- United States

- /

- Professional Services

- /

- NasdaqGS:CRAI

CRA International (CRAI): Evaluating Shareholder Value After Recent Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for CRA International.

After a steady climb in prior years, CRA International’s shares have cooled recently, with a 1-month share price return of -10.39% suggesting some profit-taking or shifting sentiment. Despite this, the 3-year total shareholder return still stands at a remarkable 91%, which shows that long-term momentum has rewarded patient investors even as short-term volatility picks up.

If you’re curious about other areas of the market showing strong momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with CRA International currently trading at a notable discount to analyst price targets and steady fundamentals, the question remains: is this a real buying opportunity, or is the market already factoring in future growth?

Most Popular Narrative: 25.9% Undervalued

With CRA International’s fair value calculated at $239.50, well above its last close of $177.58, the narrative favors a sizable upside for those betting on its growth story. The gap between analyst assumptions and today’s price makes this a focal point for valuation-driven investors who want to look deeper at the underlying evidence.

Expanding needs for data analytics, regulatory strategy, and compliance consulting, particularly in the fast-evolving energy and healthcare/life sciences sectors, are increasing demand for CRA's specialized practices. This supports both revenue uplift and margin enhancement via premium service offerings. CRA is realizing pricing power through successful rate increases, indicating clients' willingness to pay more for high-value services in a complex regulatory environment. This trend may lead to improved net margins and earnings.

Want to know what bold assumptions are fueling this big discount to fair value? The narrative is built around powerful growth levers and a future profit story that challenges sector norms. What hidden projections and aggressive expectations really drive that eye-catching price target? Find out what the consensus is counting on and see why this valuation is sparking debate.

Result: Fair Value of $239.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish outlook could unravel if global dealmaking slows or if CRA faces challenges in recruiting talent for its most specialized practices.

Find out about the key risks to this CRA International narrative.

Another View: Looking at Multiples

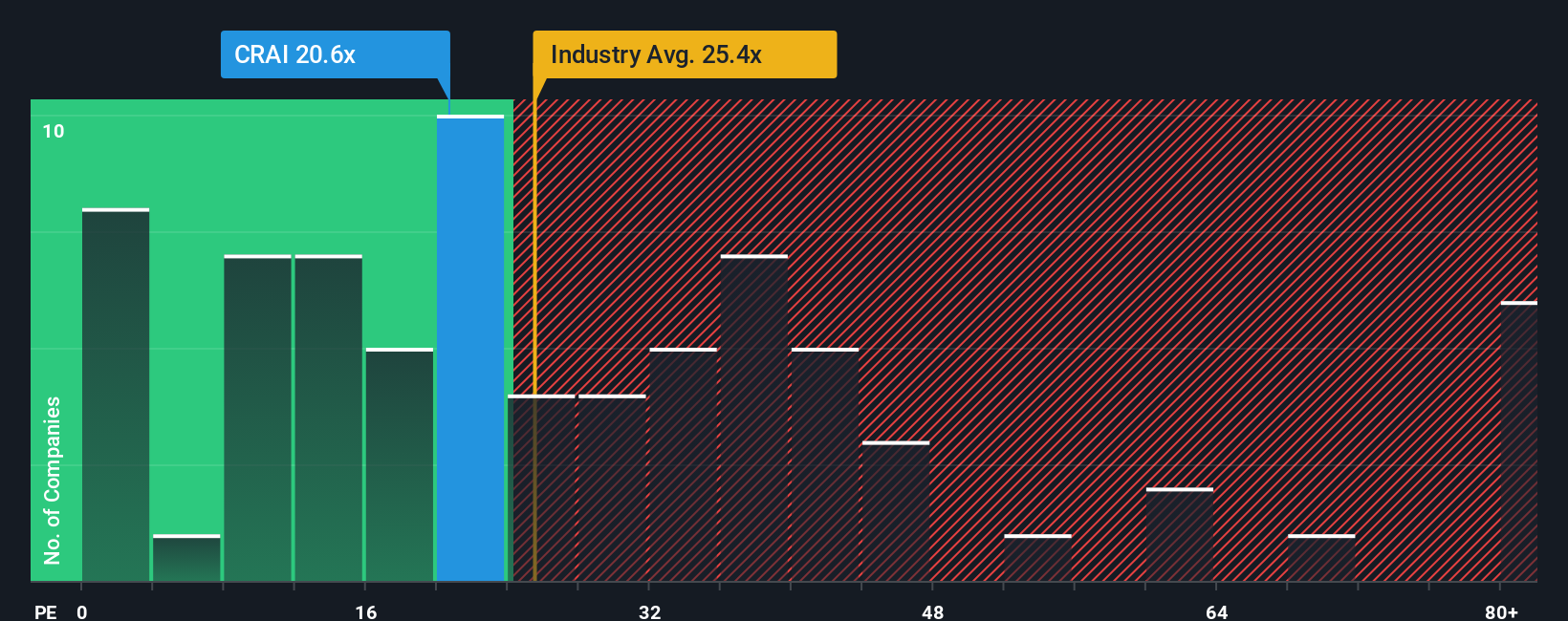

While the current narrative paints CRA International as undervalued, there is another perspective worth considering. The company trades at a price-to-earnings ratio of 20.7x, which is lower than the industry average of 25.2x and well below the peer average of 39.7x. However, it is slightly higher than the fair ratio of 18x. This means the market is valuing CRAI at a discount compared to peers, yet not low enough to be considered a clear bargain by fair ratio standards. Is this a sign that risks are increasing, or could it indicate that expectations are simply more moderated here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CRA International Narrative

If you think the consensus view leaves something out or you'd rather investigate the numbers on your own terms, you can build your personal outlook in just a few minutes, Do it your way

A great starting point for your CRA International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Find your next winning stock by putting your research into action with these handpicked investment angles available right now:

- Tap into massive payout potential when you search for robust income streams through these 18 dividend stocks with yields > 3%, which boasts yields over 3%.

- Seize the future of medicine by targeting innovation leaders who are building tomorrow’s breakthroughs with these 33 healthcare AI stocks.

- Catch hugely undervalued businesses before the market wakes up by leveraging these 881 undervalued stocks based on cash flows, based on rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRAI

CRA International

Provides economic, financial, and management consulting services worldwide.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion