- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CNXN

Undiscovered Gems in the US Market for May 2025

Reviewed by Simply Wall St

The United States market has shown robust performance recently, with a 1.8% increase over the last week and a 9.5% climb in the past year, as earnings are projected to grow by 14% annually. In this thriving environment, identifying lesser-known stocks that possess strong fundamentals and potential for growth can offer unique opportunities for investors seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

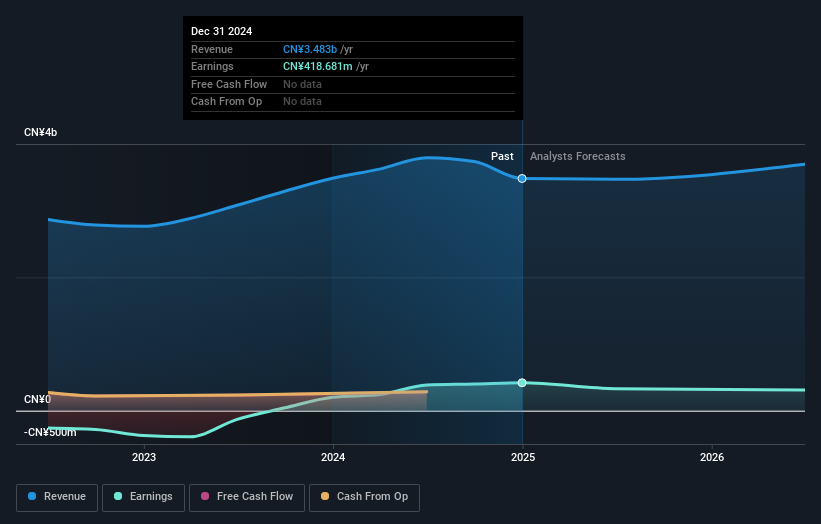

QuantaSing Group (NasdaqGM:QSG)

Simply Wall St Value Rating: ★★★★★★

Overview: QuantaSing Group Limited offers online learning services in the People’s Republic of China and has a market cap of $315.37 million.

Operations: QuantaSing Group generates revenue primarily through its online learning services in China. The company's cost structure includes expenses related to content creation, technology infrastructure, and marketing efforts. Its net profit margin has shown variability across reporting periods, reflecting the impact of these operational costs on profitability.

QuantaSing Group, a nimble player in the consumer services sector, has demonstrated impressive earnings growth of 107.7% over the past year, outpacing industry norms. The company remains debt-free and is trading at 69.8% below estimated fair value, highlighting its potential for investors seeking undervalued opportunities. Despite a volatile share price recently, QuantaSing's strategic expansion into wellness markets and senior-focused products offers promising revenue diversification avenues. However, challenges persist with a projected decline in profit margins from 12% to 5.8%. Its robust cash position of RMB 1,213 million supports strategic investments for future growth initiatives.

