- United States

- /

- Commercial Services

- /

- NasdaqCM:QRHC

Do Quest Resource Holding's (NASDAQ:QRHC) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Quest Resource Holding (NASDAQ:QRHC). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Quest Resource Holding

How Fast Is Quest Resource Holding Growing Its Earnings Per Share?

In the last three years Quest Resource Holding's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, Quest Resource Holding's EPS soared from US$0.069 to US$0.09, over the last year. That's a commendable gain of 31%.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Quest Resource Holding is growing revenues, and EBIT margins improved by 3.7 percentage points to 4.0%, over the last year. That's great to see, on both counts.

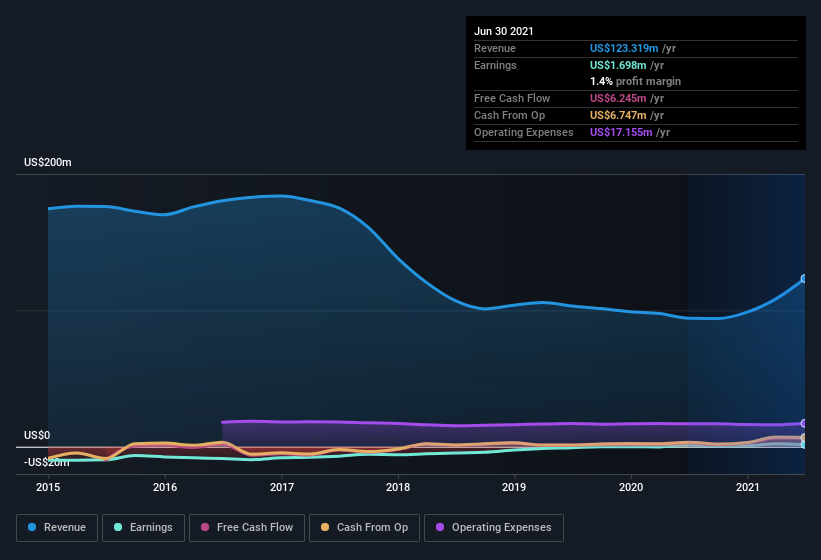

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Quest Resource Holding EPS 100% free.

Are Quest Resource Holding Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Quest Resource Holding shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that President S. Hatch bought US$5.0k worth of shares at an average price of around US$3.90.

Is Quest Resource Holding Worth Keeping An Eye On?

For growth investors like me, Quest Resource Holding's raw rate of earnings growth is a beacon in the night. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; Quest Resource Holding is a strong candidate for your watchlist. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Quest Resource Holding that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Quest Resource Holding, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Quest Resource Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:QRHC

Quest Resource Holding

Provides solutions for the reuse, recycling, and disposal of various waste streams and recyclables in the United States.

Very undervalued slight.

Similar Companies

Market Insights

Community Narratives