- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

LegalZoom (LZ): Assessing Valuation Following Raised Guidance and Expanded Share Buybacks

Reviewed by Simply Wall St

LegalZoom.com (LZ) recently reported third-quarter earnings, raised its full-year and fourth-quarter revenue guidance, and announced additional share repurchases. These updates have caught the attention of the market and analysts alike.

See our latest analysis for LegalZoom.com.

LegalZoom.com’s upbeat earnings, stronger revenue guidance, and expanded buybacks arrive just as the company signals its interest in strategic M&A opportunities. Over the past year, shareholders have notched a nearly 30% total return, a clear sign that momentum has been building and optimism around growth potential is growing despite a recent pause in the share price rally.

If you’re weighing what other companies are showing strong momentum, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares already delivering nearly 30% total returns over the past year and the stock still trading below average analyst price targets, the key question is whether LegalZoom.com is undervalued or if future growth is already reflected in the price.

Most Popular Narrative: 18% Undervalued

LegalZoom.com’s most widely followed valuation narrative pegs fair value at $12.21 per share, over $2 above its last close of $10.01. This pricing gap points to upside potential if the narrative’s financial forecasts play out in full.

“Strong momentum in high-margin, recurring subscription offerings, especially within compliance and concierge do-it-for-me products, signals continued growth in predictable revenues and improved customer retention, directly supporting higher net margins and earnings stability. Enhanced automation and AI deployment throughout the business is driving operating efficiency gains and enabling scalable delivery of higher-touch services, underpinning continued EBITDA margin expansion and reduced cost structure.”

Curious how a blend of margin expansion and automation could fuel a jump in LegalZoom’s value? The answer lies in growth estimates and a profit model that challenges common expectations. Dive into the full narrative and see what figures could power a re-rating, and which bold assumptions keep even the bulls guessing.

Result: Fair Value of $12.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid advances in AI and increased competition could threaten LegalZoom’s revenue growth. This may challenge the optimistic margin and valuation forecasts driving the current narrative.

Find out about the key risks to this LegalZoom.com narrative.

Another View: Valuation by Earnings Ratio

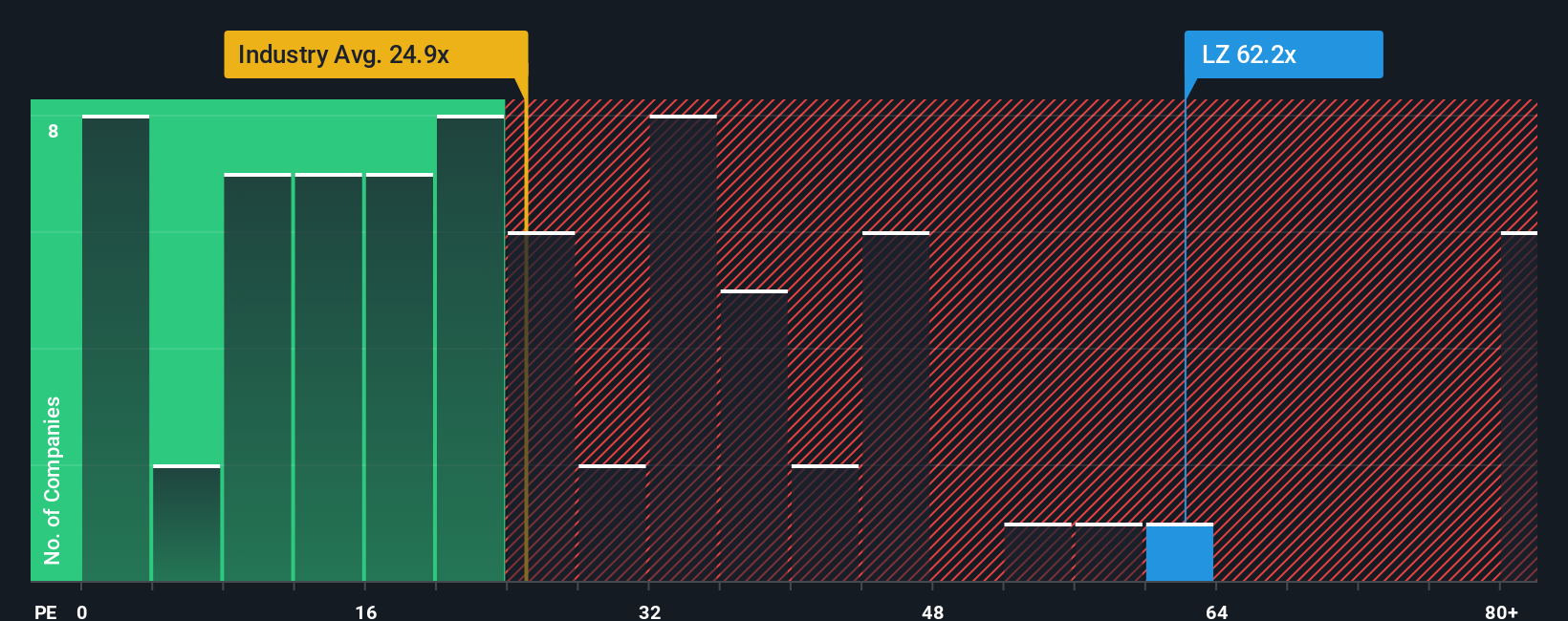

While analyst forecasts suggest LegalZoom.com is undervalued, looking at its earnings ratio tells a much different story. The company trades at nearly 80 times its earnings, which is much higher than the industry average of 24 and its peer average of 21. Even the fair ratio estimate of 47 is well below LegalZoom’s current level. This gap signals potential valuation risk if expectations cool. Will LegalZoom’s growth catch up, or is the market overreaching?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LegalZoom.com Narrative

If you have a different perspective or want to dig into the numbers yourself, you can develop your own narrative in just a few minutes. Do it your way

A great starting point for your LegalZoom.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't settle for just one great stock when there’s a world of opportunity out there. Powerful tools can help you uncover hidden gems, unbeatable growth, and unique sector gains. Don’t let these market movers pass you by.

- Start earning while you sleep by checking out these 16 dividend stocks with yields > 3% offering attractive yields above 3% and potential for defensive growth.

- Tap into the AI boom with these 26 AI penny stocks to see which innovative companies are transforming industries and outpacing the competition.

- Ride the future of medicine by exploring these 31 healthcare AI stocks, designed to highlight stocks powering advancements in healthcare technology and AI-driven therapies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives