- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Will ADP’s Surprising Private Sector Job Loss Shift Its Investment Narrative Amid Economic Uncertainty?

Reviewed by Sasha Jovanovic

- Automatic Data Processing (ADP) reported that US private sector employment unexpectedly declined by 32,000 jobs in September, a figure that missed analyst forecasts and drew heightened scrutiny as official government labor data remains delayed due to the ongoing federal government shutdown.

- This release has amplified ADP’s influence as a key indicator for labor market conditions, especially as investors and the Federal Reserve look for guidance amidst growing economic uncertainty and expectations for interest rate policy changes.

- We'll explore how ADP's surprising labor market data result could shape the company’s investment narrative, particularly its outlook in a softer hiring climate.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Automatic Data Processing Investment Narrative Recap

To be an ADP shareholder, you have to believe in the long-term demand for outsourced payroll and HR services, even when labor markets soften. The recent announcement of a 32,000-job decline in US private employment may influence short-term investor sentiment, but it does not materially change the company’s central growth catalysts or introduce new immediate risks to its core business. The most pressing risk remains the potential for further slowing in US payroll growth, which could limit organic revenue expansion and earnings momentum if persistent.

Of the recent announcements, ADP’s new Embedded Payroll platform stands out as most relevant in this climate. By integrating payroll services directly into platforms used by small businesses, ADP is addressing customer needs for efficiency and automation, which supports resilient demand for its core solutions, even in a sluggish hiring environment. This product initiative ties directly to ADP’s central catalyst: accelerating demand for advanced, cloud-based HR solutions that can drive higher recurring revenues.

Yet, despite these growth drivers, investors should be aware that, in contrast to the positive adoption trends, risks related to further payroll softness and retention declines...

Read the full narrative on Automatic Data Processing (it's free!)

Automatic Data Processing's narrative projects $24.3 billion revenue and $5.1 billion earnings by 2028. This requires 5.7% yearly revenue growth and a $1.0 billion earnings increase from $4.1 billion currently.

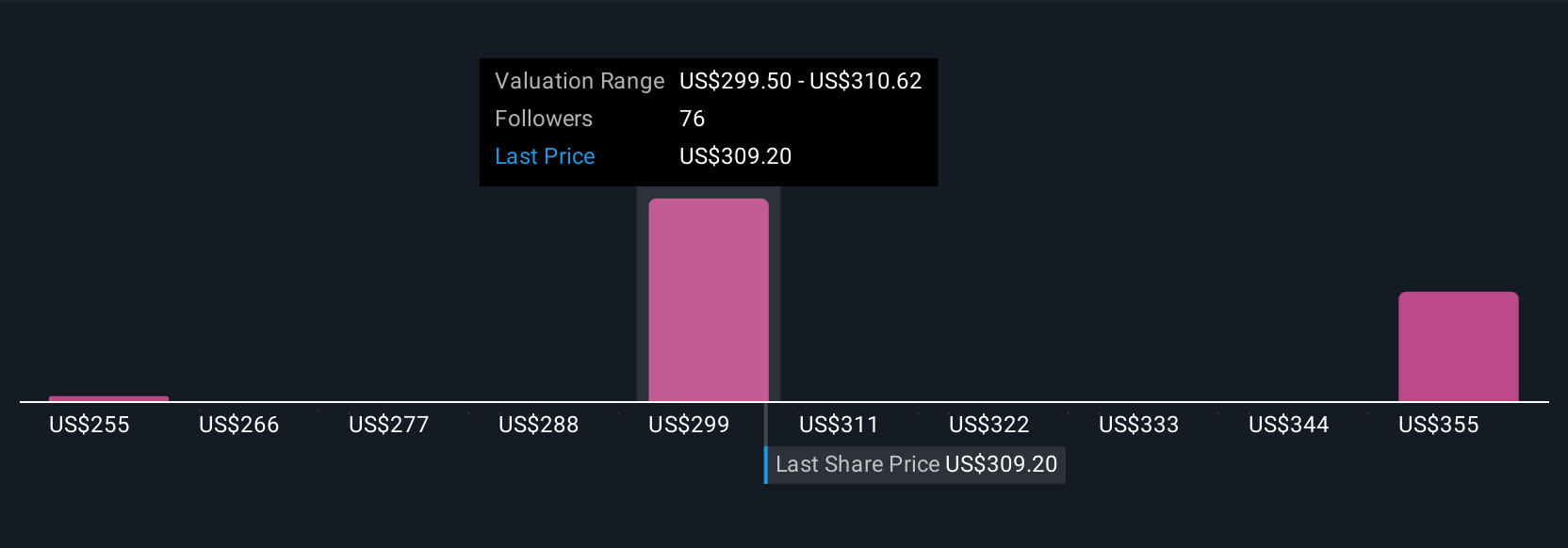

Uncover how Automatic Data Processing's forecasts yield a $318.17 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community range from US$235 to US$386.99 per share. Amid these varied opinions, slowing US payroll growth and hiring activity may weigh on future performance, so reviewing multiple viewpoints can help you take a broader view.

Explore 8 other fair value estimates on Automatic Data Processing - why the stock might be worth 19% less than the current price!

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Automatic Data Processing's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives