- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

Innodata (INOD): Assessing the Valuation After Federal Expansion and Strategic Leadership Moves

Reviewed by Simply Wall St

Innodata (INOD) just launched Innodata Federal, a dedicated unit aiming to deliver AI solutions to U.S. government agencies. This move comes as the company strengthens its leadership with new board appointments from technology and defense backgrounds.

See our latest analysis for Innodata.

After a rapid run-up earlier in the year, momentum has cooled in recent weeks as Innodata's share price retraced 28% over the past month. New government-focused initiatives and fresh leadership appointments have made headlines. Still, the stock's 45% gain year-to-date and robust 56% total shareholder return over the past year point to strong, longer-term conviction among investors excited about its expansion potential.

If this string of leadership moves and public sector deals has you curious, now is the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With the company trading well below analyst targets despite its recent rally, the question now is whether Innodata remains undervalued for forward-looking investors or if today’s price already fully reflects its projected growth.

Most Popular Narrative: 33.5% Undervalued

With the narrative fair value set at $86, Innodata's last close price of $57.21 suggests a dramatic gap between market expectations and what key analysts believe the company is really worth. This disconnect sheds light on bullish assumptions that warrant a closer look, especially as the market debates whether high future growth can justify such a premium.

Increasing adoption of AI across industries requires curated and high-quality datasets, and Innodata's evolving role from simple data provider to strategic partner (sitting "at the table" with clients' data scientists) is likely to support premium pricing, recurring contracts, and market share gains, with positive impact on both revenue stability and net margins.

Want to peek behind the scenes of this sky-high narrative? The secret is a bold financial forecast that hinges on something only a few companies can pull off: premium pricing, sticky client relationships, and a market positioning that goes way beyond selling data. The numbers and assumptions shaping this fair value might just surprise you.

Result: Fair Value of $86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should consider that losing key tech clients or rising industry competition could quickly challenge Innodata's ambitious growth narrative.

Find out about the key risks to this Innodata narrative.

Another View: Looking at Market Comparisons

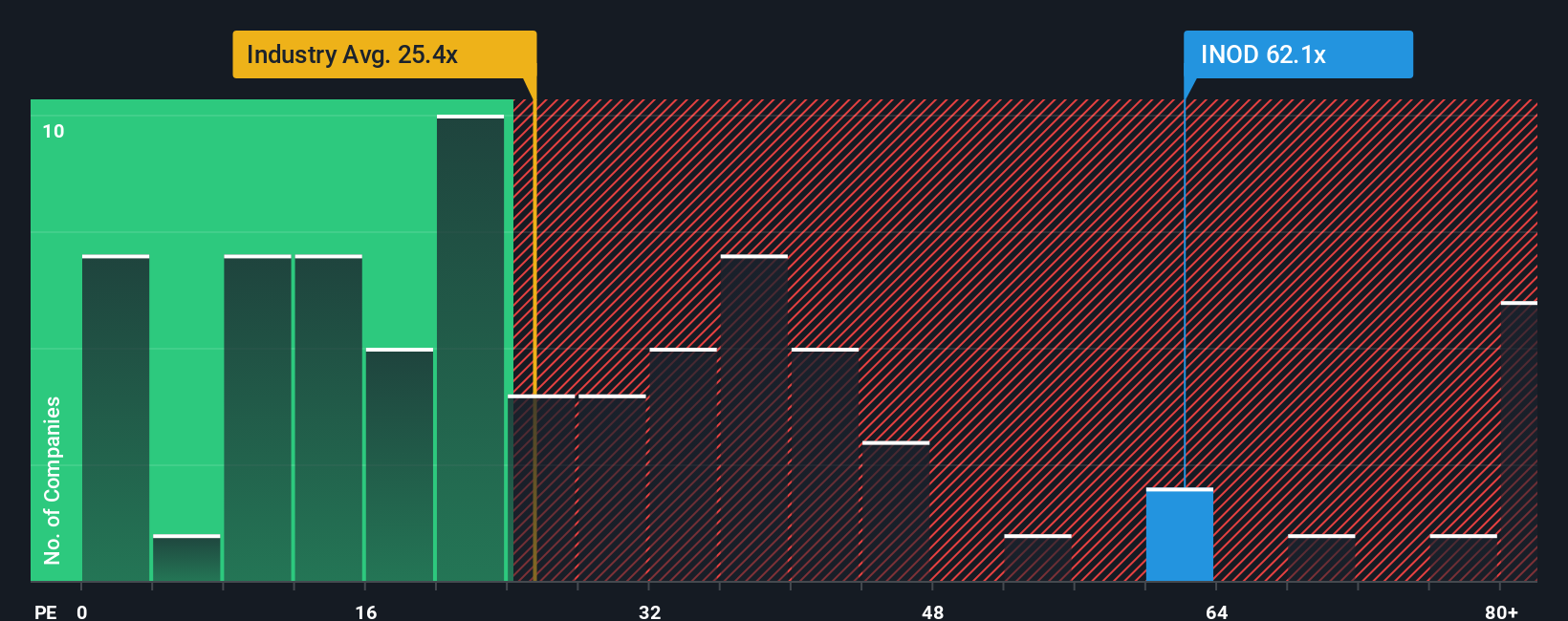

While the narrative puts Innodata's fair value at $86, market-based measures tell a different story. Its price-to-earnings ratio of 54.2x is well above peers at 41.1x, the Professional Services industry average of 23.9x, and the fair ratio of 33.3x. This suggests the market is already pricing in a lot of optimism, posing a risk that expectations may be running ahead of fundamentals. Could this premium persist, or is a reality check looming?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Innodata Narrative

If the story so far doesn't match your outlook, or you want to dive deeper on your own terms, you can build a custom thesis in just a few minutes. Do it your way

A great starting point for your Innodata research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Ideas?

Don’t let opportunity pass you by. The smartest investors stay ahead by searching beyond the obvious. Unique opportunities are waiting to be found with the right tools.

- Unlock growth by targeting high-yield opportunities with these 16 dividend stocks with yields > 3%, rewarding shareholders with robust passive income streams.

- Spot emerging breakthroughs and capitalize on innovation by tapping into these 25 AI penny stocks, fueling tomorrow’s advancements in artificial intelligence.

- Maximize your potential returns with these 886 undervalued stocks based on cash flows, featuring companies trading below their intrinsic worth and ready for a market re-rate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives