- United States

- /

- Commercial Services

- /

- NasdaqGS:HCSG

Healthcare Services Group (NASDAQ:HCSG) earnings and shareholder returns have been trending downwards for the last five years, but the stock ascends 6.7% this past week

For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Healthcare Services Group, Inc. (NASDAQ:HCSG) shareholders for doubting their decision to hold, with the stock down 44% over a half decade. The falls have accelerated recently, with the share price down 13% in the last three months. But this could be related to the weak market, which is down 9.4% in the same period.

On a more encouraging note the company has added US$51m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

See our latest analysis for Healthcare Services Group

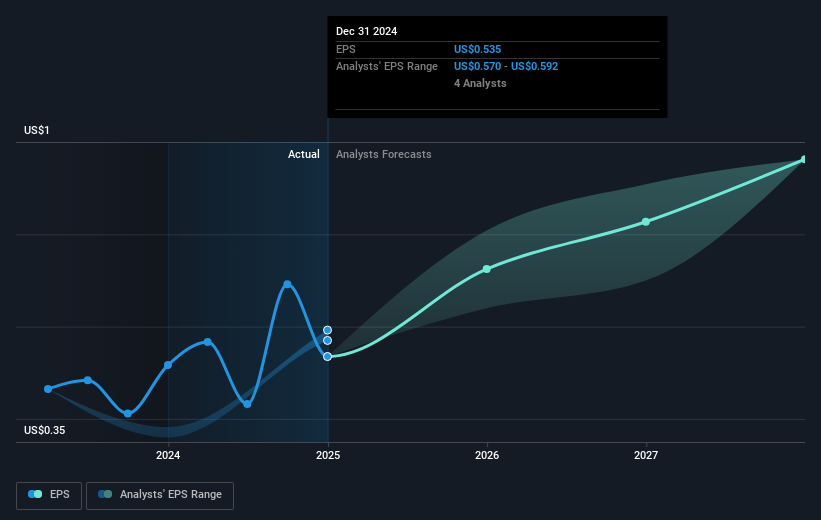

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Looking back five years, both Healthcare Services Group's share price and EPS declined; the latter at a rate of 9.2% per year. This change in EPS is reasonably close to the 11% average annual decrease in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price change has reflected changes in earnings per share.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Healthcare Services Group's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We've already covered Healthcare Services Group's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Healthcare Services Group's TSR of was a loss of 37% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Healthcare Services Group shareholders are down 10% for the year, but the market itself is up 8.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Before spending more time on Healthcare Services Group it might be wise to click here to see if insiders have been buying or selling shares.

Of course Healthcare Services Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HCSG

Healthcare Services Group

Provides management, administrative, and operating services to the housekeeping, laundry, linen, facility maintenance, and dietary service departments of nursing homes, retirement complexes, rehabilitation centers, and hospitals in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives