- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

Why Investors Shouldn't Be Surprised By Innodata Inc.'s (NASDAQ:INOD) 33% Share Price Surge

Innodata Inc. (NASDAQ:INOD) shares have continued their recent momentum with a 33% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 54%.

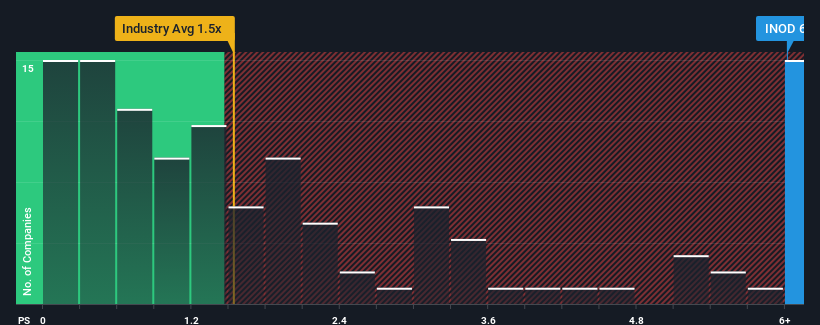

Following the firm bounce in price, when almost half of the companies in the United States' Professional Services industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Innodata as a stock not worth researching with its 6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Innodata

How Has Innodata Performed Recently?

Recent times have been advantageous for Innodata as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Innodata's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Innodata's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. The strong recent performance means it was also able to grow revenue by 58% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 33% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 7.0% each year, which is noticeably less attractive.

With this information, we can see why Innodata is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Innodata have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Innodata shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Innodata (including 1 which is a bit unpleasant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives