- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

Is ExlService Holdings (NASDAQ:EXLS) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies ExlService Holdings, Inc. (NASDAQ:EXLS) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for ExlService Holdings

What Is ExlService Holdings's Net Debt?

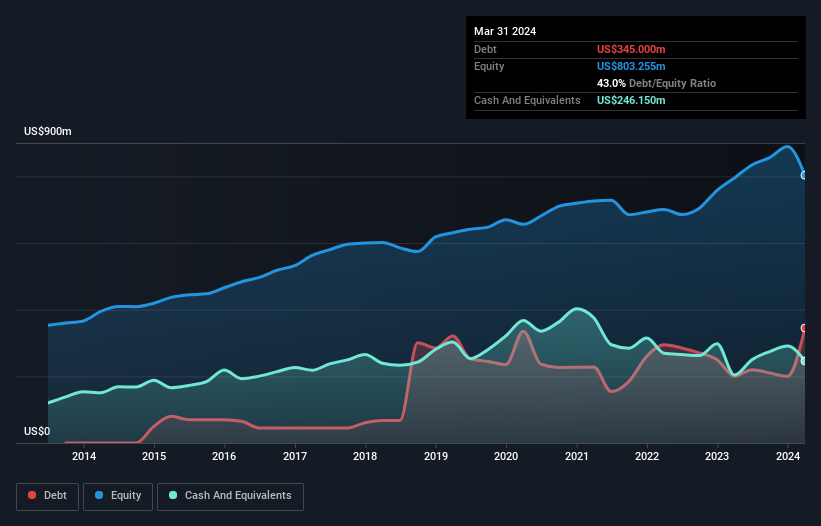

You can click the graphic below for the historical numbers, but it shows that as of March 2024 ExlService Holdings had US$345.0m of debt, an increase on US$200.0m, over one year. However, it does have US$246.2m in cash offsetting this, leading to net debt of about US$98.9m.

A Look At ExlService Holdings' Liabilities

The latest balance sheet data shows that ExlService Holdings had liabilities of US$261.4m due within a year, and liabilities of US$374.7m falling due after that. On the other hand, it had cash of US$246.2m and US$356.9m worth of receivables due within a year. So its liabilities total US$33.1m more than the combination of its cash and short-term receivables.

This state of affairs indicates that ExlService Holdings' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$4.85b company is short on cash, but still worth keeping an eye on the balance sheet.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

ExlService Holdings's net debt is only 0.35 times its EBITDA. And its EBIT easily covers its interest expense, being 53.5 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Also good is that ExlService Holdings grew its EBIT at 16% over the last year, further increasing its ability to manage debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if ExlService Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, ExlService Holdings produced sturdy free cash flow equating to 65% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, ExlService Holdings's impressive interest cover implies it has the upper hand on its debt. And that's just the beginning of the good news since its net debt to EBITDA is also very heartening. Zooming out, ExlService Holdings seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with ExlService Holdings .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Excellent balance sheet with reasonable growth potential.