- United States

- /

- Professional Services

- /

- NasdaqGS:HSII

Evaluating Heidrick & Struggles (HSII) Valuation After 16% One-Month Share Price Rally

Reviewed by Kshitija Bhandaru

Heidrick & Struggles International (HSII) shares have gained ground over the past month, climbing about 16%. Investors seem interested in how the company is performing as overall results continue to trend positive year to date.

See our latest analysis for Heidrick & Struggles International.

Momentum is clearly building for Heidrick & Struggles International, with the stock’s 1-month share price return of nearly 16% reinforcing a year-to-date rally of almost 32%. Looking longer term, the company’s total shareholder return stands out at 58% over the past year and an impressive 189% over five years. This suggests investor confidence is growing thanks to both operational progress and positive shifts in market sentiment.

Curious what else is gaining traction beyond professional services? Now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

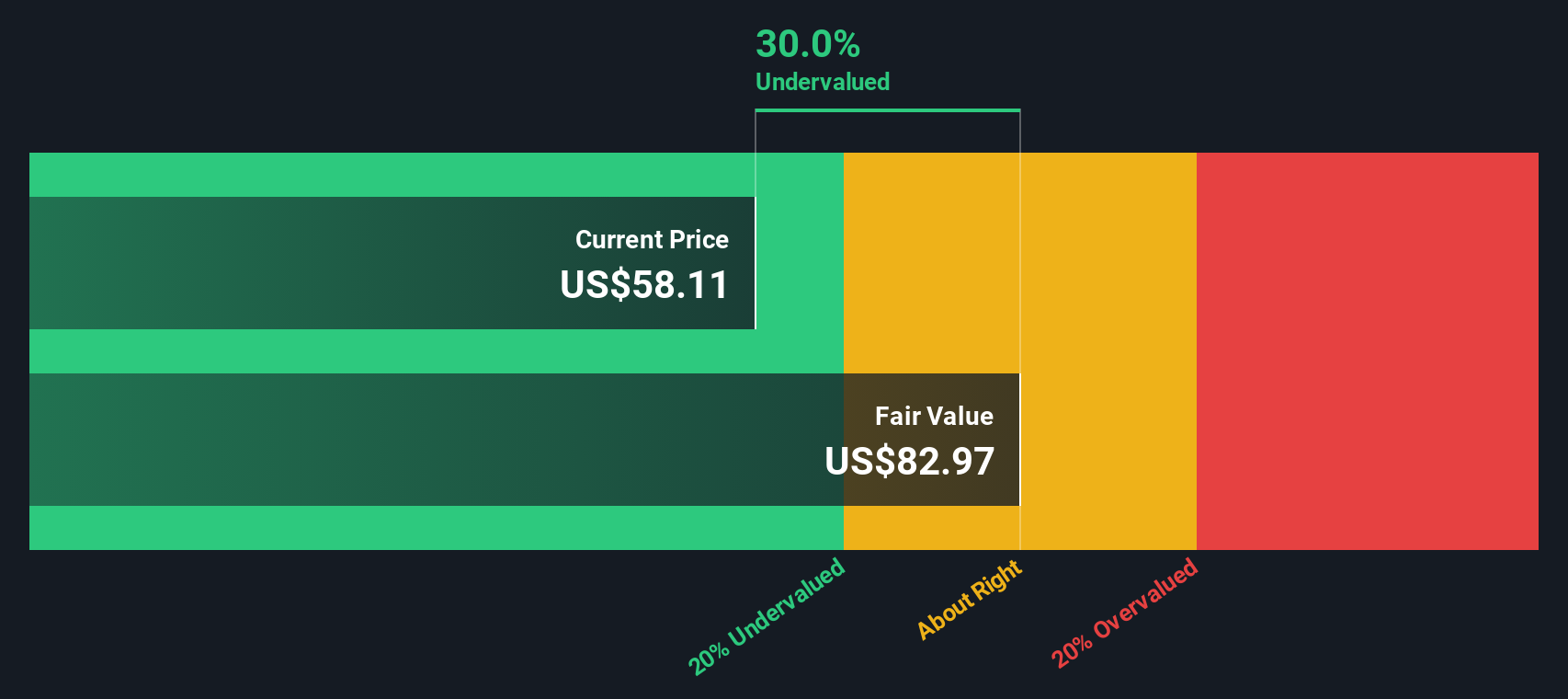

With shares rallying and recent results impressing, the key question for investors is whether Heidrick & Struggles International remains undervalued, or if the market has already factored in all of its future growth potential.

Most Popular Narrative: 20% Overvalued

With Heidrick & Struggles International closing at $58.11, the most popular narrative suggests its fair value sits closer to $48. This places the stock well above what is justified based on expected growth and profitability. The stage is set to see why the valuation appears stretched according to the leading analyst consensus.

The shift toward technology-driven client solutions and the adoption of AI across industries presents a risk if Heidrick & Struggles struggles to scale or differentiate its proprietary digital offerings versus larger or more technologically advanced competitors. This could potentially limit future margin expansion and net income growth. Increasing investments in hiring and compensation, especially from early talent acquisition and development, raise the company's fixed cost base. If revenue growth slows or productivity trends revert to historical levels, this could exert downward pressure on net margins and overall earnings.

How does a stock end up priced this far above its calculated value? The narrative behind this premium weaves together aggressive earnings projections, ambitious margin expansion, and a future profit multiple that rivals sector high-flyers. Which figures and assumptions are bold enough to produce such a high fair value estimate? Read the full story to uncover the key details shaping this view.

Result: Fair Value of $48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic uncertainty and rapid shifts toward in-house or digital solutions could challenge Heidrick & Struggles’ long-term growth expectations.

Find out about the key risks to this Heidrick & Struggles International narrative.

Another View: Discounted Cash Flow Tells a Different Story

While the popular narrative sees Heidrick & Struggles International as overvalued, our DCF model suggests a very different outcome. On this basis, shares look about 30% undervalued compared to what the company’s future cash flows might be worth today. Can the fundamentals justify this gap, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Heidrick & Struggles International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Heidrick & Struggles International Narrative

If you think there’s a different angle or want to look deeper into the numbers, you can craft your own story in just a few minutes, and Do it your way.

A great starting point for your Heidrick & Struggles International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye out for fresh opportunities. Don’t let valuable prospects slip away. See what else could energize your portfolio today.

- Capitalize on the hottest trends in artificial intelligence by reviewing these 25 AI penny stocks, which are poised to shape tomorrow’s innovations and disrupt entire industries.

- Target yields that matter and identify top picks among these 19 dividend stocks with yields > 3% paying more than 3%, so your money works harder for you.

- Seize undervalued gems using these 887 undervalued stocks based on cash flows to get a head start on companies with strong cash flow and breakthrough growth on the horizon.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidrick & Struggles International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSII

Heidrick & Struggles International

Provides executive search, consulting, and on-demand talent services to businesses and business leaders worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.