- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

What Recent AI Partnership Means for Innodata’s Soaring Share Price in 2025

Reviewed by Bailey Pemberton

If you’ve ever wondered whether Innodata is still a smart move after its historic run, you’re definitely not alone. The stock has become one of the market’s most talked-about high flyers, and with a 2886.5% return over the past five years, it’s easy to see why investors are keeping a close watch. More recently, Innodata climbed 18.7% over the past month, though it did dip by 4.6% over the last week. Year to date, it’s already up an impressive 101.1%, and over the past year, it’s rocketed by 322.6%. Investors have responded to industry optimism and market developments, which has supercharged the growth narrative around the company and at times shifted how the market thinks about its risk profile.

With this kind of performance, the big question is whether Innodata still offers value at today’s price or if all that excitement has pushed it beyond rational valuation. Perhaps surprisingly, the latest scores say it’s not undervalued according to the major methods. Innodata gets a valuation score of 0 out of 6. That’s your first clue that the story may be more complicated than simple momentum or speculation. Next, we’ll break down what each valuation approach tells us about where Innodata stands, and before we wrap up, I’ll show you a more insightful way to size up its true worth.

Innodata scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Innodata Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common tool for assessing a company's value by projecting its future free cash flows and discounting them back to today's dollars. This approach aims to estimate what Innodata is actually worth, based on expected cash flows it might generate in the years ahead.

For Innodata, the latest available data shows current Free Cash Flow (FCF) at $32.58 million. Looking ahead, analyst estimates suggest FCF will be around $26.04 million by 2026. Beyond that, projections extend ten years into the future, using estimates from both analysts and extrapolation. Over this period, cash flows appear relatively stable, with gradual increases projected over time.

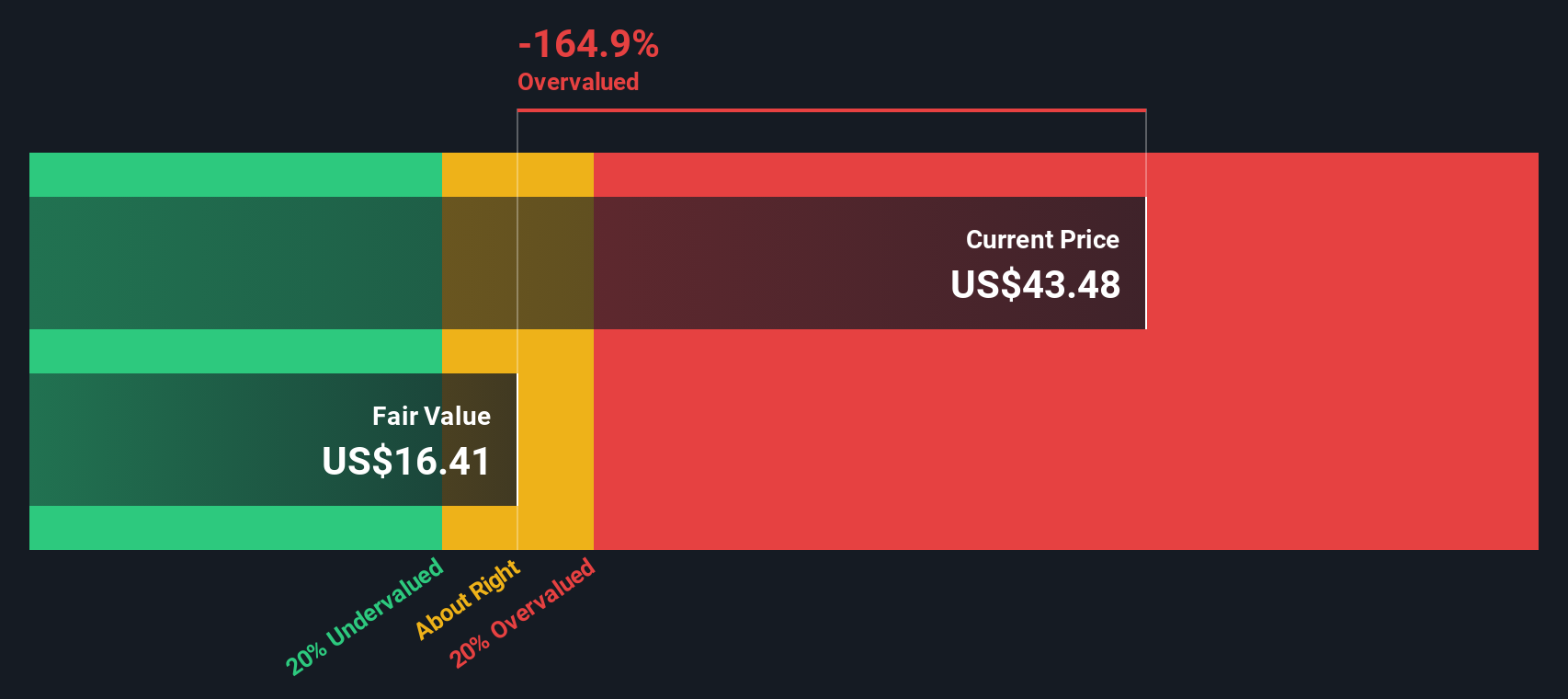

All these future cash flows are discounted back to their present value to arrive at an intrinsic fair value for the stock. According to this DCF model, Innodata's estimated fair value is $16.42 per share. Compared to its current trading price, this implies the stock is 383.8% overvalued based on future cash flow expectations alone.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Innodata may be overvalued by 383.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Innodata Price vs Earnings

For companies that generate consistent profits, the Price-to-Earnings (PE) ratio is a classic and effective way to assess valuation. It helps investors compare what the market is willing to pay for current earnings relative to other businesses, giving context about growth prospects and perceived risk.

In general, companies with higher growth expectations or lower risk profiles command a higher PE ratio because the market anticipates those future profits will keep rising. Conversely, more volatile or slower-growing firms typically trade at lower multiples. So, when sizing up Innodata, it is important to put its PE in context rather than view it in isolation.

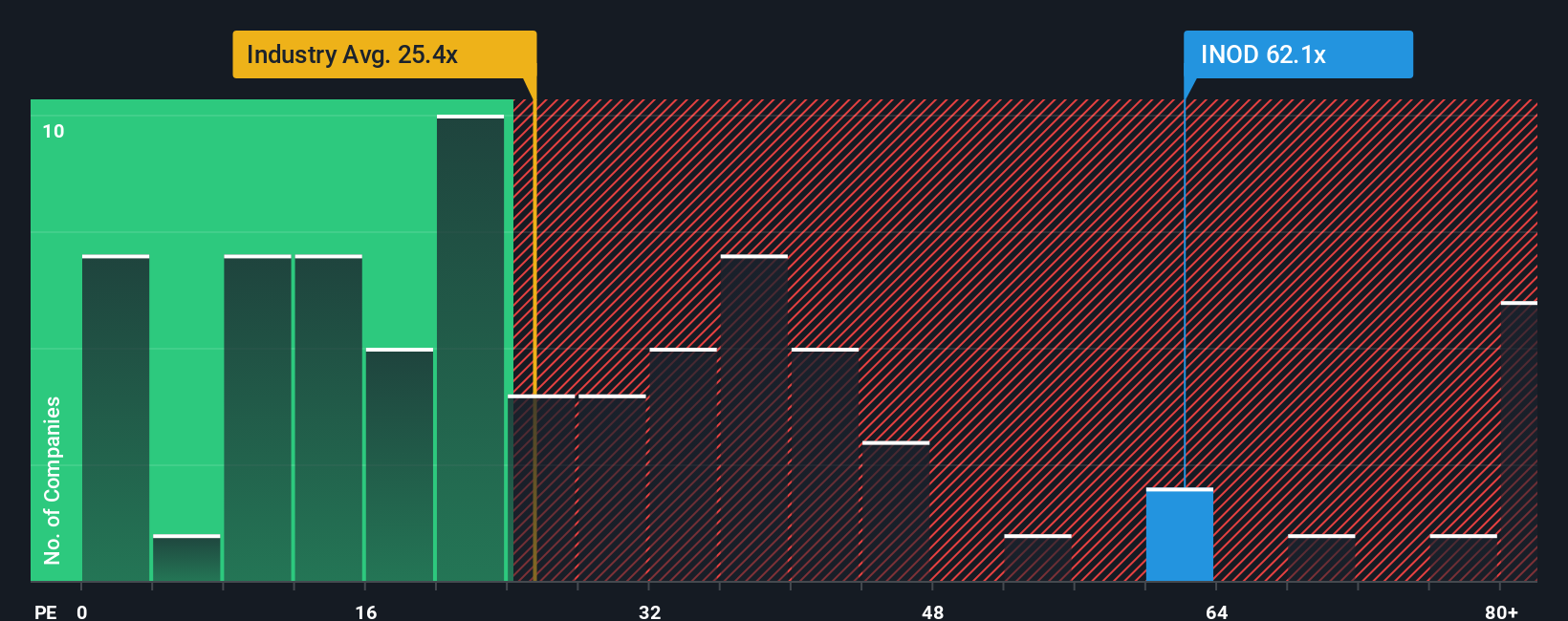

Innodata currently trades at a PE of 59.26x. That is significantly above the Professional Services industry average of 24.94x and higher than its peer average of 46.38x. On the surface, this premium might seem to signal that investors expect particularly strong results ahead, or it could reflect excessive optimism.

This is where Simply Wall St’s "Fair Ratio" comes in. The Fair Ratio for Innodata is 22.44x, calculated using a mix of factors including its earnings growth, margins, industry norms, market capitalization, and risk profile. Unlike simple peer or industry comparisons, the Fair Ratio provides a more precise benchmark grounded in the company’s unique fundamentals, not just broad averages that may overlook key differences.

Since Innodata’s current PE is well above its Fair Ratio, the stock appears overvalued according to this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Innodata Narrative

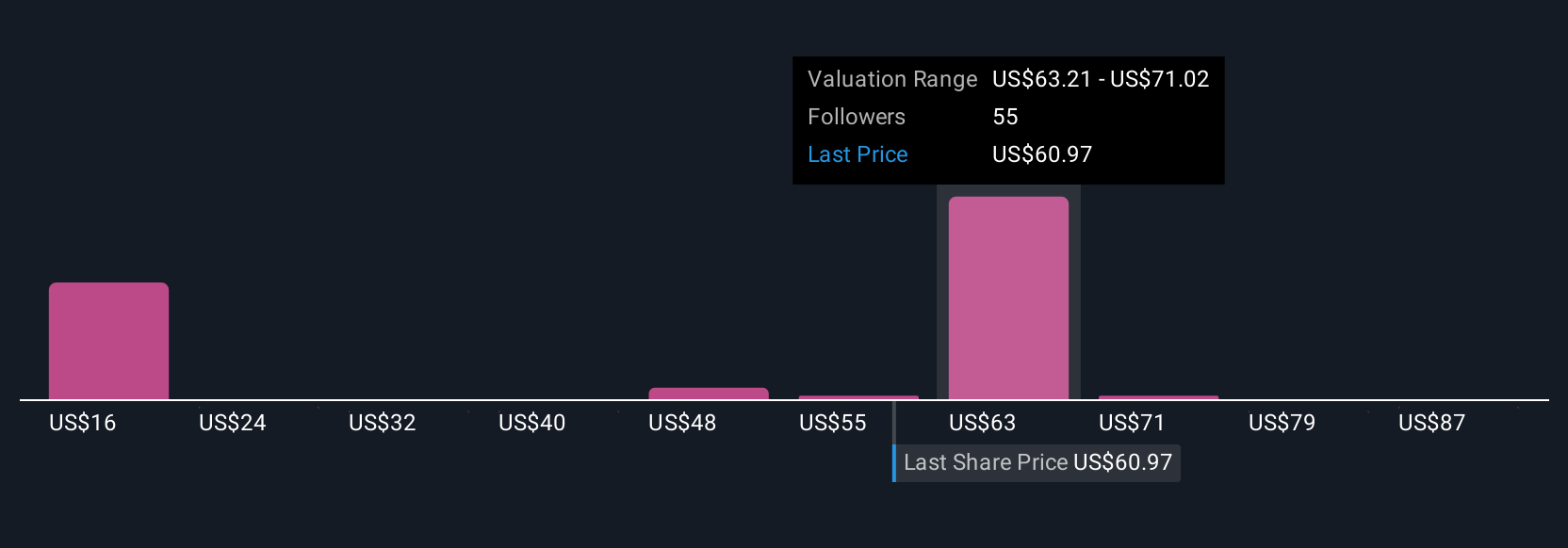

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, connecting your view of the business and its market with a simple financial forecast and a resulting fair value estimate. Instead of relying solely on one-size-fits-all ratios or traditional models, Narratives let you turn your insights or expectations for Innodata, such as revenue growth, margins, or industry trends, into an actionable price target you can easily compare to the stock’s actual price.

Narratives are designed to be accessible for any investor and are available to millions on Simply Wall St’s Community page. They help you make smarter buy or sell decisions by offering dynamic fair values that update automatically as breaking news or earnings reports are published, so your opinions remain in sync with the company’s performance and outlook.

For example, some investors’ Narratives for Innodata reflect strong optimism, projecting a fair value as high as $75.00 per share, while others, concerned about margin risks or industry headwinds, land at just $55.00. Whichever perspective you lean toward, Narratives allow you to harness both your story and the numbers to guide your investment decisions in a more flexible, real-world way.

Do you think there's more to the story for Innodata? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion