- United States

- /

- Commercial Services

- /

- NasdaqGS:CPRT

Copart (NasdaqGS:CPRT) Shows Revenue Growth in Strong Earnings Release for Q3 2025

Reviewed by Simply Wall St

Copart (NasdaqGS:CPRT) recently reported strong financial performance in its Q3 earnings, with revenue rising to $1,212 million and earnings per share increasing. This solid growth may have supported the company's share price increase of 7% over the last quarter. Meanwhile, broader market concerns, such as trade tensions and tariff threats, led to a general market decline as demonstrated by a 1.4% drop. In this context, Copart’s robust earnings report and lack of significant shareholder action likely provided stability that countered some of the wider market volatility, aiding its total shareholder return during this period.

Buy, Hold or Sell Copart? View our complete analysis and fair value estimate and you decide.

The advancements in AI-enabled image recognition and Title Express, as highlighted in the news, are poised to enhance Copart's operational efficiency and bolster its insurance revenue. These technologies can boost Copart's economic capacity by enabling quicker processing and precise total loss decisions. Consequently, this innovation may positively influence the company's revenue, underscoring the earnings forecasts provided. The anticipated diversification into financial institutions and car fleets aims to further widen its customer base, which is significant when considering Copart's recent strong quarterly performance. Over the past five years, Copart's total shareholder return was robust at 172.26%, illustrating substantial long-term growth. This performance signifies the company's effective handling of its market environment, even in the face of broader economic pressures. While Copart has outperformed the US market, which returned 10.5% over the past year, it fell short compared to the US Commercial Services industry's 17.3% return.

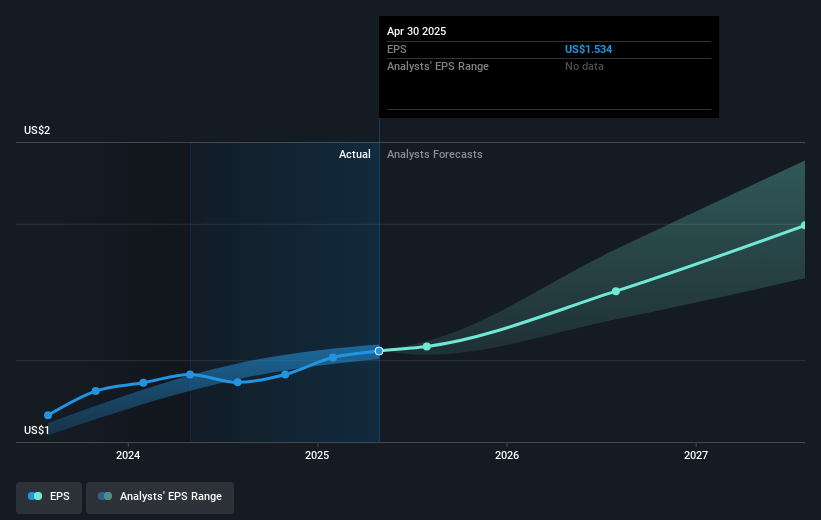

The current share price of $60.80 aligns closely with the consensus price target of $61.89, representing a modest potential upside of 1.8%. This suggests that the stock is generally viewed as being fairly valued under existing market conditions and taking into account its projected growth and current financial metrics. Components such as AI integration and external economic factors will likely continue to have implications on revenue projections, which are forecasted to grow at 10.1% annually. Copart's strategic technology investments are well-positioned to enhance future performance, contributing to its long-term shareholder value, while analyst expectations of earnings reaching US$2.1 billion by 2028 highlight the company's growth trajectory. However, potential geopolitical challenges could impact market pricing and overall financial results moving forward.

Understand Copart's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPRT

Copart

Provides online auctions and vehicle remarketing services in the United States, Canada, the United Kingdom, Brazil, the Republic of Ireland, Germany, Finland, the United Arab Emirates, Oman, Bahrain, and Spain.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives