- United States

- /

- Professional Services

- /

- NasdaqGS:CNXC

Is There Now an Opportunity in Concentrix After Recent Three-Year Price Slump?

Reviewed by Bailey Pemberton

If you’re wondering what to do with Concentrix stock right now, you’re not alone. Plenty of investors are surveying the landscape, asking whether recent price swings represent opportunity or signal more risk ahead. Over the past week, Concentrix edged up 0.9%, but that comes after a bumpy month that saw shares drop 10.3%. Even with a year-to-date return of 10.8% up to now, the one-year move is still negative at -4.1%, and the longer term paints a picture of steep decline, with the stock down more than 58% across the last three years.

This back-and-forth isn’t happening in a vacuum. Across the sector, market watchers have been weighing broad business services industry developments and shifting investor sentiment about how technology-driven outsourcing and customer experience providers like Concentrix will fit into post-pandemic growth. Some investors see these market changes as the start of a new cycle, possibly offering room to rebound from recent lows.

And here is the real stunner for valuation-focused buyers: by objective accounting, Concentrix currently looks undervalued in every one of the six valuation checks we ran, scoring a perfect 6 out of 6 on our value scale. That number alone is worth a deeper look, because while simple ratios can tell us a lot, there are more nuanced ways to figure out what a great deal really looks like. Let’s break down those valuation approaches and explore what really goes into a company’s true worth. Plus, stay tuned for one metric at the end that might just change how you value stocks altogether.

Why Concentrix is lagging behind its peers

Approach 1: Concentrix Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting those cash flows back to their value today. This approach helps investors gauge whether a stock price reflects the true intrinsic value of the underlying business. For Concentrix, the current reported Free Cash Flow (FCF) stands at $507 million, and analysts forecast steady growth over coming years. By 2029, projections suggest FCF could reach $980.9 million, with the following years extrapolated by Simply Wall St estimating a continued rise into the next decade.

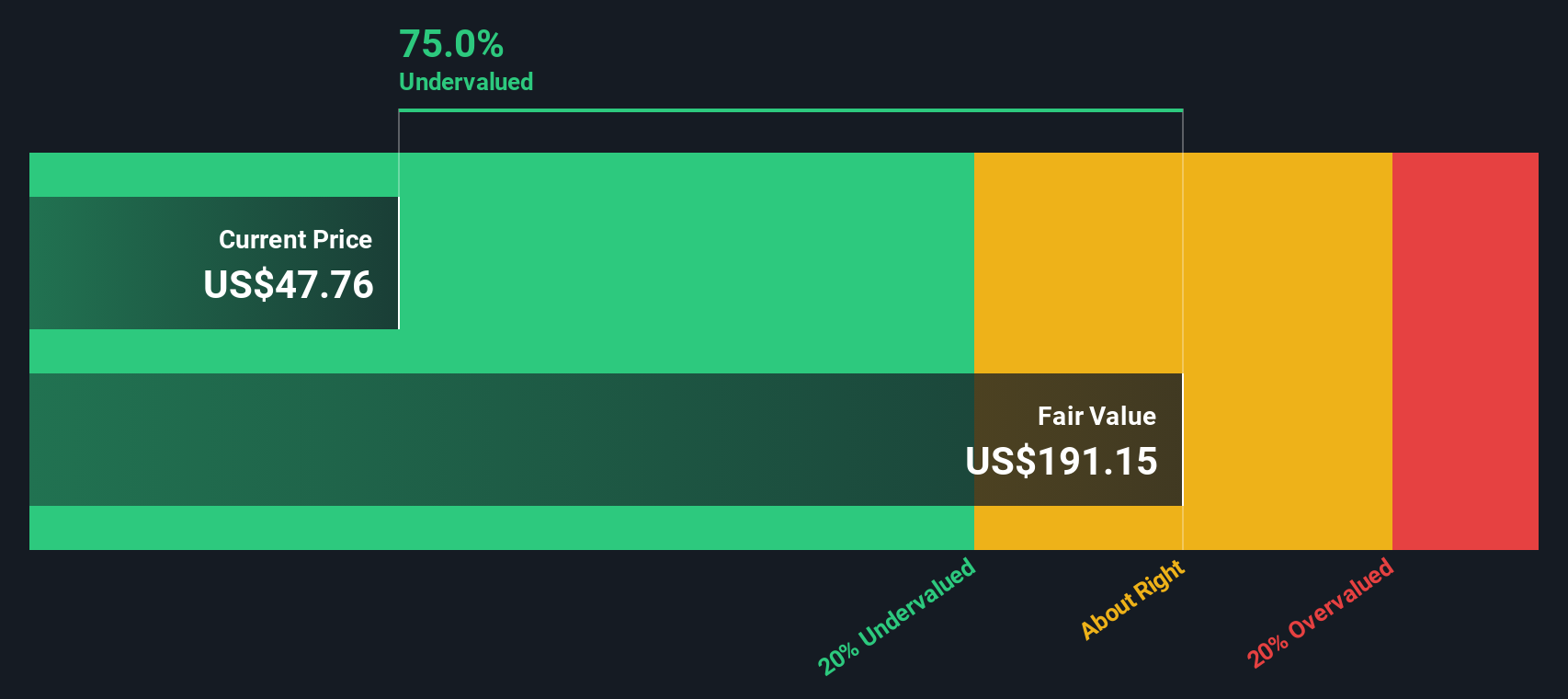

This particular DCF analysis uses a 2 Stage Free Cash Flow to Equity model, combining both analyst targets for the next five years and more conservative, model-based assumptions beyond that. Notably, the model's output points to a fair value per share of $192.66. When compared with Concentrix’s current share price, the calculations indicate the stock is trading at a 75.0% discount to its intrinsic value, a significant margin for value hunters.

In summary, the DCF assessment firmly suggests Concentrix shares are deeply undervalued in the market based on present and reasonably projected future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Concentrix is undervalued by 75.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Concentrix Price vs Earnings

For profitable companies like Concentrix, the Price-to-Earnings (PE) ratio is a widely recognized and effective measure of valuation. It gives investors a direct sense of how much they are paying for each dollar of annual profit the company generates. The "right" or "fair" PE ratio is influenced by factors such as the company's future growth prospects and risk profile. Generally, higher expected earnings growth and lower perceived risk allow for higher PE multiples, while slower growth or elevated risks would justify lower ones.

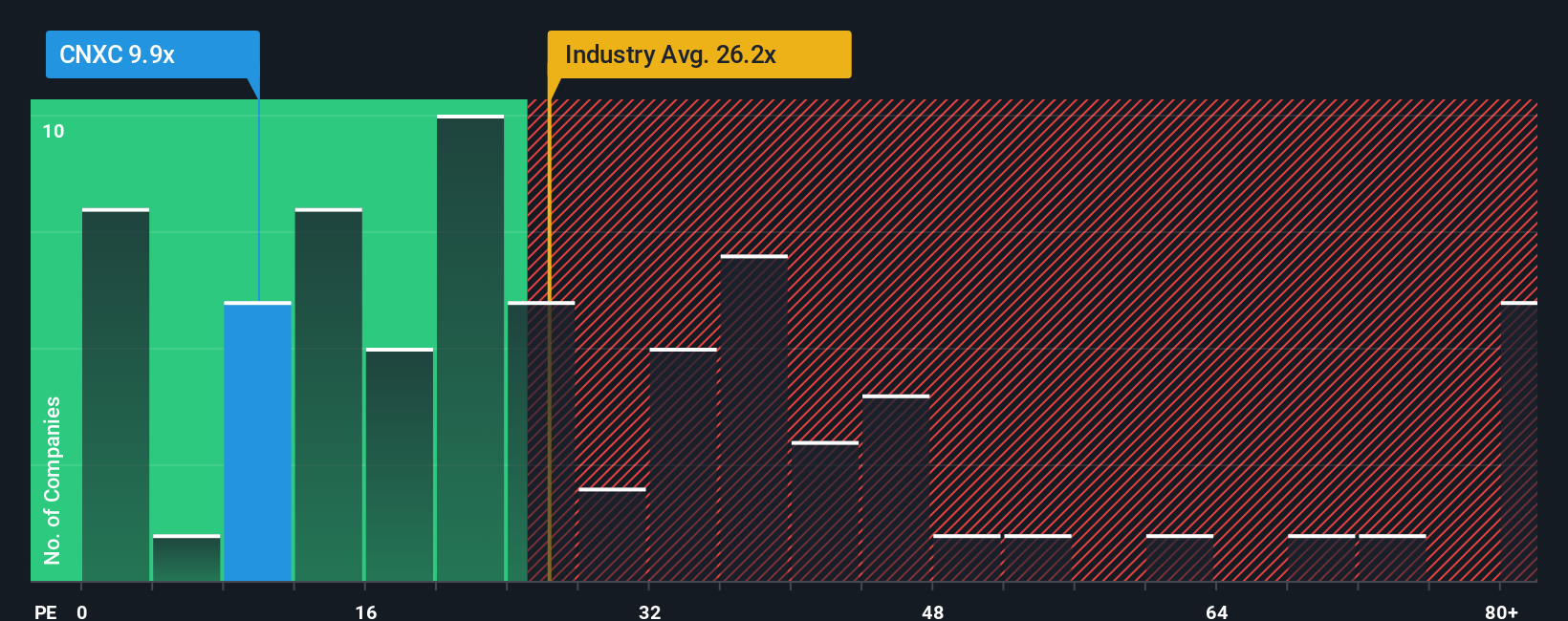

Currently, Concentrix trades at a PE ratio of 10x. When set against the Professional Services industry average of 27x and the wider peer group average of 34x, Concentrix appears far cheaper on a relative basis. However, simply comparing raw multiples can be misleading, as it does not reflect unique factors affecting the company's value.

This is where Simply Wall St's "Fair Ratio" comes in. For Concentrix, the Fair PE Ratio is calculated at 23.3x. Unlike generic comparisons, this Fair Ratio accounts for Concentrix’s specific earnings growth, risk profile, profit margin, industry positioning, and market capitalization. This makes it a more accurate and relevant yardstick for valuation. Because the current PE of 10x is well below the Fair Ratio of 23.3x, this analysis indicates that Concentrix stock is significantly undervalued on an earnings multiple basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Concentrix Narrative

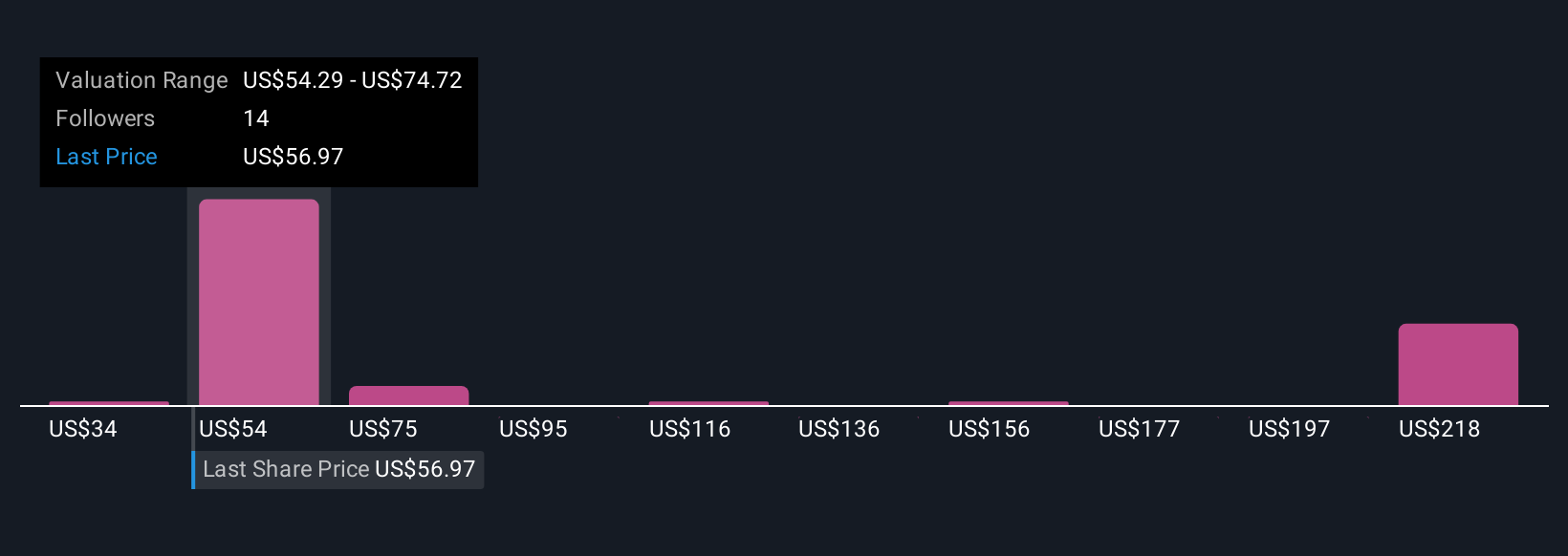

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple, intuitive tool that lets you connect your own perspective, the story you see unfolding at a company, with the numbers behind it, such as your expectations for Concentrix's future revenue, profits, and margins. By shaping a Narrative, you link the company’s actual business story to a financial forecast and ultimately to a calculated fair value for the shares.

Using Narratives on Simply Wall St’s Community page, millions of investors can easily share and compare these forward-looking scenarios. Narratives help you see whether the current price presents a buy or sell opportunity by directly comparing your Fair Value against the market’s price. Plus, your Narrative updates automatically when new information, like earnings releases or big news, changes the outlook, keeping your assessment relevant at all times.

For example, investors tracking Concentrix may arrive at very different fair values based on their Narratives. The most bullish scenario recently saw a price target of $80, while the most cautious view set it at $61, reflecting contrasting stories about AI integration, margin improvement, or possible risks. Narratives empower you to make smarter, story-driven investing decisions, tailored to how you see the company’s future.

Do you think there's more to the story for Concentrix? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNXC

Concentrix

Designs, builds, and runs integrated customer experience (CX) solutions worldwide.

Very undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026