- United States

- /

- Professional Services

- /

- NasdaqGS:PCTY

A Fresh Look at Paylocity (PCTY) Valuation Following High-Profile Partnership and New Platform Integration

Reviewed by Kshitija Bhandaru

Paylocity Holding (PCTY) has announced a new partnership with the NHL’s Vegas Golden Knights, positioning the company alongside a high-profile brand. At the same time, Paylocity is integrating Rain’s earned wage access solution, which broadens payroll features for its clients.

See our latest analysis for Paylocity Holding.

Even with these high-profile moves, Paylocity’s share price has struggled in 2025, with a 1-year total shareholder return of -12.7% and a sharp 22.9% drop year-to-date. While recent partnerships and product expansions point to growth potential, this downward momentum suggests investors are still weighing future risks against the company’s long-term promise.

Curious what else the market has to offer right now? This could be your signal to broaden your search and discover fast growing stocks with high insider ownership

So with shares now trading at a notable discount to analyst targets after a tough year, is Paylocity an overlooked value play primed for a rebound, or is the market right to price in only modest future growth?

Most Popular Narrative: 30.3% Undervalued

Paylocity’s most-followed narrative places its fair value at $215.63, well above the last close of $150.32, drawing attention to a potential value gap that defies current market sentiment.

Expansion of Paylocity's unified HR and finance platform, coupled with advanced AI-powered features, is enhancing automation and streamlining complex workflows for clients. This positions the company to capture growing demand from businesses undergoing digital transformation, which could drive higher recurring revenue and average revenue per client over time.

Want to know what projections fuel such a sharp gap between price and value? This narrative expects transformation-level gains not just in revenue, but in profit margins and market reach. Curious which bold assumptions underpin the high target? Unlock the full playbook to see the figures and financial reasoning behind the optimism.

Result: Fair Value of $215.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing revenue growth and heightened competition from larger industry players remain key risks that could curb Paylocity’s momentum in the future.

Find out about the key risks to this Paylocity Holding narrative.

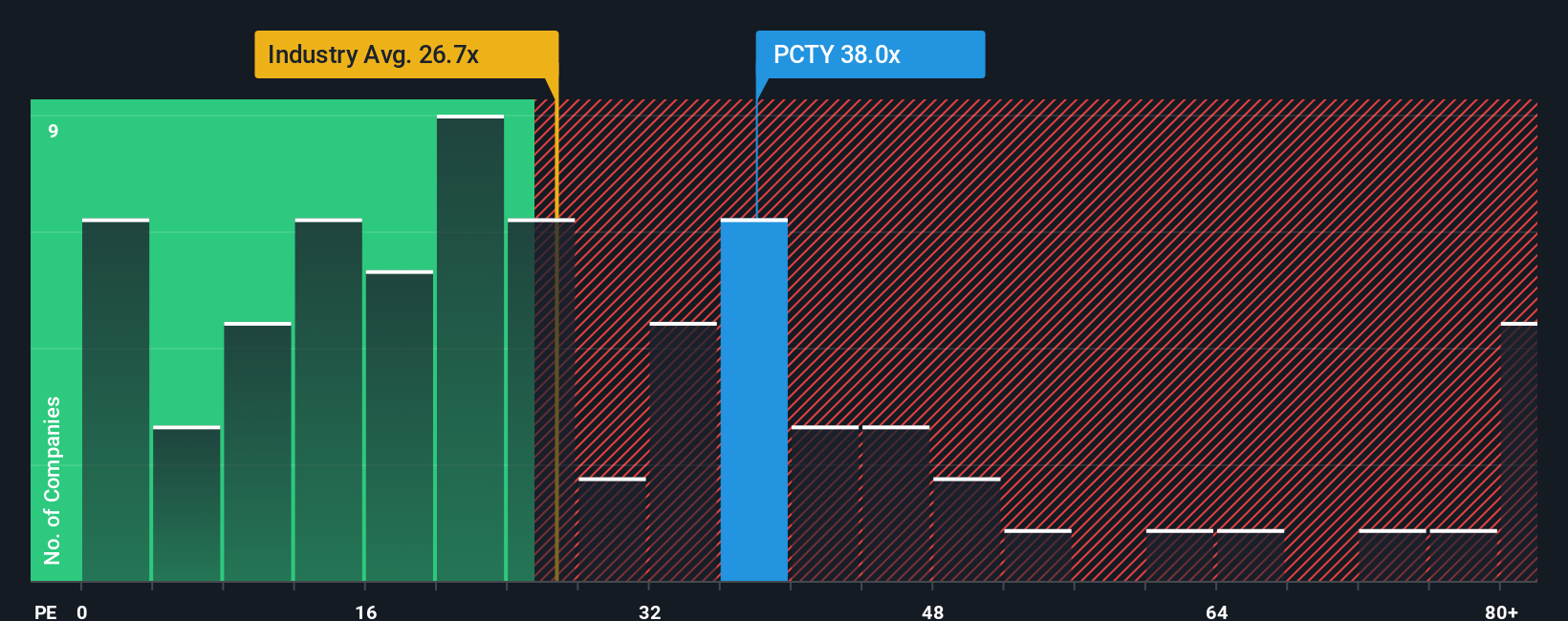

Another View: Looking Through the Lens of Earnings Multiples

Stepping away from fair value calculations, Paylocity’s current price-to-earnings ratio stands at 36.5x, which is notably higher than the US Professional Services industry average of 24.9x and the peer average of 23.9x. Even compared to its fair ratio of 27.3x, shares look expensive. This suggests a premium that exposes investors to greater valuation risk if growth underwhelms. Could the market be overestimating Paylocity’s potential, or does this premium signal something the valuation models miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Paylocity Holding Narrative

If you see the story playing out differently or want to explore further on your own terms, you can craft your own take in just a few minutes and at your own pace with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Paylocity Holding.

Looking for More Investment Ideas?

Markets change fast, and smart investors know where to look next. Don’t miss your chance to find tomorrow’s standouts; use the Simply Wall St Screener today.

- Tap into generational wealth by checking out these 18 dividend stocks with yields > 3%, which offers robust yields that stand strong even during volatile markets.

- Ride the next wave of innovation with these 24 AI penny stocks, focused on artificial intelligence breakthroughs that are redefining industries and fueling fresh growth.

- Strengthen your portfolio with these 33 healthcare AI stocks, which is driving digital transformation in health and delivering solutions with real-world impact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCTY

Paylocity Holding

Provides cloud-based human capital management, payroll software, and spend management solutions for the workforce in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives