- United States

- /

- Professional Services

- /

- NasdaqGS:ICFI

Does a Shrinking Sales Pipeline Challenge ICF International's Growth Story or Signal Shifting Priorities for ICFI?

Reviewed by Sasha Jovanovic

- Earlier this week, investors raised concerns after comments revealed ICF International is experiencing a declining sales pipeline and projecting lower future revenue.

- This raises questions about the company's ability to sustain growth momentum in the face of headwinds affecting its project pipeline.

- We'll examine how concerns over ICF International's shrinking sales pipeline may shape its investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

ICF International Investment Narrative Recap

To be confident as a shareholder in ICF International, you have to believe in the company's ability to convert a strong position in energy consulting and technology into consistent long-term growth, even as near-term challenges emerge. Recent news revealing a shrinking sales pipeline and projected revenue decline could have a material impact on the company’s main short-term catalyst: a return to federal contract growth, while reinforcing current risks tied to procurement slowdowns and contract delays. A particularly relevant recent announcement is ICF’s confirmation on July 31, 2025, of its 2025 earnings guidance, acknowledging up to a 10% decline in revenue from 2024 levels, yet aiming for EPS at the high end of the range. This guidance points to management’s recognition of pipeline and backlog headwinds, coinciding with wider concerns about reduced revenue visibility due to contract delays and funding issues. However, in contrast to past years, investors should be especially mindful of...

Read the full narrative on ICF International (it's free!)

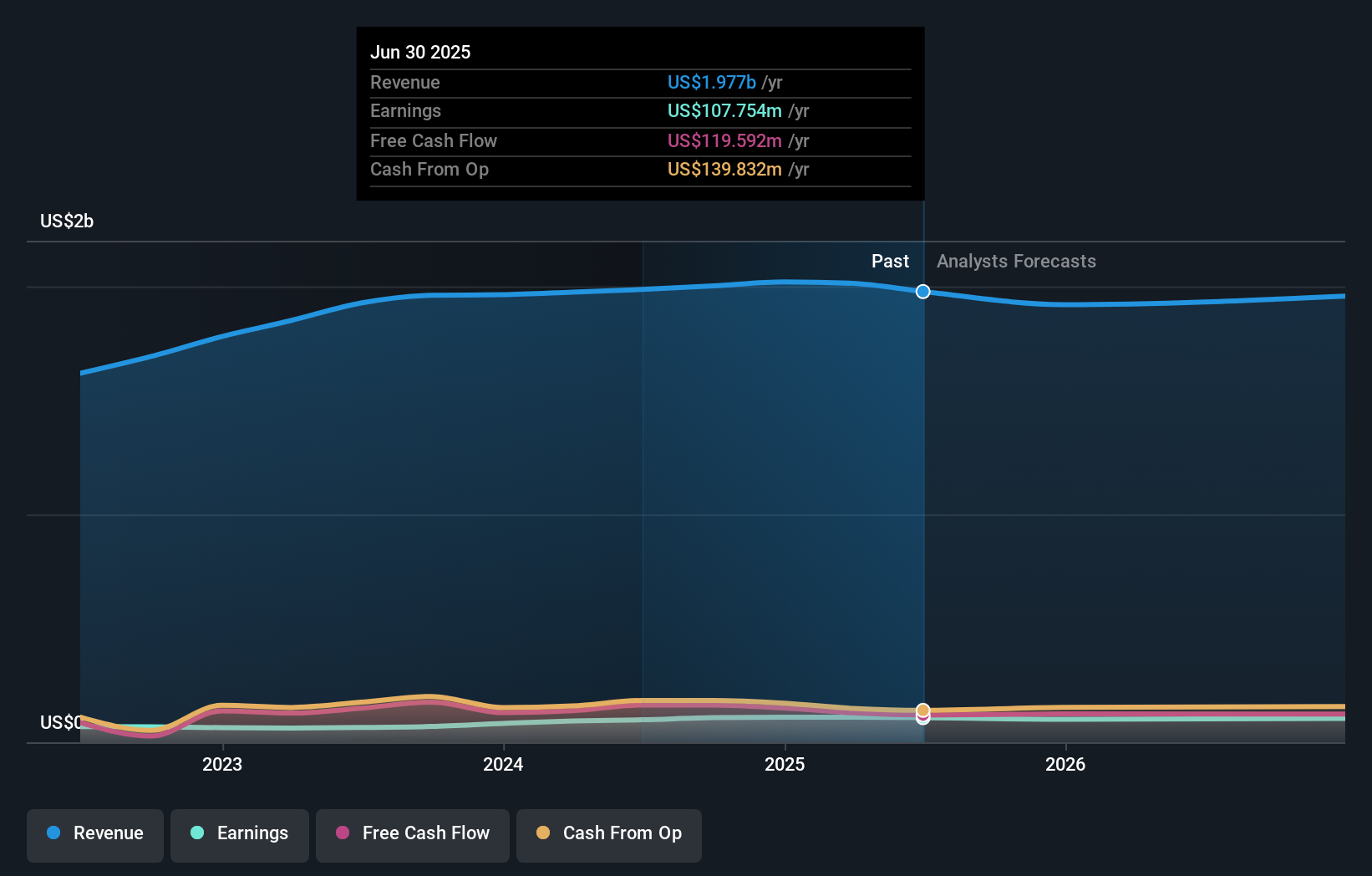

ICF International's outlook anticipates $1.9 billion in revenue and $97.8 million in earnings by 2028. This scenario assumes a 0.9% yearly revenue decline and a $10 million decrease in earnings from the current $107.8 million.

Uncover how ICF International's forecasts yield a $103.25 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community have posted two fair value estimates for ICF International stock between US$103.25 and US$111.90. While these perspectives suggest a potential share price gap, the company’s risks around US federal contract reductions and pipeline weakness may become clearer as project conversions slow. Read multiple viewpoints to inform your own outlook.

Explore 2 other fair value estimates on ICF International - why the stock might be worth just $103.25!

Build Your Own ICF International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICF International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ICF International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICF International's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICFI

ICF International

Provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives