- United States

- /

- Commercial Services

- /

- NasdaqGS:CTAS

Cintas (NASDAQ:CTAS) Is Increasing Its Dividend To $1.15

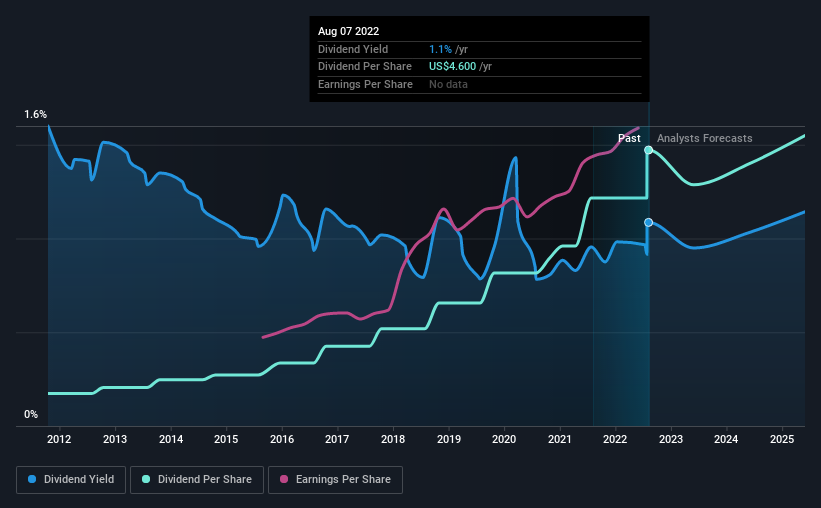

Cintas Corporation (NASDAQ:CTAS) will increase its dividend from last year's comparable payment on the 15th of September to $1.15. Despite this raise, the dividend yield of 1.1% is only a modest boost to shareholder returns.

Check out our latest analysis for Cintas

Cintas' Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. Before making this announcement, Cintas was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

The next year is set to see EPS grow by 18.6%. If the dividend continues on this path, the payout ratio could be 34% by next year, which we think can be pretty sustainable going forward.

Cintas Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2012, the annual payment back then was $0.54, compared to the most recent full-year payment of $4.60. This works out to be a compound annual growth rate (CAGR) of approximately 24% a year over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Cintas has seen EPS rising for the last five years, at 23% per annum. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

We Really Like Cintas' Dividend

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Cintas that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CTAS

Cintas

Engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives