- United States

- /

- Healthcare Services

- /

- NasdaqGS:PHLT

What Type Of Returns Would Performant Financial's(NASDAQ:PFMT) Shareholders Have Earned If They Purchased Their SharesThree Years Ago?

Performant Financial Corporation (NASDAQ:PFMT) shareholders will doubtless be very grateful to see the share price up 104% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 44% in the last three years, significantly under-performing the market.

View our latest analysis for Performant Financial

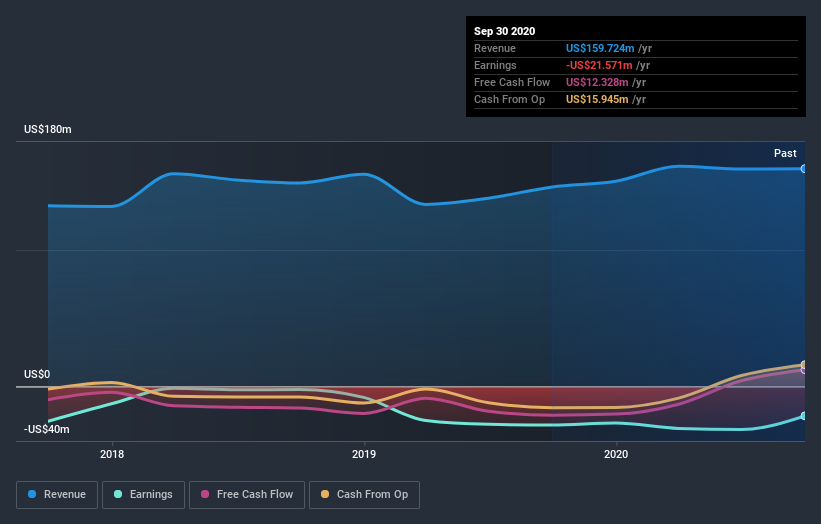

Given that Performant Financial didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Performant Financial grew revenue at 4.4% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. Indeed, the stock dropped 13% over the last three years. Shareholders will probably be hoping growth picks up soon. But the real upside for shareholders will be if the company can start generating profits.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Performant Financial's TSR for the year was broadly in line with the market average, at 32%. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 1.7% over the last five years. While 'turnarounds seldom turn' there are green shoots for Performant Financial. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Performant Financial has 3 warning signs (and 1 which is potentially serious) we think you should know about.

We will like Performant Financial better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Performant Financial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PHLT

Performant Healthcare

Provides audit, recovery, and analytics services in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives