- United States

- /

- Professional Services

- /

- NasdaqGM:IBEX

IBEX Limited (NASDAQ:IBEX) Soars 31% But It's A Story Of Risk Vs Reward

IBEX Limited (NASDAQ:IBEX) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. The annual gain comes to 110% following the latest surge, making investors sit up and take notice.

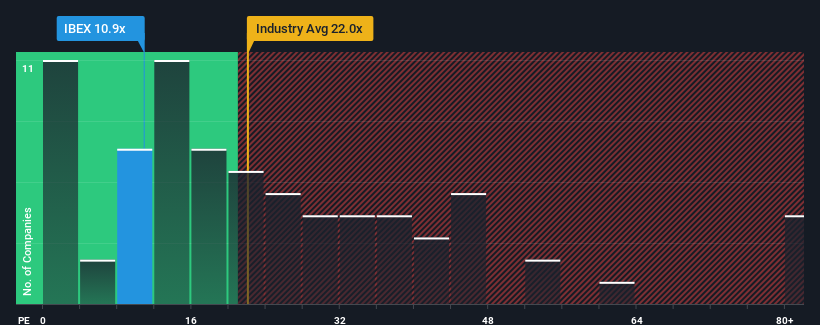

In spite of the firm bounce in price, IBEX may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.9x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 32x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

We've discovered 1 warning sign about IBEX. View them for free.With earnings growth that's exceedingly strong of late, IBEX has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for IBEX

How Is IBEX's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as IBEX's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 51% last year. Pleasingly, EPS has also lifted 132% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 14% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that IBEX's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

IBEX's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that IBEX currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Plus, you should also learn about this 1 warning sign we've spotted with IBEX.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:IBEX

IBEX

Provides end-to-end technology-enabled customer lifecycle experience solutions in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success