- United States

- /

- Professional Services

- /

- NasdaqGS:BZ

Kanzhun (NasdaqGS:BZ): Exploring Valuation Following Strong Q3 Results and Double-Digit Growth Guidance

Reviewed by Simply Wall St

Kanzhun (NasdaqGS:BZ) just released its third quarter results, reporting sharp increases in revenue and net income compared to a year ago. The company also issued guidance projecting double-digit revenue growth for the next quarter.

See our latest analysis for Kanzhun.

Kanzhun’s upbeat quarterly results come as its stock has been on a tear in 2024, with a year-to-date share price return of nearly 60%. When reinvested dividends are factored in, the one-year total shareholder return increases to about 80%, highlighting building momentum as the company delivers strong growth and guidance.

If Kanzhun’s momentum has you thinking about what other market leaders might be out there, consider broadening your search and discovering fast growing stocks with high insider ownership

Yet with shares already soaring nearly 60% year-to-date and analysts’ targets still projecting further upside, investors must now ask whether Kanzhun is trading at a bargain or if the market has already factored in its future growth.

Most Popular Narrative: 13.1% Undervalued

Kanzhun's narrative-based fair value estimate of $25.03 stands above the last closing price of $21.75, pointing to meaningful upside potential. This sets the stage for a closer look at the underlying catalysts driving such a premium.

Operating leverage through cost control, efficiency gains from AI integration across R&D and customer service, and a robust two-sided network effect are together driving margin expansion. These factors suggest continued improvement in net margins and profitability.

Curious what assumptions lift Kanzhun’s valuation? The boldest forecasts hinge on a rising profit multiple, future revenues large enough to rival sector leaders, and persistent margin expansion. See which single financial projection holds the key to the upside narrative and why some think the price could keep climbing.

Result: Fair Value of $25.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a shrinking pool of new graduates and rising competition could limit Kanzhun’s market reach and threaten its robust profit margins over time.

Find out about the key risks to this Kanzhun narrative.

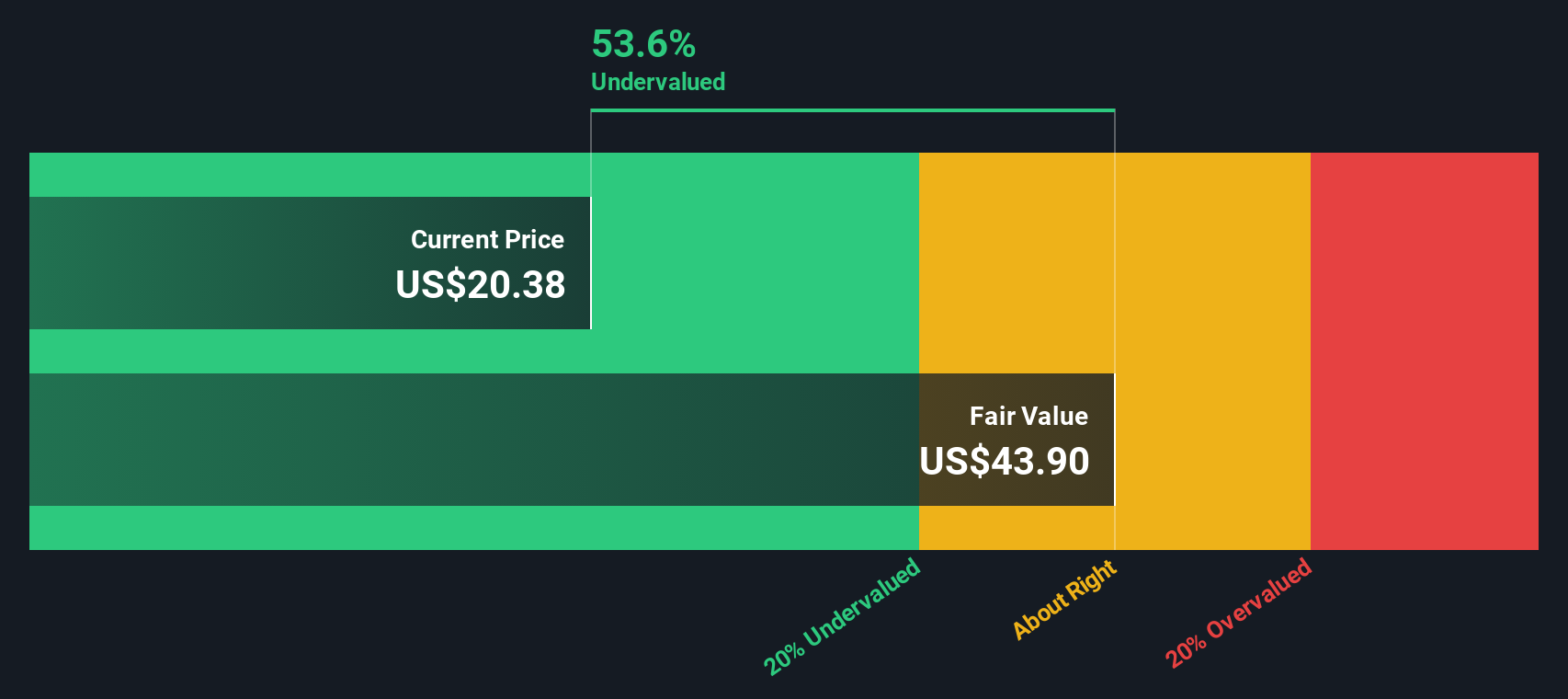

Another View: DCF Model Tells a Different Story

While market multiples suggest Kanzhun is a bit pricey compared to its peers, our DCF model paints a more optimistic picture. The SWS DCF model estimates fair value at $43.98, nearly double the current share price. This indicates significant potential undervaluation. Could the market be overlooking something critical?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kanzhun Narrative

If you have a different perspective or want to dig into the numbers firsthand, you can easily craft your own Kanzhun narrative in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kanzhun.

Looking for more investment ideas?

Missing out on the next big opportunity is never fun. Use these handpicked screens to steer your portfolio toward innovation, value, and reliable returns today:

- Find untapped potential by targeting growth with these 3581 penny stocks with strong financials, which combine solid financials and high return prospects. This approach can suit those seeking extraordinary upside.

- Accelerate your portfolio’s future by tapping into artificial intelligence trends through these 26 AI penny stocks, and get ahead of the curve as AI reshapes industries worldwide.

- Secure steady income by reviewing these 14 dividend stocks with yields > 3%, featuring consistently high-yielding opportunities designed for investors who value rewarding, stable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kanzhun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BZ

Kanzhun

Provides online recruitment services in the People’s Republic of China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026