- United States

- /

- Professional Services

- /

- NasdaqGS:SAIC

A Fresh Look at Science Applications International (SAIC) Valuation Following Leadership Shift Toward Growth and Innovation

Reviewed by Kshitija Bhandaru

Science Applications International (SAIC) is shaking up its executive ranks, with Senior Vice President Bob Ritchie stepping into the newly created role of Chief Growth Officer. By bringing both business development and technology leadership together under Ritchie’s guidance, SAIC is looking to sharpen its focus on collaboration and innovation, particularly in fast-evolving arenas like artificial intelligence, cybersecurity, and critical mission solutions. For investors, this shift signals a company actively positioning itself for growth in a competitive sector.

It has been a challenging year for SAIC’s stockholders. Shares have edged down nearly 22% over the past year, and the weak momentum is highlighted by declines over both the past month and since the start of the year. That said, SAIC has posted solid multi-year returns, hinting at underlying strengths that may not be fully recognized in the current price. Executive changes of this kind often prompt reassessment by the market. This transition could serve as a catalyst.

The question now is clear: has the recent leadership change made SAIC a bargain with growth potential, or is the market already baking in everything investors need to know?

Most Popular Narrative: 10.5% Undervalued

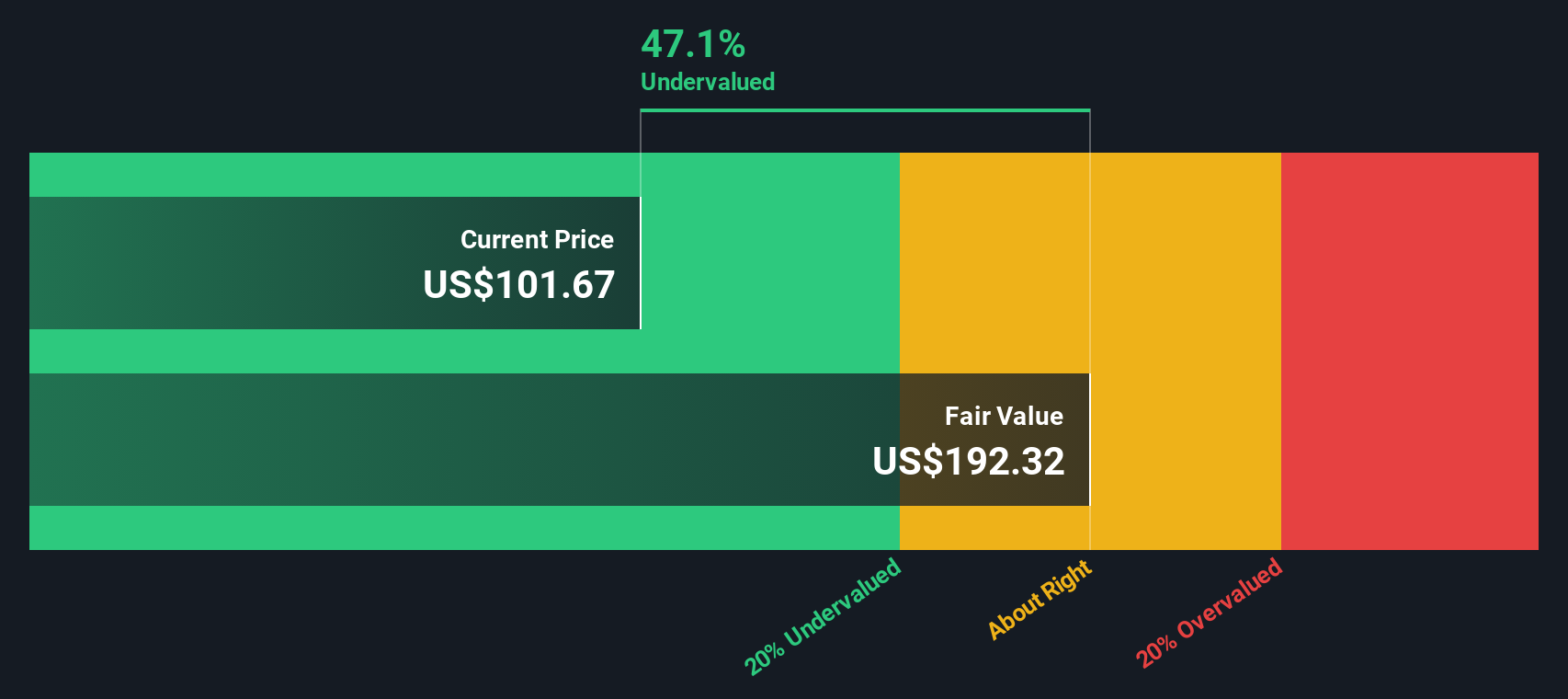

The most widely followed narrative paints Science Applications International as undervalued. The stock is currently considered to be trading below its perceived intrinsic worth based on future earnings and margins, using a 7.95% discount rate.

Progress in operational efficiency through enterprise-wide adoption of artificial intelligence and automation is expected to drive incremental margin improvement, even in a restrained revenue environment. This could support higher net margins and free cash flow.

Curious about what these analysts see that could turn the tide for this defense IT titan? Several under-the-hood forecasts underpin the fair value, including a surprising profit outlook and a future market multiple that rivals the industry’s best. Want to see the numbers behind this potential breakout? See which key assumptions are powering that double-digit upside.

Result: Fair Value of $116.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent budget uncertainty and rising competition for key government contracts could easily derail the optimistic outlook for SAIC’s long-term growth narrative.

Find out about the key risks to this Science Applications International narrative.Another View: What Does Our DCF Model Suggest?

Taking a different approach, the SWS DCF model weighs Science Applications International’s long-term cash flows rather than just its current earnings. Interestingly, it also suggests the shares are undervalued. Does this reinforce the story or reveal hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Science Applications International Narrative

If our view does not quite match your own or you would rather dig into the details yourself, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Science Applications International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Do not let the next opportunity slip by. With the right strategy and tools, you could spot tomorrow’s winners ahead of the crowd with Simply Wall Street.

- Capitalize on overlooked market gems built for long-term gains by using our undervalued stocks based on cash flows.

- Uncover future leaders at the intersection of healthcare and innovation with the power of healthcare AI stocks.

- Tap into the unstoppable momentum behind cryptocurrencies and blockchain by leveraging our cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAIC

Science Applications International

Provides technical, engineering, and enterprise information technology (IT) services in the United States.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives