- United States

- /

- Commercial Services

- /

- NasdaqGS:CWST

Casella Waste Systems, Inc. (NASDAQ:CWST) Not Flying Under The Radar

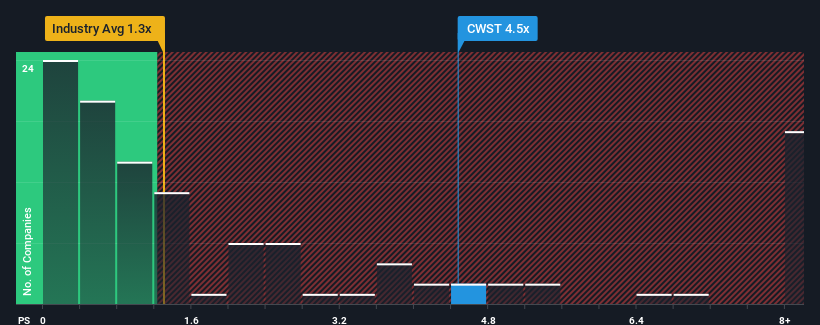

When you see that almost half of the companies in the Commercial Services industry in the United States have price-to-sales ratios (or "P/S") below 1.3x, Casella Waste Systems, Inc. (NASDAQ:CWST) looks to be giving off strong sell signals with its 4.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Casella Waste Systems

What Does Casella Waste Systems' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Casella Waste Systems has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Casella Waste Systems will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Casella Waste Systems?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Casella Waste Systems' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. The strong recent performance means it was also able to grow revenue by 77% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 12% per year over the next three years. That's shaping up to be materially higher than the 9.3% each year growth forecast for the broader industry.

With this information, we can see why Casella Waste Systems is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Casella Waste Systems' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Casella Waste Systems shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Casella Waste Systems is showing 4 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CWST

Casella Waste Systems

Operates as a vertically integrated solid waste services company in the United States.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives