- United States

- /

- Commercial Services

- /

- NasdaqGS:CWST

Casella Waste Systems (CWST): Assessing Valuation as Margin Concerns Persist and Hedge Funds Boost Holdings

Reviewed by Simply Wall St

Casella Waste Systems (CWST) landed in the spotlight after recent commentary highlighted its ongoing challenges in improving profit margins at acquired mid-Atlantic assets. Investors are watching closely, especially as hedge fund positions in the stock have ticked higher.

See our latest analysis for Casella Waste Systems.

Casella’s share price has rebounded this week following a tough spell, rising over 3% in the past day and recovering slightly from steeper declines earlier this year. While recent share price returns remain negative year-to-date, long-term total shareholder return sits at a solid 62% over five years. This reflects the company’s ability to deliver for patient investors even amid short-term bumps.

If recent volatility has you curious about other opportunities, now is a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

With shares rebounding but uncertainty still lingering over margin improvements, the key question for investors is straightforward: Is Casella Waste Systems trading at a bargain after its pullback, or is the company’s growth already fully priced in?

Most Popular Narrative: 22.9% Undervalued

Casella Waste Systems is drawing attention after the most popular narrative estimates its fair value at $116.68, well above the last close of $89.99. This pricing gap fuels debate about whether analysts are too bullish, or if the market is missing something about Casella’s future.

Infrastructure investments, such as automation in fleet (with 55 new and mostly automated trucks coming in late 2025), upgraded ERP systems, and route optimization, are expected to unlock significant operational efficiencies, capturing previously delayed cost synergies in the Mid-Atlantic region, which should materially boost net margins and EBITDA starting in 2026.

Curious what growth assumptions power that bold upside? The narrative is built on unusually aggressive projections for future profits, revenue gains, and margin leaps. Want to see exactly how analysts justify that striking fair value? The full story might surprise you.

Result: Fair Value of $116.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent integration challenges in the Mid-Atlantic and higher labor costs could weigh on margins, which may pose challenges even for the most bullish earnings forecasts.

Find out about the key risks to this Casella Waste Systems narrative.

Another View: A Multiples-Based Reality Check

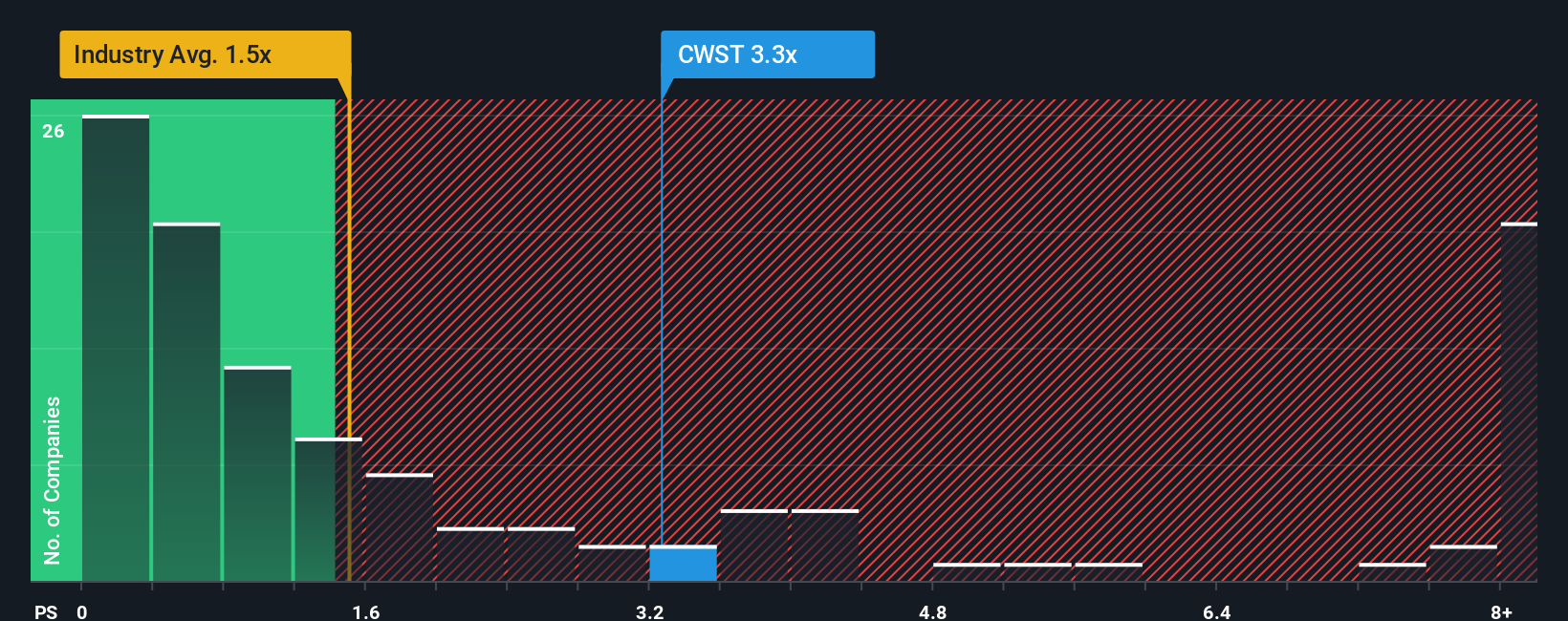

Switching gears to a price-to-sales ratio, Casella trades at 3.3x, which is well above the US Commercial Services industry average of 1.5x and the peer average of 1.7x. The fair ratio of 1.8x suggests that, compared to similar companies, Casella appears expensive and raises questions about its margin of safety after the recent rebound. Is the market pricing in too much optimism, or could future growth still surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casella Waste Systems Narrative

If you see these numbers differently or want to dig into the data on your own terms, you can build your own Casella Waste Systems narrative in just a few minutes. All it takes is Do it your way.

A great starting point for your Casella Waste Systems research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself apart from the crowd by seizing high-potential stocks others overlook. Simply Wall Street's smart screeners highlight overlooked gems and tomorrow’s winners.

- Tap into future technologies that are changing medicine by checking out these 33 healthcare AI stocks, which is driving breakthroughs in diagnostics, treatment, and patient care.

- Capture consistent income streams by targeting these 17 dividend stocks with yields > 3%, offering reliable yields and long-term payout stability.

- Make your move into fast-growing, lesser-known opportunities with these 3573 penny stocks with strong financials, showing strong financial health and upside that few are watching.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CWST

Casella Waste Systems

Operates as a vertically integrated solid waste services company in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives