- United States

- /

- Professional Services

- /

- NasdaqGS:HSON

Most Shareholders Will Probably Find That The CEO Compensation For Hudson Global, Inc. (NASDAQ:HSON) Is Reasonable

Performance at Hudson Global, Inc. (NASDAQ:HSON) has been reasonably good and CEO Jeff Eberwein has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 19 May 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for Hudson Global

How Does Total Compensation For Jeff Eberwein Compare With Other Companies In The Industry?

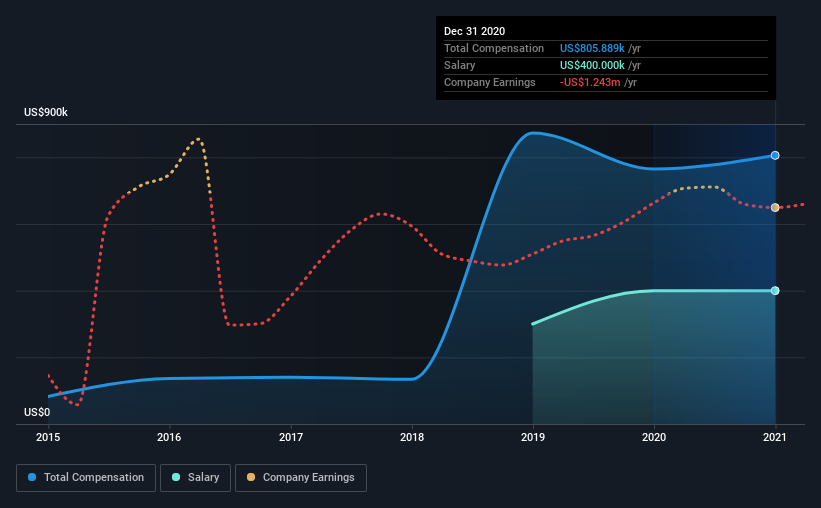

According to our data, Hudson Global, Inc. has a market capitalization of US$49m, and paid its CEO total annual compensation worth US$806k over the year to December 2020. That's a modest increase of 5.3% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$400k.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$708k. So it looks like Hudson Global compensates Jeff Eberwein in line with the median for the industry. What's more, Jeff Eberwein holds US$2.4m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$400k | US$400k | 50% |

| Other | US$406k | US$365k | 50% |

| Total Compensation | US$806k | US$765k | 100% |

Speaking on an industry level, nearly 23% of total compensation represents salary, while the remainder of 77% is other remuneration. Hudson Global is paying a higher share of its remuneration through a salary in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Hudson Global, Inc.'s Growth

Over the past three years, Hudson Global, Inc. has seen its earnings per share (EPS) grow by 73% per year. In the last year, its revenue is up 9.9%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Hudson Global, Inc. Been A Good Investment?

With a total shareholder return of 5.5% over three years, Hudson Global, Inc. has done okay by shareholders, but there's always room for improvement. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Hudson Global that investors should think about before committing capital to this stock.

Important note: Hudson Global is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Hudson Global, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Hudson Global, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hudson Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:HSON

Hudson Global

Provides talent solutions for mid-to-large-cap multinational companies and government agencies under the Hudson RPO brand in the Americas, the Asia Pacific, and Europe.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives