- United States

- /

- Commercial Services

- /

- NasdaqGM:BAER

Market Participants Recognise Bridger Aerospace Group Holdings, Inc.'s (NASDAQ:BAER) Revenues Pushing Shares 48% Higher

Bridger Aerospace Group Holdings, Inc. (NASDAQ:BAER) shares have had a really impressive month, gaining 48% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

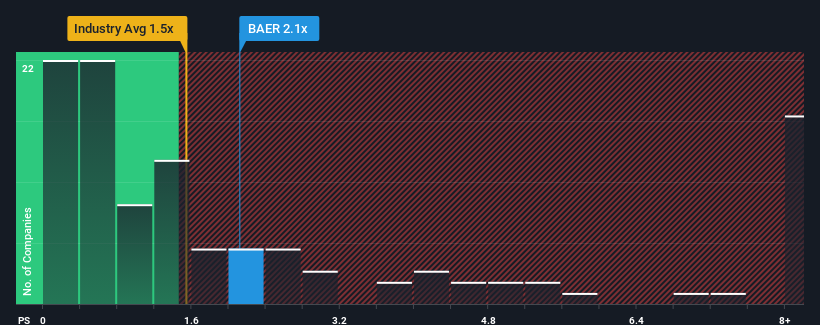

After such a large jump in price, you could be forgiven for thinking Bridger Aerospace Group Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in the United States' Commercial Services industry have P/S ratios below 1.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Bridger Aerospace Group Holdings

What Does Bridger Aerospace Group Holdings' Recent Performance Look Like?

Revenue has risen firmly for Bridger Aerospace Group Holdings recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bridger Aerospace Group Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

Bridger Aerospace Group Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. Pleasingly, revenue has also lifted 114% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 8.6% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Bridger Aerospace Group Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Bridger Aerospace Group Holdings' P/S

Bridger Aerospace Group Holdings' P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Bridger Aerospace Group Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Plus, you should also learn about these 3 warning signs we've spotted with Bridger Aerospace Group Holdings (including 1 which is a bit unpleasant).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bridger Aerospace Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:BAER

Bridger Aerospace Group Holdings

Provides aerial wildfire surveillance, relief and suppression, and aerial firefighting services in the United States.

Mediocre balance sheet low.

Market Insights

Community Narratives