- United States

- /

- Professional Services

- /

- NYSE:KFRC

Earnings Miss: Kforce Inc. Missed EPS By 10% And Analysts Are Revising Their Forecasts

Last week, you might have seen that Kforce Inc. (NASDAQ:KFRC) released its yearly result to the market. The early response was not positive, with shares down 9.3% to US$33.62 in the past week. It was not a great result overall. While revenues of US$1.3b were in line with analyst predictions, earnings were less than expected, missing statutory estimates by 10% to hit US$2.29 per share. This is an important time for investors, as they can track a company's performance in its report, look at what top analysts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Kforce

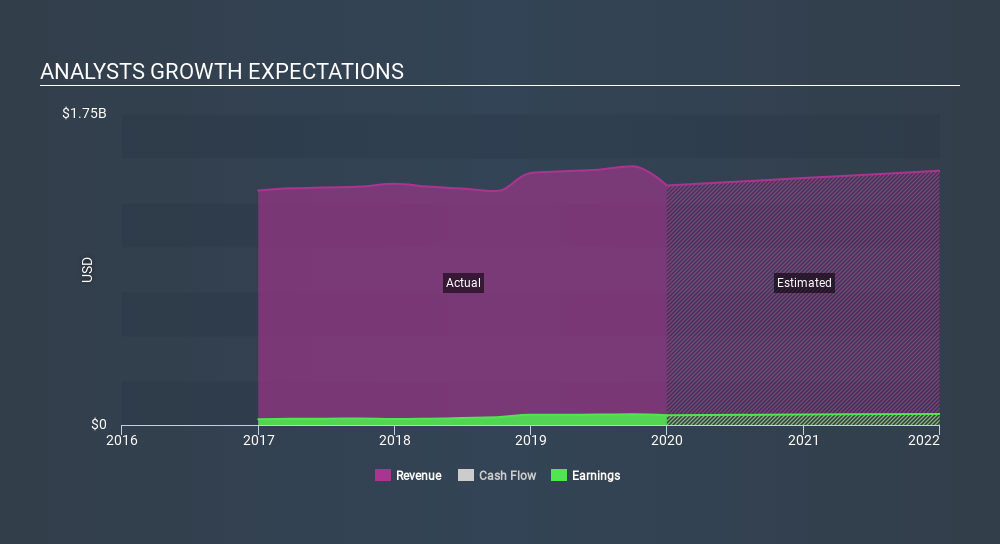

After the latest results, the four analysts covering Kforce are now predicting revenues of US$1.39b in 2020. If met, this would reflect a modest 3.1% improvement in sales compared to the last 12 months. Statutory earnings per share are expected to climb 14% to US$2.63. In the lead-up to this report, analysts had been modelling revenues of US$1.41b and earnings per share (EPS) of US$2.76 in 2020. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but analysts did make a minor downgrade to their earnings per share forecasts.

Despite cutting their earnings forecasts, analysts have lifted their price target 7.5% to US$38.33, suggesting that these impacts are not expected to weigh on the stock's value in the long term. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Kforce analyst has a price target of US$42.00 per share, while the most pessimistic values it at US$35.00. Still, with such a tight range of estimates, it suggests analysts have a pretty good idea of what they think the company is worth.

It can be useful to take a broader overview by seeing how analyst forecasts compare, both to the Kforce's past performance and to peers in the same market. It's clear from the latest estimates that Kforce's rate of growth is expected to accelerate meaningfully, with forecast 3.1% revenue growth noticeably faster than its historical growth of 2.3%p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 6.7% per year. It seems obvious that, while the future growth outlook is brighter than the recent past, analysts also expect Kforce to grow slower than the wider market.

The Bottom Line

The biggest concern with the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Kforce. On the plus side, there were no major changes to revenue estimates; although analyst forecasts imply revenues will perform worse than the wider market. There was also a nice increase in the price target, with analysts feeling that the intrinsic value of the business is improving.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Kforce analysts - going out to 2021, and you can see them free on our platform here.

You can also view our analysis of Kforce's balance sheet, and whether we think Kforce is carrying too much debt, for free on our platform here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:KFRC

Kforce

Provides professional staffing services and solutions in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives