- United States

- /

- Banks

- /

- NasdaqGS:CCBG

US Market's Hidden Treasures 3 Undiscovered Gems to Explore

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge, with major indices like the Nasdaq and S&P 500 jumping significantly, investors are increasingly optimistic about potential interest rate cuts by the Federal Reserve. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for growth; these hidden gems often thrive in such conditions by capitalizing on niche markets and innovative solutions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Capital City Bank Group (CCBG)

Simply Wall St Value Rating: ★★★★★★

Overview: Capital City Bank Group, Inc. is a financial holding company for Capital City Bank, offering various banking services to individual and corporate clients, with a market capitalization of $706.48 million.

Operations: Capital City Bank Group generates revenue primarily from its commercial banking segment, totaling $246.43 million. The company's market capitalization stands at $706.48 million.

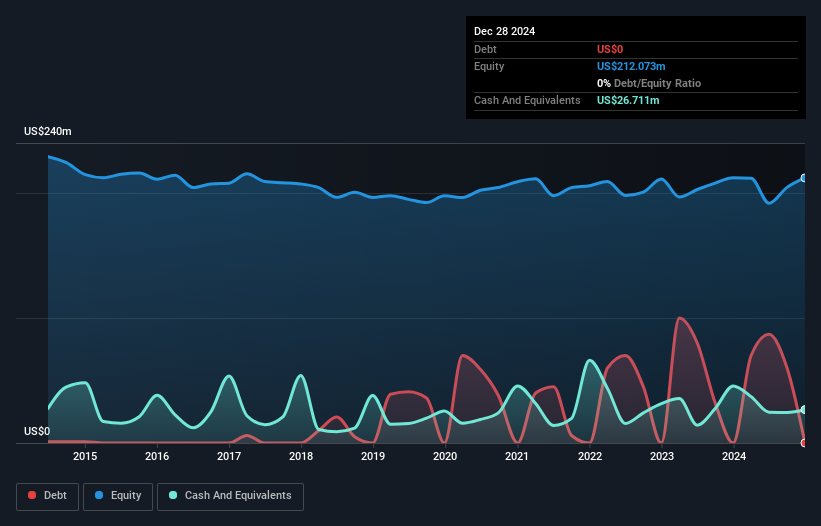

Capital City Bank Group, with total assets of US$4.3 billion and equity of US$540.6 million, showcases a robust financial profile. The bank's total deposits stand at US$3.6 billion against loans of US$2.6 billion, reflecting solid balance sheet management with a net interest margin of 4.1%. It has an impressive bad loan ratio at just 0.3%, supported by a sufficient allowance for potential losses (369%). Despite trading 41.9% below estimated fair value, its earnings growth outpaced the industry last year at 18.2%, indicating high-quality past earnings and primarily low-risk funding sources comprising 96% customer deposits.

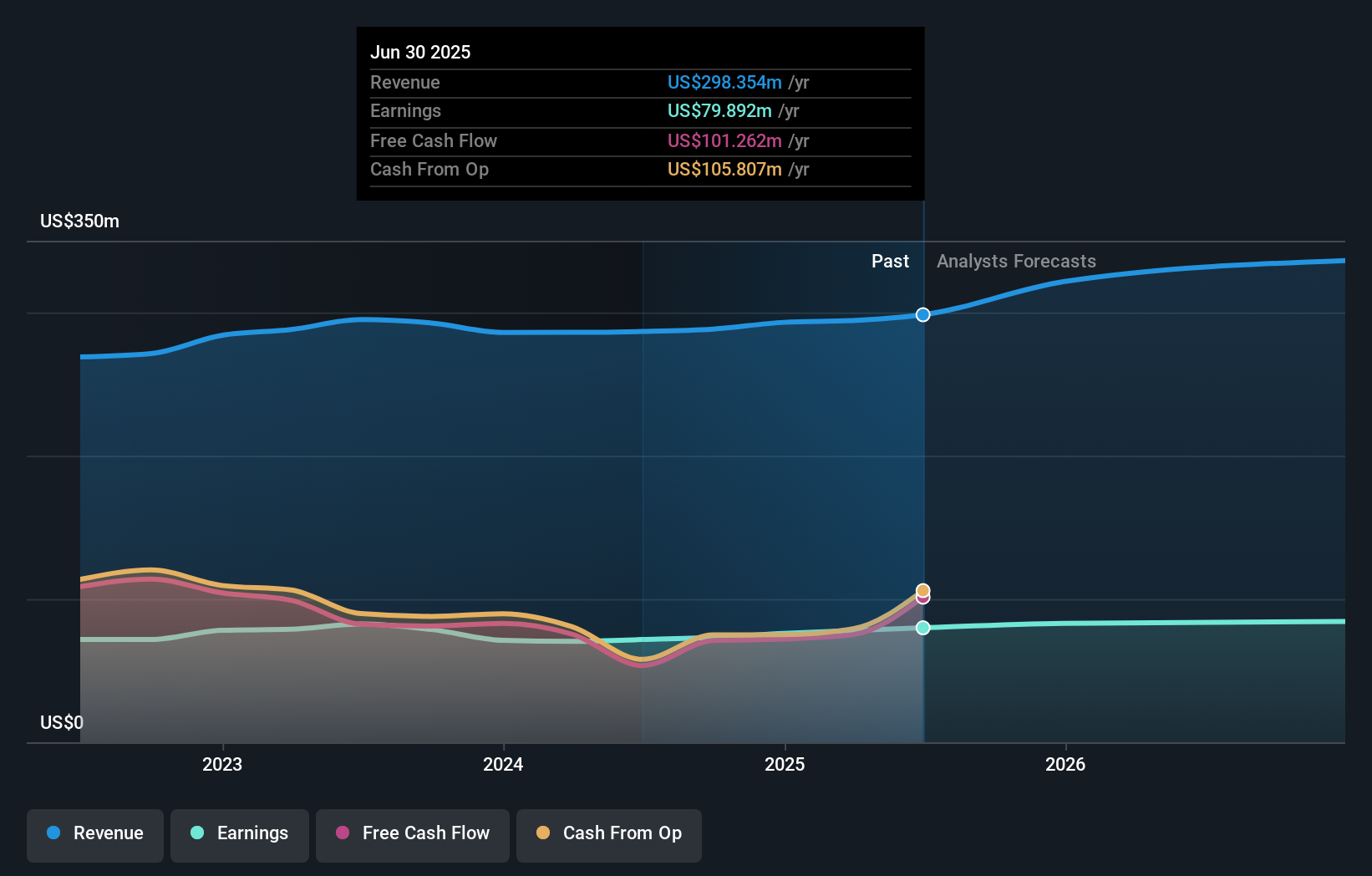

CRA International (CRAI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CRA International, Inc., along with its subsidiaries, offers economic, financial, and management consulting services globally and has a market cap of $1.17 billion.

Operations: CRAI generates revenue primarily from professional and consulting services, amounting to $731.05 million.

CRA International, a nimble player in the professional services sector, is making waves with robust earnings growth of 31.4% over the past year, outpacing its industry peers. The company's debt to equity ratio has risen from 18.4% to 47.1% over five years, yet it remains satisfactory with net debt at 36%. Trading at a significant discount of 41.6% below estimated fair value, CRAI's interest payments are comfortably covered by EBIT at a multiple of 16.8x. Recent strategic moves include increasing their quarterly dividend by 16%, and repurchasing shares worth $4 million recently enhances shareholder value further.

Univest Financial (UVSP)

Simply Wall St Value Rating: ★★★★★★

Overview: Univest Financial Corporation operates as the bank holding company for Univest Bank and Trust Co. with a market capitalization of $892.43 million.

Operations: Univest Financial derives its revenue primarily from banking, which contributes $264.95 million, followed by wealth management at $31.30 million and insurance services at $22.40 million.

Univest Financial, with assets totaling $8.6 billion and equity of $933.2 million, operates primarily on low-risk funding sources, as 94% of its liabilities are customer deposits. The company has a total loan portfolio of $6.7 billion and maintains an appropriate allowance for bad loans at 0.4%. Recently, Univest issued $50 million in subordinated notes to refinance existing debt and support corporate activities, indicating strategic financial maneuvering. Over the past year, earnings grew by 18.7%, outpacing industry averages and reflecting high-quality earnings despite some insider selling activity in recent months.

Turning Ideas Into Actions

- Access the full spectrum of 297 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCBG

Capital City Bank Group

Operates as the financial holding company for Capital City Bank that provides a range of banking services to individual and corporate clients.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives