- United States

- /

- Commercial Services

- /

- NasdaqGS:CPRT

Copart’s (CPRT) Digital Lienholder Integration Could Be a Game Changer for Value-Added Services

Reviewed by Sasha Jovanovic

- Earlier in October 2025, One Inc. announced a collaboration with Copart, Inc. to integrate ClaimsPay with Copart's Title Express and Loan Payoff system, aiming to digitize and accelerate lienholder payments for total loss vehicle claims across the insurance and auto finance ecosystem.

- This initiative replaces traditional, paper-based processes with a digital network, helping insurers, banks, and vehicle owners achieve faster settlements and improved efficiency in claims and title administration, impacting a sector where tens of billions of U.S. dollars in auto loans are repaid annually.

- We'll examine how the rollout of Copart's digital lienholder payment solution could influence its value-added services and operational margin outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Copart Investment Narrative Recap

Owning Copart stock means believing in the company's ability to expand its position in digital vehicle auctions and value-added services, leveraging technology to boost efficiency and margins even if total loss volumes face cyclical pressures. The recent One Inc. partnership to digitize lienholder payments could enhance Copart’s competitive position in the insurance claims process, but it does not materially address the biggest near-term risk: falling unit volumes due to competitor actions or insurance industry shifts.

Among recent announcements, the launch of Total Loss Assist with Hi Marley stands out as directly relevant, focusing on streamlining communication and automating workflows in total loss claims. This complements the One Inc. collaboration by strengthening Copart’s digital offerings around settlement efficiency, supporting key catalysts like increased digital adoption and expansion of ancillary services.

However, despite these digital advances, a contrasting risk investors should be aware of is the company’s...

Read the full narrative on Copart (it's free!)

Copart's narrative projects $6.4 billion revenue and $2.1 billion earnings by 2028. This requires 11.1% yearly revenue growth and a $0.5 billion earnings increase from $1.6 billion.

Uncover how Copart's forecasts yield a $56.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

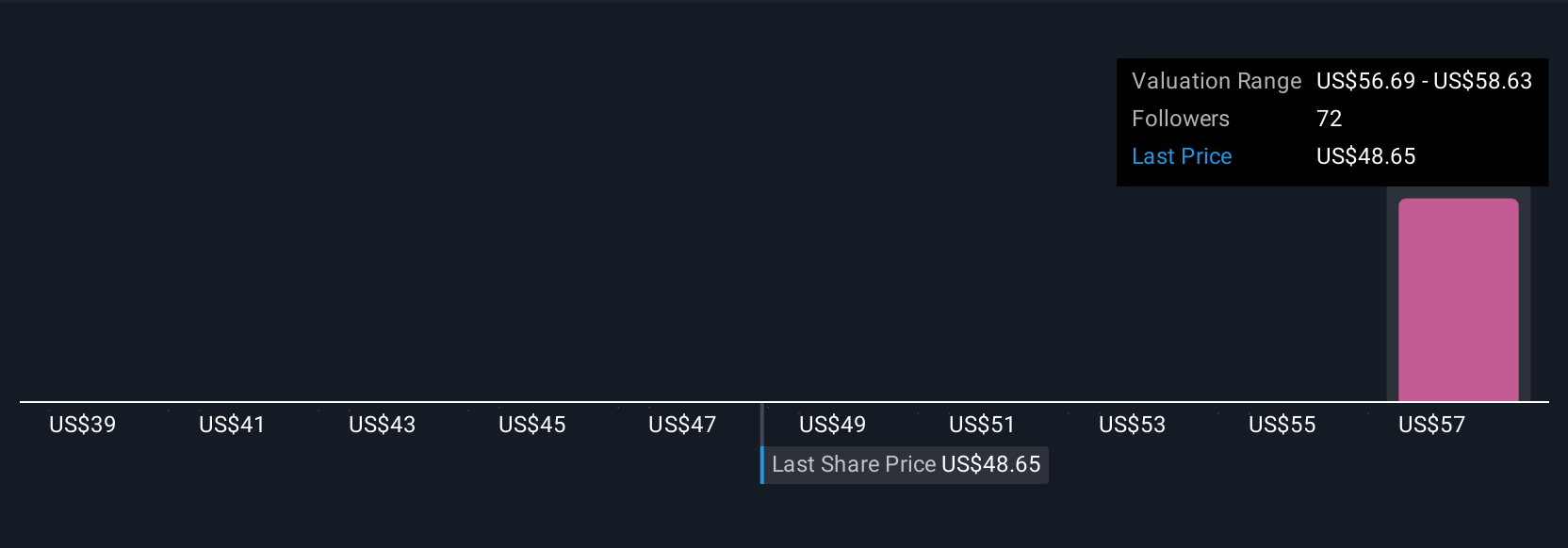

Twelve member fair value estimates from the Simply Wall St Community range from US$39.26 to US$62.53 per share. While opinions differ, falling total loss volumes remain a key theme influencing Copart’s future growth outlook and invite you to consider multiple perspectives.

Explore 12 other fair value estimates on Copart - why the stock might be worth 12% less than the current price!

Build Your Own Copart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Copart research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Copart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Copart's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPRT

Copart

Provides online auctions and vehicle remarketing services in the United States, the United Kingdom, Germany, Brazil, Canada, the United Arab Emirates, Spain, Finland, Oman, the Republic of Ireland, and Bahrain.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives