- United States

- /

- Software

- /

- NasdaqCM:REKR

It May Be Possible That Rekor Systems, Inc.'s (NASDAQ:REKR) CEO Compensation Could Get Bumped Up

Shareholders will be pleased by the robust performance of Rekor Systems, Inc. (NASDAQ:REKR) recently and this will be kept in mind in the upcoming AGM on 14 September 2021. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

See our latest analysis for Rekor Systems

Comparing Rekor Systems, Inc.'s CEO Compensation With the industry

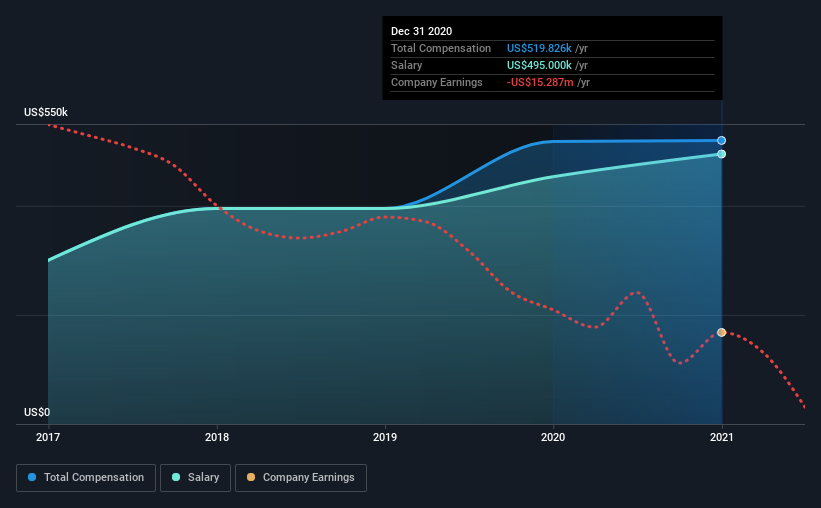

At the time of writing, our data shows that Rekor Systems, Inc. has a market capitalization of US$364m, and reported total annual CEO compensation of US$520k for the year to December 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of US$495.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from US$200m to US$800m, the reported median CEO total compensation was US$1.7m. Accordingly, Rekor Systems pays its CEO under the industry median. Moreover, Robert Berman also holds US$68m worth of Rekor Systems stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$495k | US$453k | 95% |

| Other | US$25k | US$65k | 5% |

| Total Compensation | US$520k | US$518k | 100% |

On an industry level, roughly 23% of total compensation represents salary and 77% is other remuneration. Investors will find it interesting that Rekor Systems pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Rekor Systems, Inc.'s Growth Numbers

Over the last three years, Rekor Systems, Inc. has shrunk its earnings per share by 12% per year. In the last year, its revenue is up 84%.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Rekor Systems, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Rekor Systems, Inc. for providing a total return of 781% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Robert receives almost all of their compensation through a salary. The company's overall performance, while not bad, could be better. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 1 which is concerning) in Rekor Systems we think you should know about.

Important note: Rekor Systems is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Rekor Systems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:REKR

Rekor Systems

Provides infrastructure solutions for public safety, urban mobility, and transportation management markets in the United States and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026