- United States

- /

- Commercial Services

- /

- NasdaqGS:CTAS

How Strong Q1 Results and Buybacks at Cintas (CTAS) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Cintas Corporation reported its first quarter 2026 results in September 2025, revealing year-over-year increases in sales, revenues, net income, and earnings per share, alongside raised full-year guidance and completion of significant share repurchase programs totaling over US$1 billion.

- An interesting element of the news is Cintas' emphasis on leveraging technology investments and process improvements to drive operational efficiency and customer conversion across its service lines.

- We'll examine how Cintas' upgraded fiscal year guidance and share buybacks may influence its long-term investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 33 companies in the world exploring or producing it. Find the list for free.

Cintas Investment Narrative Recap

To be a shareholder in Cintas, you need to believe its ongoing service diversification, customer retention, and continuous investment in technology can help it outperform structural challenges from shifts to remote work and workplace automation. The recent Q1 results reinforce this outlook, with strong revenue and net income growth, but do not materially alter the biggest near-term catalyst, customer outsourcing trends, or the most important risk, which remains a potential drop in uniform demand if physical work declines.

The company's raised full-year guidance for both revenue (now US$11.06 billion to US$11.18 billion) and diluted EPS puts a spotlight on its confidence in continued business momentum and efficiency gains. These projections align directly with management’s ongoing technology initiatives, which are meant to support operational efficiency and customer conversion, core contributors to the most important short-term catalyst of expanded outsourcing.

Yet, in contrast to these positive developments, investors should be aware that rising remote and hybrid work adoption could still limit uniform demand down the road if...

Read the full narrative on Cintas (it's free!)

Cintas' outlook anticipates $12.8 billion in revenue and $2.4 billion in earnings by 2028. This scenario presumes a 7.2% annual revenue growth rate and an increase in earnings of $0.6 billion from current earnings of $1.8 billion.

Uncover how Cintas' forecasts yield a $217.44 fair value, a 7% upside to its current price.

Exploring Other Perspectives

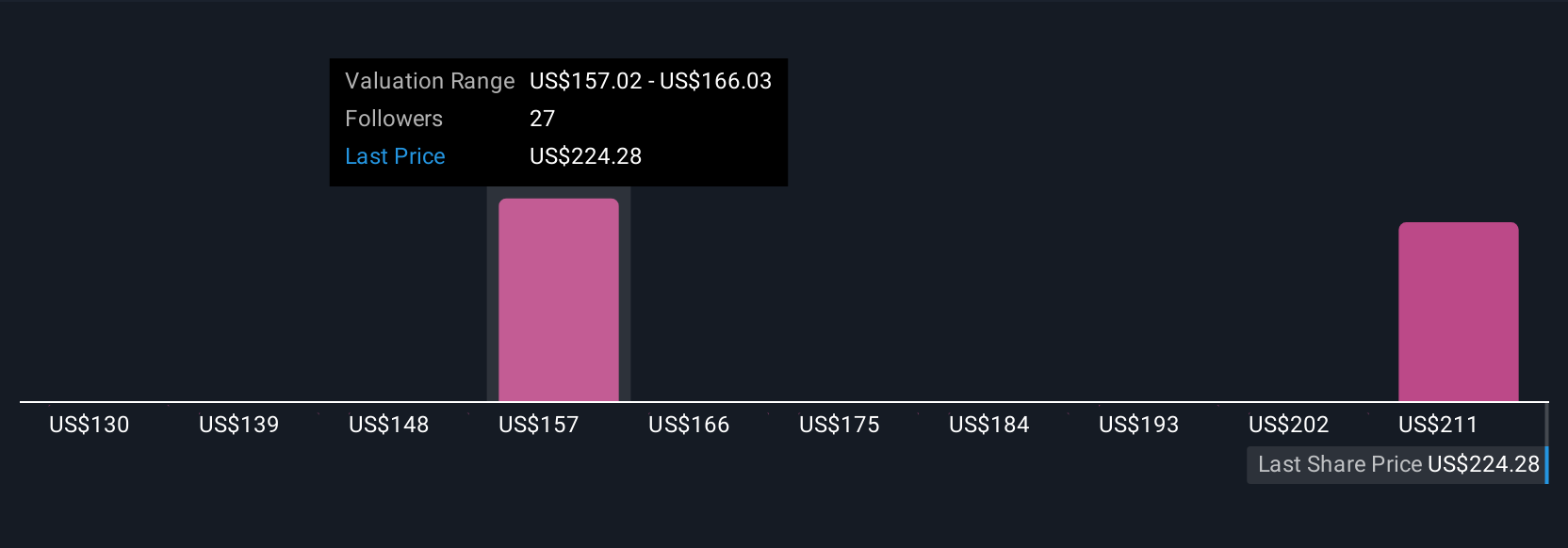

Seven members of the Simply Wall St Community submitted individual fair value estimates for Cintas, ranging from US$130 to US$217.44 per share. While market participants recognize ongoing gains from outsourced services, opinions differ on how remote work could affect long-term demand, driving a broad spectrum of expectations for company performance.

Explore 7 other fair value estimates on Cintas - why the stock might be worth as much as 7% more than the current price!

Build Your Own Cintas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cintas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cintas' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTAS

Cintas

Engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives