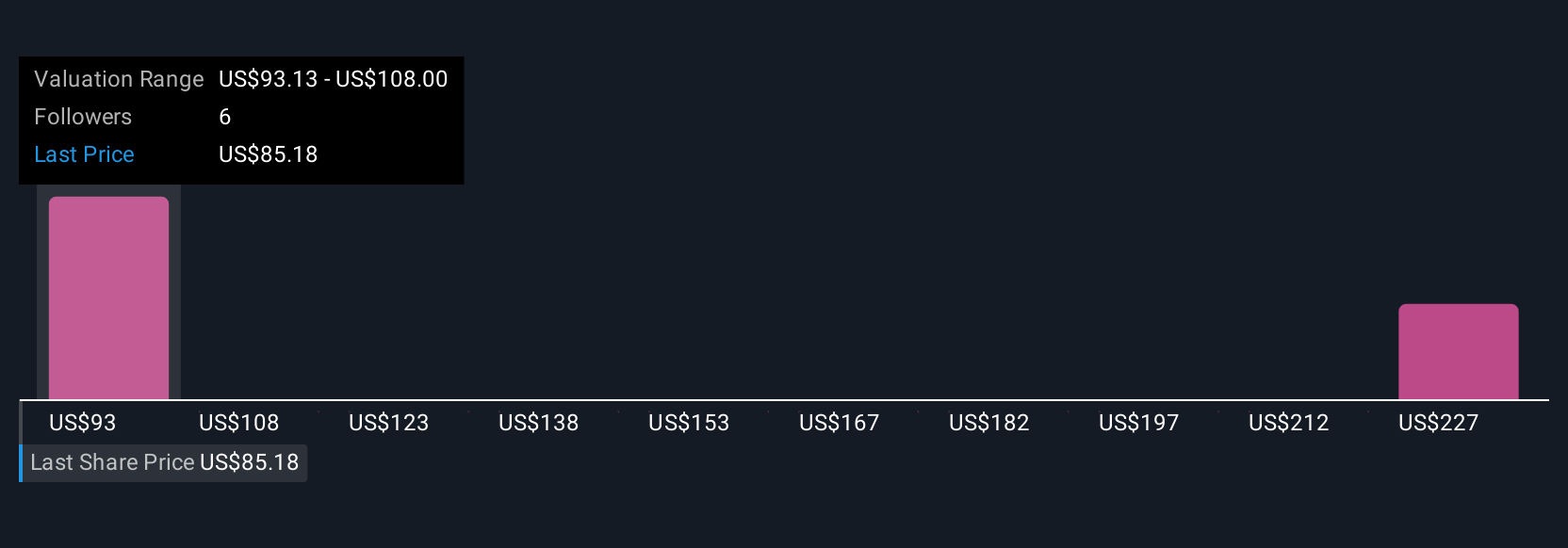

Uncover how SS&C Technologies Holdings' forecasts yield a $97.89 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have provided three fair value estimates for SS&C Technologies Holdings, ranging widely from US$97.04 to US$156.30. These diverse opinions reflect the importance of international expansion as a growth driver and invite you to consider multiple viewpoints before forming your outlook.

Explore 3 other fair value estimates on SS&C Technologies Holdings - why the stock might be worth just $97.04!

Build Your Own SS&C Technologies Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SS&C Technologies Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SS&C Technologies Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SS&C Technologies Holdings' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SSNC

SS&C Technologies Holdings

Provides software products and software-enabled services to financial services and healthcare industries.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives