- United States

- /

- Commercial Services

- /

- NasdaqGS:CPRT

Copart (CPRT): Valuation Update Following New Digital Partnerships and Market Expansion Efforts

Reviewed by Simply Wall St

Copart (CPRT) has been busy on the innovation front, rolling out a new collaboration with Mapa Broker focused on a Spanish-language auction app and teaming up with One Inc. to digitize lienholder payments. These efforts suggest a broader push for digital inclusion and operational efficiency, which could expand Copart's market reach and appeal for partners in the insurance sector.

See our latest analysis for Copart.

Copart’s latest moves to digitize and broaden access come amid a year of notable market volatility. Despite the steady drumbeat of digital innovation and partnerships, the stock’s 1-year total shareholder return sits at -14.04%, and the shares are down by more than 20% year to date. This reflects tempered momentum after several years of standout gains, including a remarkable 58% total return over five years. Still, investors seem to be weighing long-term growth potential against shifting short-term sentiment as new technology initiatives take shape.

If the digital push at Copart has you watching for other breakout companies, now’s an ideal moment to broaden your search and uncover fast growing stocks with high insider ownership

With mixed signals from both the market and recent partnerships, the key question is whether Copart's recent pullback opens up a genuine value opportunity or if investors have already factored in the company's digital growth prospects.

Most Popular Narrative: 20.1% Undervalued

With Copart’s narrative-driven fair value set at $56 and the last close price at $44.76, the gap suggests analysts expect the stock’s recent dip to be temporary as underlying fundamentals remain strong. The latest analyst consensus now prices in both softer revenue growth and stronger margins than earlier projections, resulting in a sharply defined outlook.

“Accelerating digital adoption in vehicle auctions and heavy investment in proprietary, AI-enabled platforms are expected to enhance Copart's competitive advantage in transaction efficiency, supporting higher net margins and greater buyer/seller engagement.”

Want to know what elevates Copart's share price far above current levels? The latest fair value draws on bullish forecasts for tech adoption, profit margins, and future earnings. Which single financial lever could make this target reality? Dive in to discover the strategic assumptions hiding behind the $56 valuation.

Result: Fair Value of $56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining accident rates and shifting insurance trends could curb Copart’s auction volumes and revenue growth. This raises questions about the company’s long-term outlook.

Find out about the key risks to this Copart narrative.

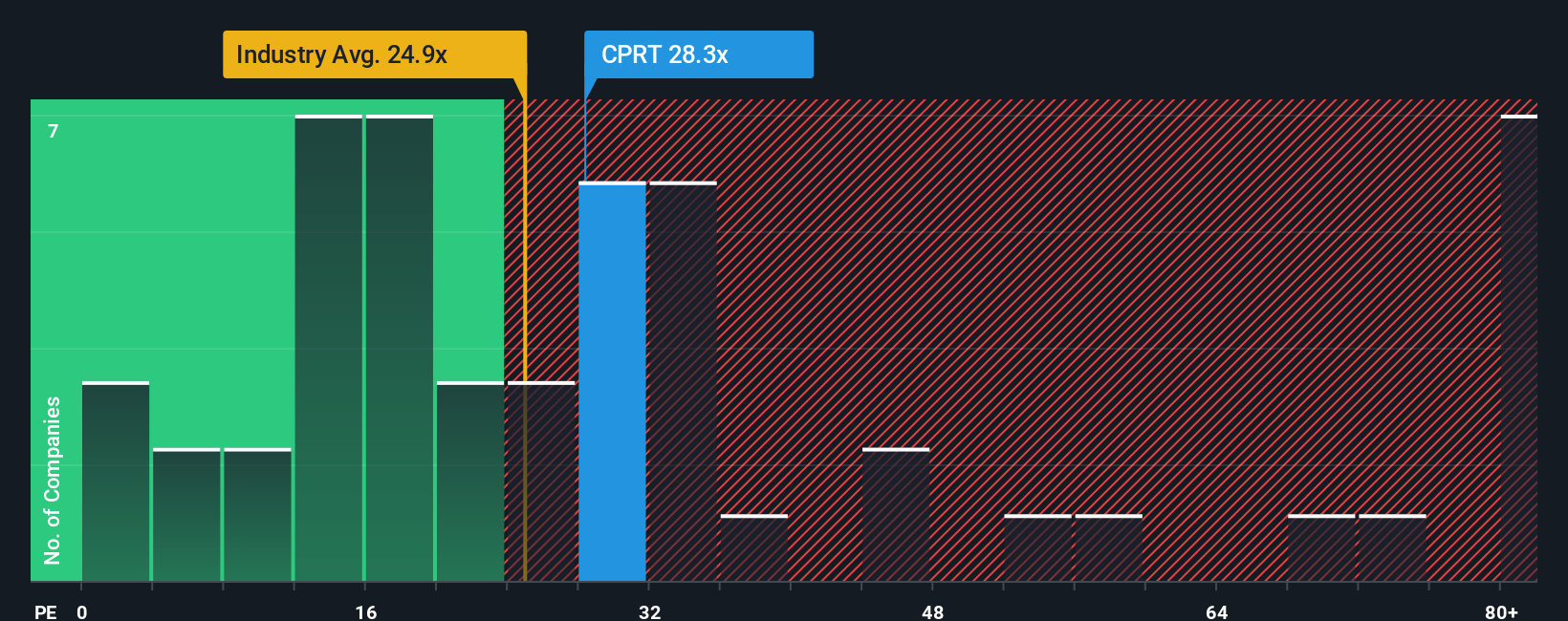

Another View: Market-Based Valuation

Looking through the lens of price-to-earnings, Copart currently trades at 27.9 times earnings. That is slightly above the US Commercial Services industry average of 26.7x, but below the peer average of 36.8x. Interestingly, it is also under the level our fair ratio analysis suggests the market could move toward, at 29.9x. This leaves room for debate about whether Copart's premium is justified, or a warning that valuation risk could rise if expectations shift. Is this a sustainable edge, or is the market pricing in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Copart Narrative

If you see the story differently or want to dig into the data on your own terms, crafting your own narrative can be done in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Copart.

Looking for more investment ideas?

Smart investors never stop searching for their next win. Broaden your watchlist and seize fresh opportunities using these handpicked market strategies only found at Simply Wall Street:

- Supercharge your portfolio by targeting consistent passive income with these 17 dividend stocks with yields > 3% featuring strong yields and reliable payouts.

- Tap into tech breakthroughs by accessing these 24 AI penny stocks that fuel tomorrow’s innovation with cutting-edge artificial intelligence.

- Catch undervalued gems ahead of the crowd through these 874 undervalued stocks based on cash flows to position yourself for potential upside others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPRT

Copart

Provides online auctions and vehicle remarketing services in the United States, the United Kingdom, Germany, Brazil, Canada, the United Arab Emirates, Spain, Finland, Oman, the Republic of Ireland, and Bahrain.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives