- United States

- /

- Software

- /

- NasdaqCM:KERN

Akerna Corp. Analysts Are Cutting Their Estimates: Here's What You Need To Know

Akerna Corp. (NASDAQ:KERN) just released its second-quarter report and things are looking bullish. Results overall were solid, with revenues arriving 4.2% better than analyst forecasts at US$3.3m. Higher revenues also resulted in substantially lower statutory losses which, at US$0.40 per share, were 4.2% smaller than analysts expected. This is an important time for investors, as they can track a company's performance in its report, look at what top analysts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see analysts' latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Akerna

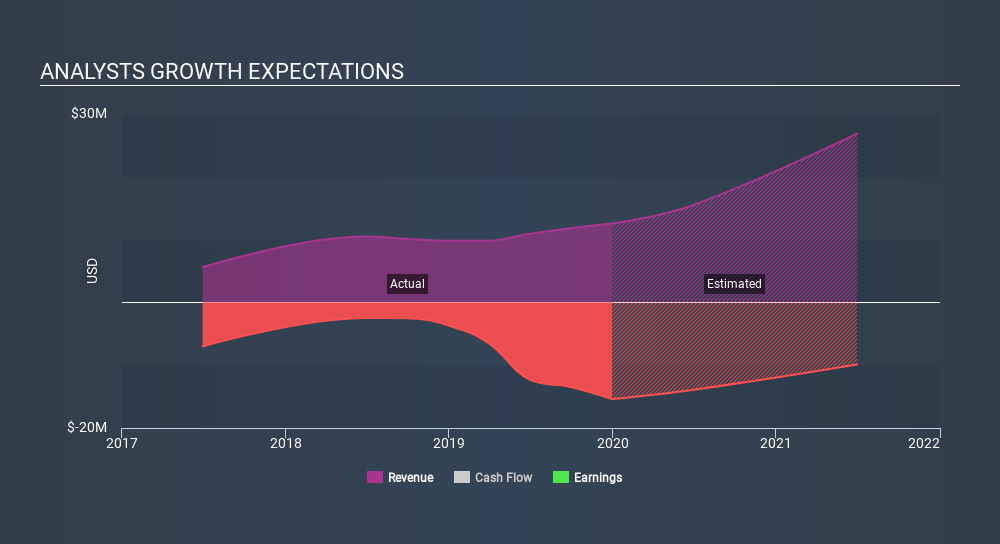

Following the latest results, Akerna's sole analyst are now forecasting revenues of US$15.5m in 2020. This would be a sizeable 24% improvement in sales compared to the last 12 months. Statutory losses are forecast to balloon 37% to US$1.13 per share. Before this latest report, the consensus had been expecting revenues of US$18.0m and US$0.74 per share in losses. It looks like analyst sentiment has declined substantially in the aftermath of these results, with a real cut to revenue estimates and a large cut to consensus earnings per share numbers as well.

The consensus price target fell 22% to US$14.00, with analysts clearly concerned about the company following the weaker revenue and earnings outlook.

Further, we can compare these estimates to past performance, and see how Akerna forecasts compare to the wider market's forecast performance. We can infer from the latest estimates that analysts are expecting a continuation of Akerna's historical trends, as next year's forecast 24% revenue growth is roughly in line with 28% annual revenue growth over the past year. Compare this with the wider market, which analyst estimates (in aggregate) suggest will see revenues grow 5.7% next year. So it's pretty clear that Akerna is forecast to grow substantially faster than its market.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses next year, perhaps suggesting Akerna is moving incrementally towards profitability. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by the latest results, leading to a lower estimate of Akerna's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on Akerna. Long-term earnings power is much more important than next year's profits. We have analyst estimates for Akerna going out as far as 2021, and you can see them free on our platform here.

We also provide an overview of the Akerna Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:KERN

Akerna

Akerna Corp. provides enterprise software solutions that enable regulatory compliance and inventory management in the United States and Canada.

Slightly overvalued with weak fundamentals.

Similar Companies

Market Insights

Community Narratives