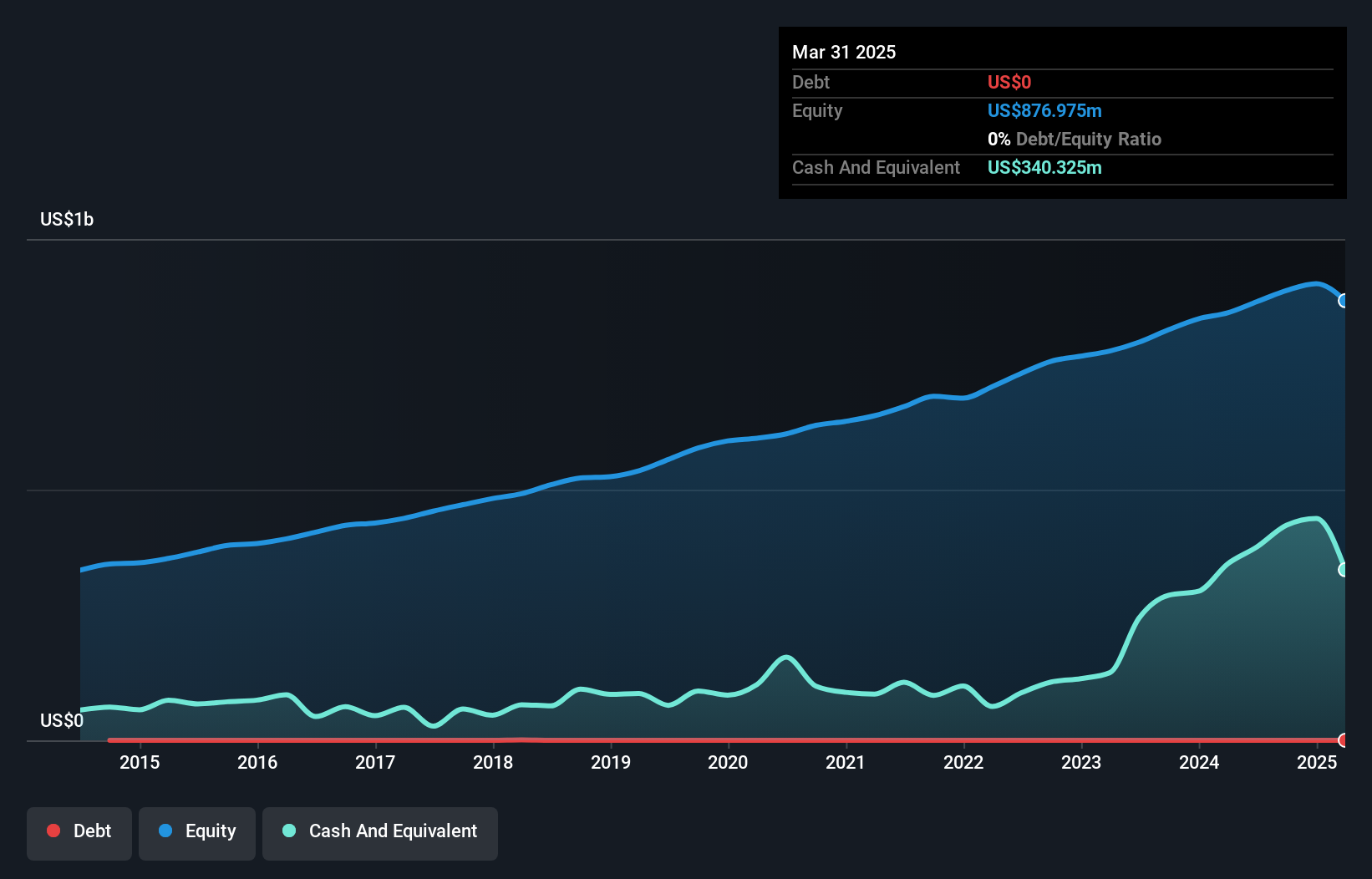

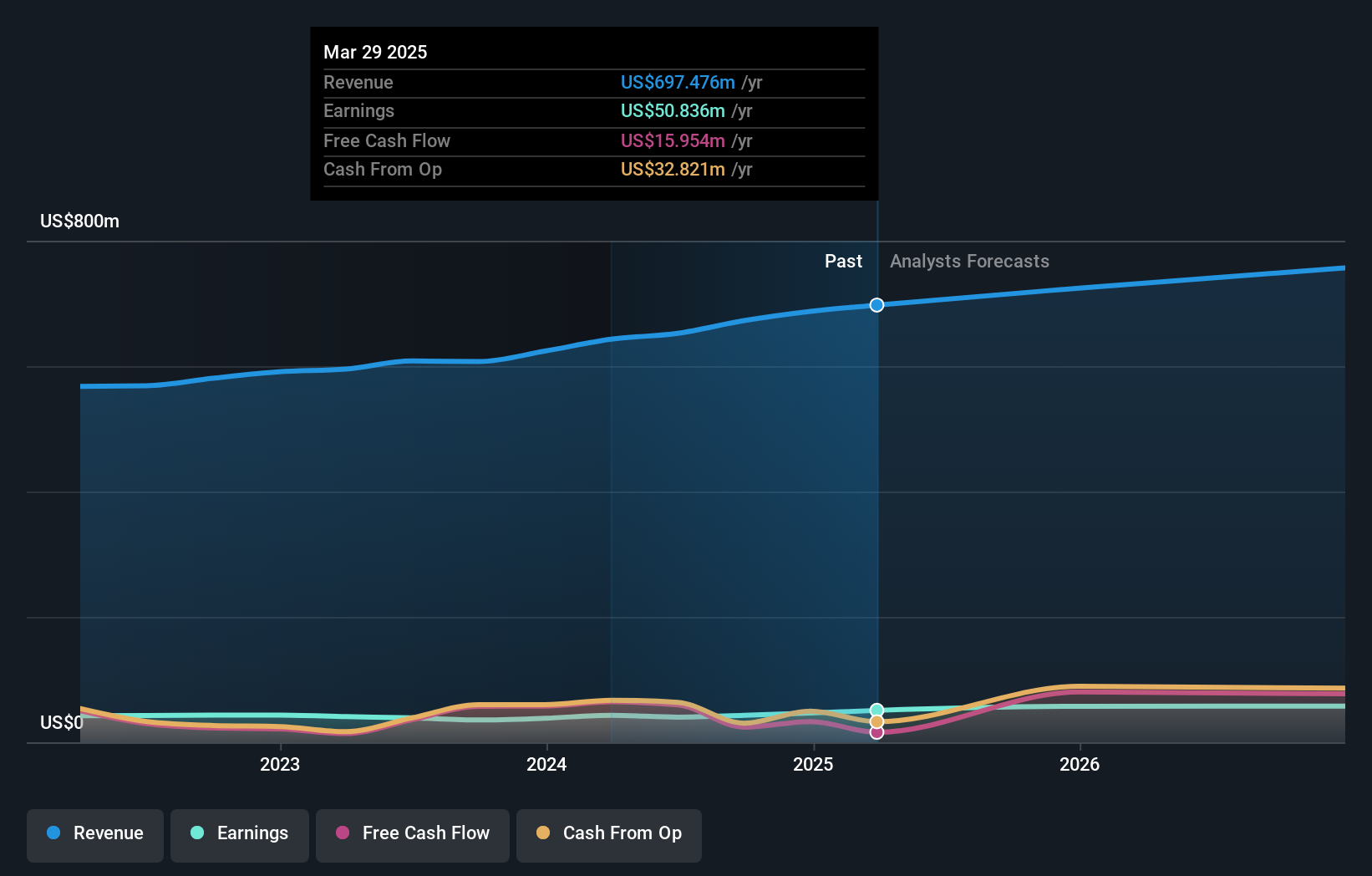

PC Connection (NasdaqGS:CNXN)

Simply Wall St Value Rating: ★★★★★★

Overview: PC Connection, Inc., along with its subsidiaries, offers a range of information technology solutions globally and has a market cap of $1.61 billion.

Operations: PC Connection generates revenue through its IT solutions offerings. The company's gross profit margin is 16.79%.

PC Connection, a nimble player in the electronics industry, showcases a promising blend of strategic investments and financial health. With earnings growth of 6.3% over the past year, it outpaces the industry average of -2.4%. The company's debt-free status further bolsters its stability, while its price-to-earnings ratio of 19.6x remains competitive against the sector's 20.2x average. Recent quarterly sales reached US$701 million, up from US$632 million last year, with net income slightly increasing to US$13.48 million from US$13.15 million previously reported—reflecting resilience amid market challenges and strategic initiatives aimed at long-term growth.

CRA International (NasdaqGS:CRAI)

Simply Wall St Value Rating: ★★★★★★

Overview: CRA International, Inc. and its subsidiaries offer economic, financial, and management consulting services globally with a market cap of $1.10 billion.

Operations: CRA International generates revenue primarily through its economic, financial, and management consulting services. The company reported a market capitalization of $1.10 billion.

CRA International's recent performance highlights its potential as a noteworthy player in the consulting industry. Over the past year, earnings grew by 21.5%, surpassing the Professional Services industry's 18.7% growth rate. The company remains debt-free, with no concerns over interest coverage, and trades at a significant discount of 43.2% below its estimated fair value. Despite substantial insider selling recently, CRA's high-quality earnings and positive free cash flow underscore its financial health. With strategic capital allocation through dividends and share repurchases, it shows confidence in sustaining shareholder value amidst competitive pressures and economic uncertainties.

Seize The Opportunity

- Gain an insight into the universe of 288 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade PC Connection, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNXN

PC Connection

Provides various information technology (IT) solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives