- United States

- /

- Professional Services

- /

- NasdaqCM:PIXY

Some Confidence Is Lacking In ShiftPixy, Inc.'s (NASDAQ:PIXY) P/S

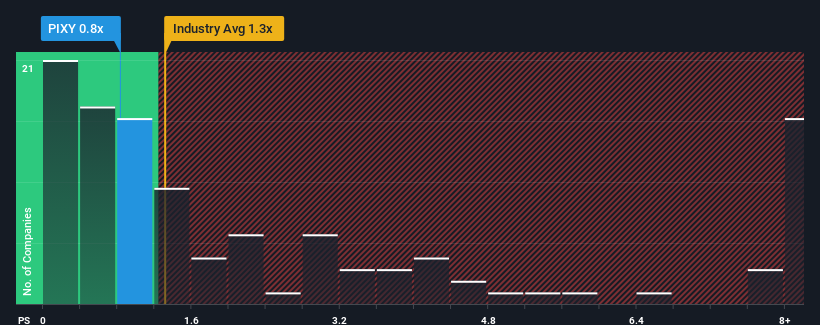

It's not a stretch to say that ShiftPixy, Inc.'s (NASDAQ:PIXY) price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" for companies in the Professional Services industry in the United States, where the median P/S ratio is around 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for ShiftPixy

How Has ShiftPixy Performed Recently?

While the industry has experienced revenue growth lately, ShiftPixy's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think ShiftPixy's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For ShiftPixy?

The only time you'd be comfortable seeing a P/S like ShiftPixy's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. Even so, admirably revenue has lifted 108% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 14% as estimated by the only analyst watching the company. That's not great when the rest of the industry is expected to grow by 7.1%.

With this in consideration, we think it doesn't make sense that ShiftPixy's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While ShiftPixy's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 6 warning signs with ShiftPixy (at least 4 which are potentially serious), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on ShiftPixy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PIXY

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives