- United States

- /

- Machinery

- /

- NasdaqGS:CECO

CECO Environmental (NASDAQ:CECO) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that CECO Environmental Corp. (NASDAQ:CECO) does use debt in its business. But should shareholders be worried about its use of debt?

Our free stock report includes 4 warning signs investors should be aware of before investing in CECO Environmental. Read for free now.Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is CECO Environmental's Net Debt?

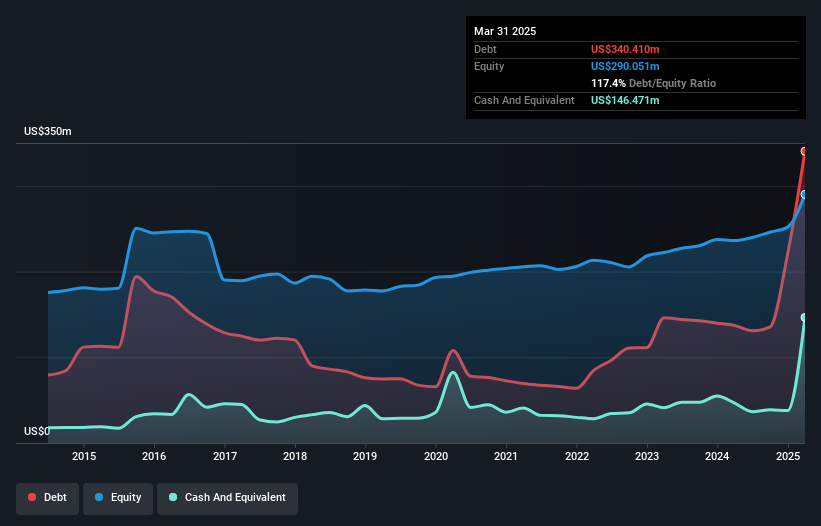

The image below, which you can click on for greater detail, shows that at March 2025 CECO Environmental had debt of US$340.4m, up from US$137.2m in one year. However, it does have US$146.5m in cash offsetting this, leading to net debt of about US$193.9m.

A Look At CECO Environmental's Liabilities

The latest balance sheet data shows that CECO Environmental had liabilities of US$278.8m due within a year, and liabilities of US$388.3m falling due after that. Offsetting this, it had US$146.5m in cash and US$235.7m in receivables that were due within 12 months. So it has liabilities totalling US$284.8m more than its cash and near-term receivables, combined.

This deficit isn't so bad because CECO Environmental is worth US$926.8m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

Check out our latest analysis for CECO Environmental

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While CECO Environmental's debt to EBITDA ratio (3.6) suggests that it uses some debt, its interest cover is very weak, at 2.4, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Even more troubling is the fact that CECO Environmental actually let its EBIT decrease by 9.3% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if CECO Environmental can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, CECO Environmental produced sturdy free cash flow equating to 51% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

While CECO Environmental's EBIT growth rate makes us cautious about it, its track record of covering its interest expense with its EBIT is no better. At least its conversion of EBIT to free cash flow gives us reason to be optimistic. When we consider all the factors discussed, it seems to us that CECO Environmental is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example CECO Environmental has 4 warning signs (and 2 which are significant) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.