- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

Why Innodata (INOD) Is Down 12.2% After Launching a New Federal AI Services Unit

Reviewed by Sasha Jovanovic

- In recent months, Innodata repositioned itself as a data engineering partner for generative AI, while also launching a new federal business unit targeting U.S. defense and intelligence agencies with an initial engagement expected to generate about US$25,000,000 in revenue.

- This shift toward higher-value AI services and federal work, alongside improving EBITDA margins and a stronger cash position, marks a meaningful evolution in the company’s business mix and customer base.

- We’ll now examine how the new federal business unit could reshape Innodata’s investment narrative as an enterprise generative AI partner.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Innodata Investment Narrative Recap

To own Innodata, you need to believe it can convert its generative AI positioning and deep data engineering expertise into durable, diversified revenue, while managing customer concentration and rising investment needs. The new Innodata Federal unit could be a meaningful short term catalyst if the forecast US$25,000,000 engagement proves a template for larger work, but it does not remove the key risk that a small group of big tech clients still drives a large share of revenue.

The Innodata Federal launch is the most directly relevant recent development, as it opens a new government channel that is structurally different from Innodata’s commercial tech relationships. If this business gains traction, it could reduce reliance on a few large technology customers and partially offset the risk that those clients cut spend or in-source data and AI capabilities, which remains a central issue in assessing the company’s resilience.

Yet behind the promise of new federal AI work, investors should be aware that revenue is still heavily tied to a small set of large tech customers...

Read the full narrative on Innodata (it's free!)

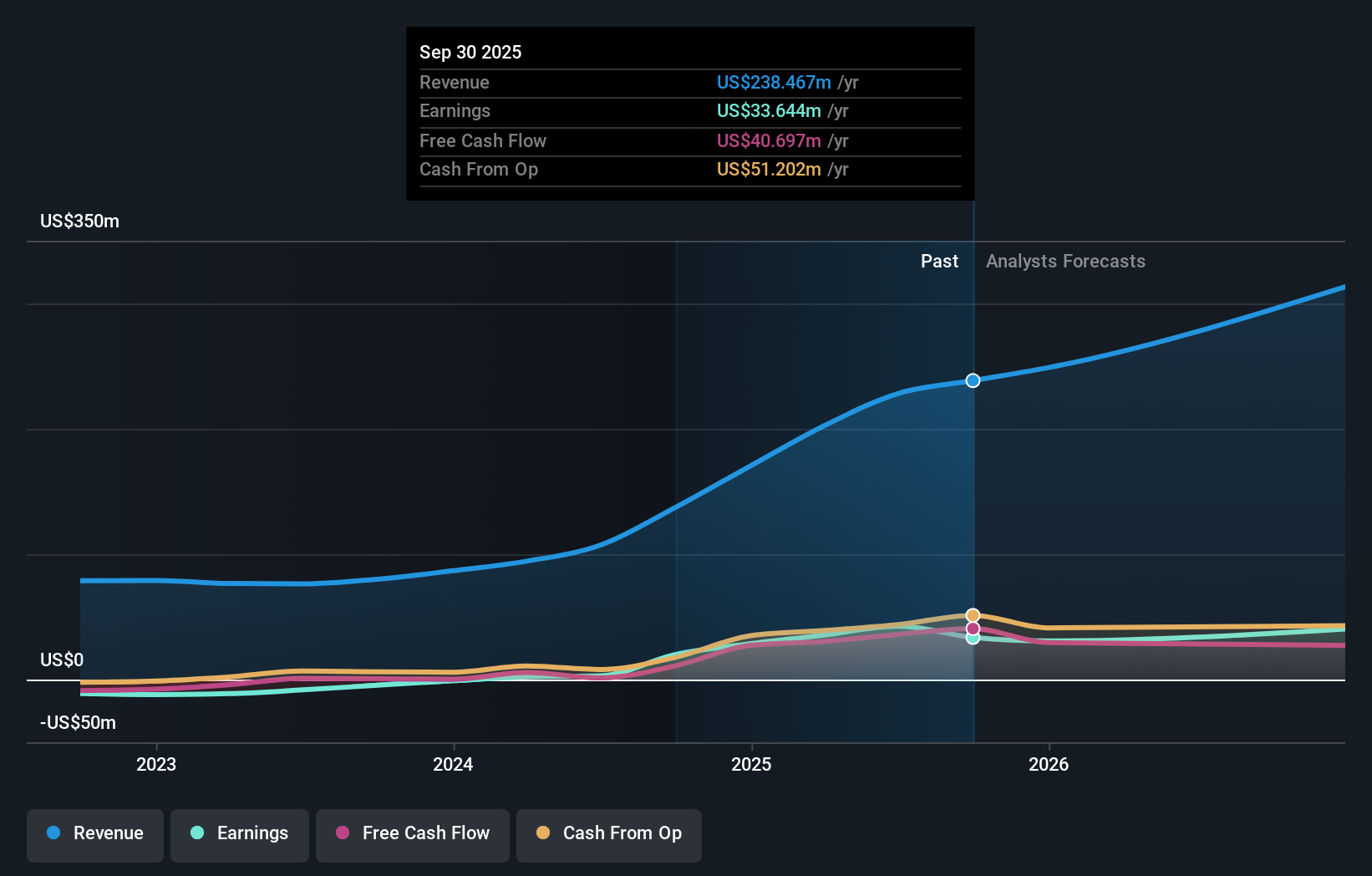

Innodata's narrative projects $350.9 million revenue and $41.6 million earnings by 2028. This requires 15.4% yearly revenue growth and a $1.1 million earnings decrease from $42.7 million today.

Uncover how Innodata's forecasts yield a $93.75 fair value, a 95% upside to its current price.

Exploring Other Perspectives

Sixteen fair value estimates from the Simply Wall St Community span roughly US$12 to US$94. You can weigh those views against the concentration risk around Innodata’s largest technology customers and consider how different outcomes there could affect the business over time.

Explore 16 other fair value estimates on Innodata - why the stock might be worth less than half the current price!

Build Your Own Innodata Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innodata research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Innodata research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innodata's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion