- United States

- /

- Professional Services

- /

- NasdaqGS:ICFI

ICF International’s Share Price Drop Sparks Fresh Debate on Value in 2025

Reviewed by Bailey Pemberton

If you have been eyeing ICF International lately and wondering whether now is the right moment to get in, you are not alone. With shares closing at $94.15 recently, the stock’s story over the last year has been anything but smooth. A 43.1% drop over twelve months would make anyone pause and reconsider. However, it is worth noting that zooming out to a five-year horizon, ICF International is still up 43.9%. Those longer-term gains highlight that, despite the turbulence, the company has demonstrated resilience that investors cannot ignore.

More recently, the stock is showing subtle signs of stabilization. Over the last week, it saw a modest lift of 1.2%, even though the previous month was slightly negative at -1.1%. Of course, the year-to-date number, down 20.2%, still weighs heavily on sentiment. Some of that negative movement traces back to heightened market risk aversion, especially toward consulting and government services firms, as investors reassess growth expectations across the sector. While external shocks have pushed prices down, it has also created an interesting setup for valuation-oriented investors.

On that note, I ran ICF International through six of the major undervaluation checks people use, from price-to-earnings to discounted cash flows. The company measures as undervalued on four out of six, giving it a value score of 4, suggesting potential that is hard to ignore for anyone who likes to buy quality at a bargain.

So, is ICF International really undervalued, or do the recent share price moves reflect deeper risks? Let us walk through the main ways to evaluate value, and then I will highlight an often-overlooked angle that could tell you even more about what the market is missing.

Why ICF International is lagging behind its peers

Approach 1: ICF International Discounted Cash Flow (DCF) Analysis

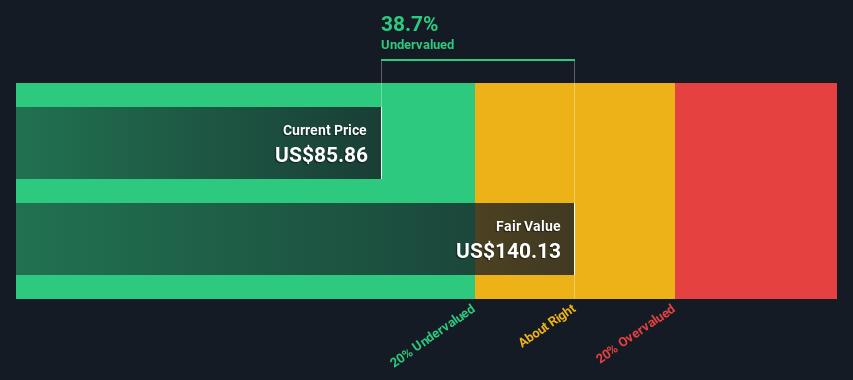

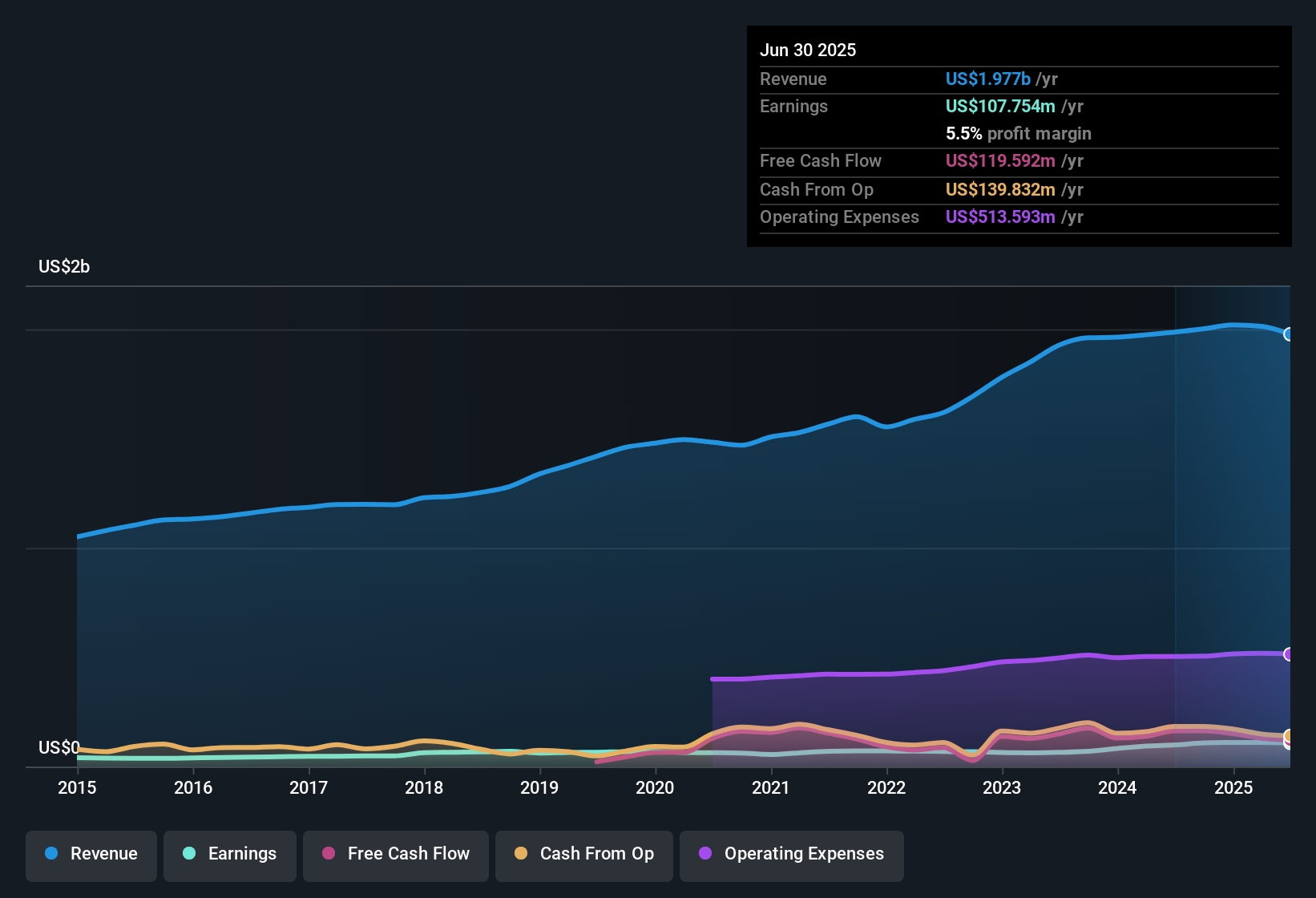

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to reflect today's value. For ICF International, this approach uses the company's current Free Cash Flow, which stands at $117.5 million, as a baseline. Analysts forecast that the Free Cash Flow will reach $123.7 million by 2026. Beyond 2026, further projections, extrapolated using trends and assumptions, continue up to 2035, with cash flows generally staying above $110 million each year.

When these future cash flows are discounted, the resulting intrinsic value for ICF International lands at $112.19 per share. Compared to the recent share price of $94.15, this implies a 16.1% discount and suggests that the stock is trading below its estimated fair value. In practical terms, it indicates that the market may be underestimating the company's long-term earning potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ICF International is undervalued by 16.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: ICF International Price vs Earnings

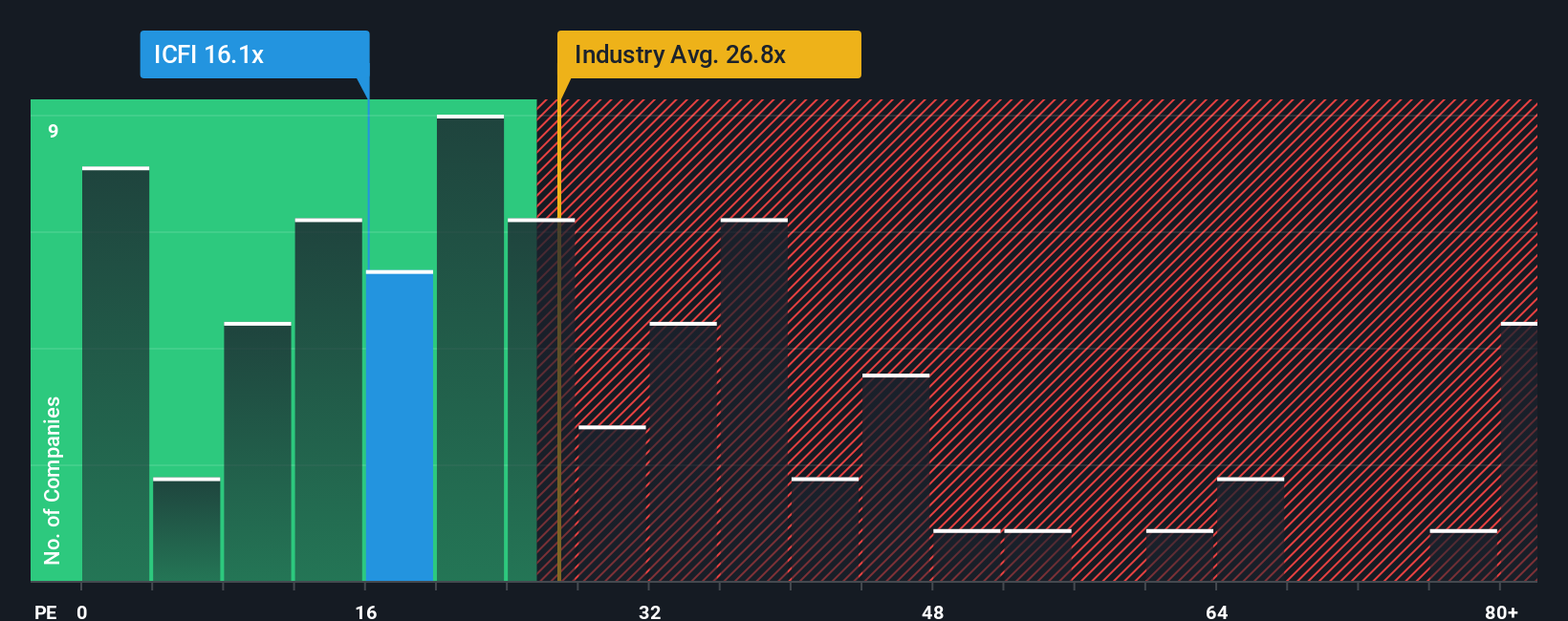

For profitable companies like ICF International, the Price-to-Earnings (PE) ratio remains one of the most widely used metrics to gauge value, as it directly links a company's market price to its earnings power. A "normal" or "fair" PE ratio varies depending on factors such as expected growth rates and the level of risk investors are willing to accept in the current market environment. High-growth companies or those perceived as safer investments often command a premium.

ICF International currently trades at a PE ratio of 16.1x. To put this in context, the Professional Services industry averages a PE of 26.8x, while the company’s peer group sits even higher at 37.0x. On the surface, ICFI’s multiple looks attractively low.

However, Simply Wall St’s Fair Ratio digs deeper. Instead of just comparing to broad industry figures, it calculates a custom benchmark based on ICF International’s own growth forecasts, risk profile, profit margins, and market cap, arriving at a Fair Ratio of 18.0x. This tailored measure gives a clearer sense of the multiple the market should assign today.

Since ICFI’s actual PE is below both its peers and its Fair Ratio, and the difference between the Fair Ratio and the current PE (1.9x) is meaningful, the shares look undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ICF International Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to the concept of Narratives. A Narrative is your unique perspective on a company, where you connect the dots between its business story, your expectations for its future revenue, margins and earnings, and what you believe its fair value should be. Narratives make investing more powerful by tying together what is happening on the ground with a forward-looking financial model. This approach helps you see whether the current share price makes sense for your view.

Simply Wall St’s Community makes Narratives easy to use and accessible to everyone, not just professionals. You can create or explore Narratives about ICF International right on the platform, then instantly see how each Narrative leads to a specific fair value. This tool helps investors make smarter buy or sell decisions by comparing these Narrative fair values to the market price. It also gets dynamically updated as news or earnings are announced, so your investment thesis can always reflect fresh information.

For example, some investors believe ICF International’s focus on energy efficiency and AI will drive future growth, supporting a high price target of $133. Others see risks from government funding and margin pressure, justifying a lower target of $88.

Do you think there's more to the story for ICF International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICFI

ICF International

Provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026