- United States

- /

- Professional Services

- /

- NasdaqGS:CSGS

CSG Systems International (CSGS): Assessing Valuation After a 23% Monthly Share Price Climb

Reviewed by Simply Wall St

CSG Systems International (CSGS) has posted impressive gains over the past month, catching the attention of investors who track performance trends. Shares are up nearly 23% in that time and this reflects growing interest in the company.

See our latest analysis for CSG Systems International.

CSG Systems International’s strong 23% share price return this past month adds to an impressive year-to-date climb of over 55%. This signals renewed momentum as investors react to recent performance and reassess the company’s longer-term growth outlook. Over the last five years, long-term investors have enjoyed a total shareholder return of 106%.

If the latest rally has sparked your curiosity, now is the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With such robust gains, the key question now is whether CSG Systems International’s recent surge still leaves room for new investors to benefit, or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 2.7% Undervalued

The consensus narrative points to a fair value of $80.70, which is just above the recent close of $78.49. This suggests analysts see limited but present upside after the share price rally. Their view hinges on recent deal developments and what might come next for CSG Systems International.

Ongoing strategic migration to asset-light, SaaS and cloud-based platforms is driving improvements in operating leverage, higher gross and operating margins, and robust free cash flow as demonstrated by operating margin expanding 250 basis points YoY and guidance being raised for margins and free cash flow growth in both 2025 and 2026.

Want to know the financial engine under this valuation? The narrative builds on a future where profits climb, margins increase, and recurring revenue reshapes the story. Which bold targets anchor this consensus? Only the full narrative reveals the critical assumptions baked into that price.

Result: Fair Value of $80.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent customer concentration and ongoing industry headwinds could still disrupt CSG Systems International’s anticipated stability and challenge the current optimistic outlook.

Find out about the key risks to this CSG Systems International narrative.

Another View: Multiples Send a Different Signal

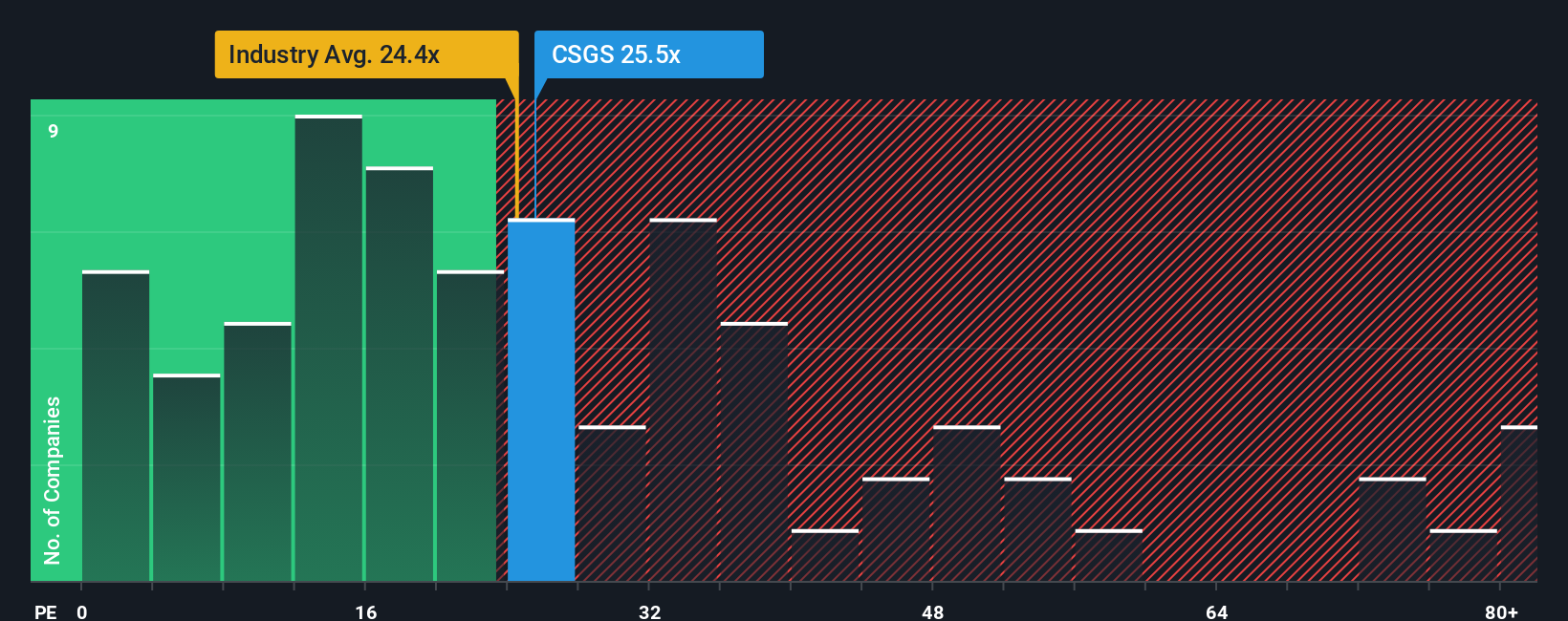

While the consensus calls CSG Systems International undervalued, its most-watched price-to-earnings ratio sits at 25.6x. This is higher than both the industry average of 24.7x and the fair ratio of 22.9x, suggesting some valuation risk if the market shifts back toward this fairer benchmark. Could this premium be justified, or is there hidden downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CSG Systems International Narrative

If you want to challenge the consensus or explore the data from your own angle, it only takes a few minutes to build your own case. Do it your way

A great starting point for your CSG Systems International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for fresh opportunities that others might overlook. Give yourself the edge by acting now, as unique ideas could be slipping away.

- Tap into the explosive growth of artificial intelligence by checking out these 27 AI penny stocks. These companies are shaping tomorrow’s innovations and transforming industries today.

- Unlock income potential and build resilience with these 14 dividend stocks with yields > 3%, featuring companies delivering reliable yields above 3% in any market climate.

- Get ahead of trends and gain an edge on the market with these 880 undervalued stocks based on cash flows, highlighting businesses with strong fundamentals that trade below their real worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGS

CSG Systems International

Provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives