- United States

- /

- Commercial Services

- /

- NasdaqGS:CMPR

Cimpress (CMPR) Valuation Update as VistaPrint Taps Dave DeSandre to Lead North America Strategy

Reviewed by Simply Wall St

Cimpress (CMPR) just gave investors a fresh leadership catalyst, with VistaPrint appointing Dave DeSandre as Senior Vice President of North America to steer category strategy, product innovation, and customer experience across its largest market.

See our latest analysis for Cimpress.

Investors seem to be cautiously warming to that story, with a 30 day share price return of 11.42 percent and a 90 day share price return of 14.81 percent, even though the 1 year total shareholder return remains negative and longer term gains still reflect earlier volatility.

If this kind of strategic reset has your attention, it might be a good moment to explore fast growing stocks with high insider ownership as you look for the next potential compounder.

With revenue and earnings back in growth mode and the share price still well below analyst targets, are investors being offered a genuine value opportunity here, or is the market already baking in a fresh leg of growth?

Most Popular Narrative: 16.6% Undervalued

With Cimpress closing at $72.11 against a most popular narrative fair value of $86.50, the current setup implies meaningful upside if that roadmap plays out.

Strategic investments in proprietary production technology, customer experience, and manufacturing well above maintenance levels are expected to deliver $70-80 million in incremental annualized adjusted EBITDA improvements by FY '27, setting the stage for significant margin expansion and higher operating income in future years.

Want to see what turns those investments into a higher share price? The narrative leans on faster earnings growth, fatter margins, and a richer future multiple. Curious how those moving parts combine into that fair value? Read on to uncover the assumptions behind the headline number.

Result: Fair Value of $86.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the pivot away from legacy print and heavy upfront capex could disappoint and leave revenue flat and free cash flow weaker than bulls expect.

Find out about the key risks to this Cimpress narrative.

Another Angle on Valuation

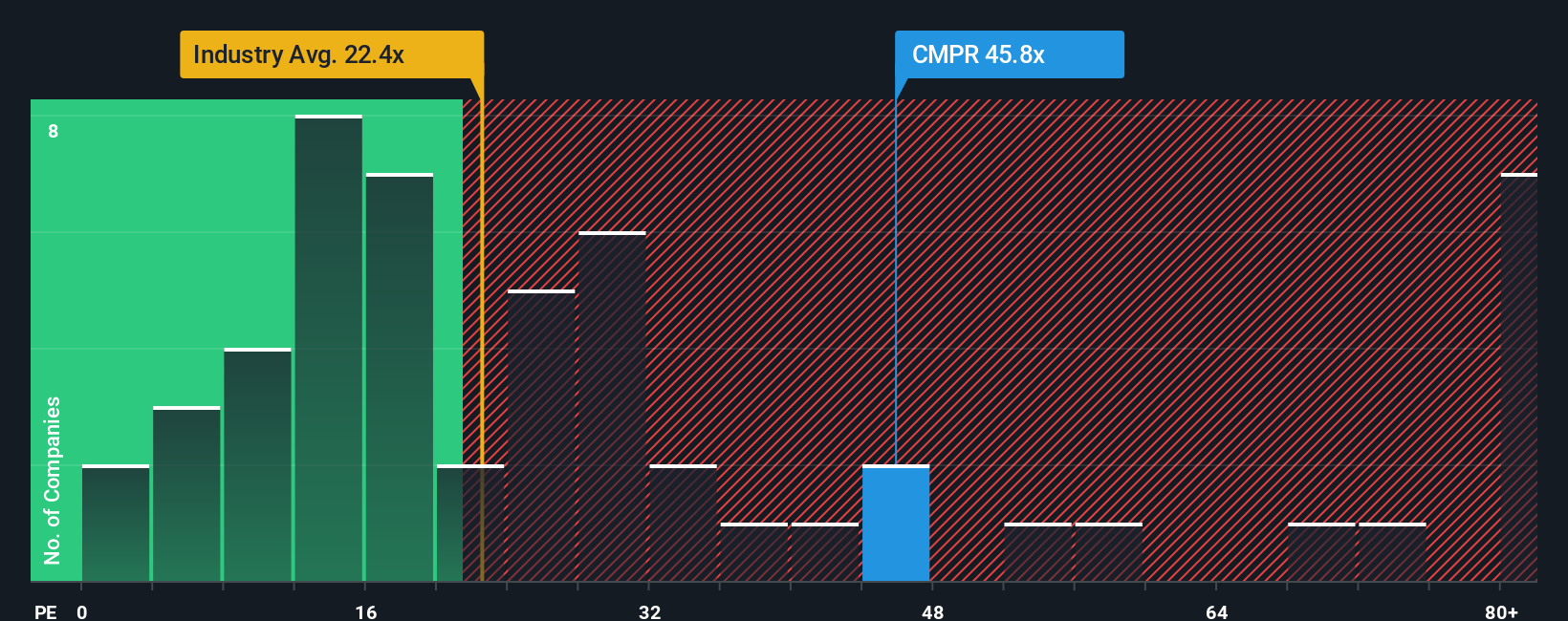

That 16.6 percent upside case sits awkwardly beside how the market is actually pricing Cimpress today. On earnings, the stock trades on roughly 50.6 times, more than double the US Commercial Services average of 23 times and well above a 24.4 times fair ratio the market could drift toward over time.

If sentiment cools or execution wobbles, that gap leaves little room for error. This could turn multiple compression into a real risk rather than a theoretical one. Are investors being paid enough for that downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cimpress Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Cimpress research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in an edge by scouting fresh opportunities with the Simply Wall St screener, so you are not relying on one story alone.

- Capture potential underpriced opportunities by targeting companies that strong cash flow forecasts suggest may trade below intrinsic value through these 910 undervalued stocks based on cash flows.

- Ride powerful technology trends by focusing on innovation driven businesses shaping automation, data intelligence, and productivity using these 26 AI penny stocks.

- Strengthen your income stream by zeroing in on reliable payers with attractive yields through these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMPR

Cimpress

Provides various mass customization of printing and related products in North America, Europe, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026