- United States

- /

- Commercial Services

- /

- NasdaqGS:CPRT

Copart (NASDAQ:CPRT) Shareholders Have Enjoyed A Whopping 427% Share Price Gain

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Copart, Inc. (NASDAQ:CPRT) shares for the last five years, while they gained 427%. This just goes to show the value creation that some businesses can achieve. The last week saw the share price soften some 2.5%.

View our latest analysis for Copart

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

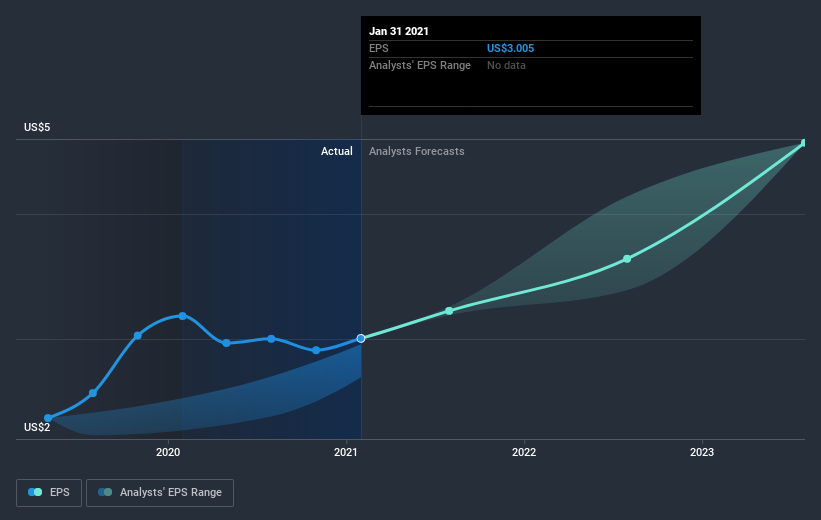

During five years of share price growth, Copart achieved compound earnings per share (EPS) growth of 27% per year. This EPS growth is slower than the share price growth of 39% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Copart's key metrics by checking this interactive graph of Copart's earnings, revenue and cash flow.

A Different Perspective

Copart shareholders gained a total return of 33% during the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 39% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Copart you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Copart, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CPRT

Copart

Provides online auctions and vehicle remarketing services in the United States, Canada, the United Kingdom, Brazil, the Republic of Ireland, Germany, Finland, the United Arab Emirates, Oman, Bahrain, and Spain.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives