- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Is It Time To Reassess Automatic Data Processing (ADP) After Recent Share Price Weakness

Reviewed by Bailey Pemberton

- If you are wondering whether Automatic Data Processing's current share price reflects its underlying worth, you are not alone. Many investors are asking the same question before making their next move.

- The stock closed at US$260.44, with returns of a 2.1% decline over the last 7 days, a 1.9% decline over 30 days, a 3.0% gain year to date, a 10.1% decline over 1 year, 17.3% over 3 years, and 78.4% over 5 years. Taken together, these figures give a mixed picture of recent and longer term performance.

- Recent headlines around Automatic Data Processing have focused on its role as a major payroll and human capital management provider, as companies continue to rely on outsourced services for core back office functions. This backdrop helps frame how investors are thinking about the stock after the recent share price moves.

- On our checks, Automatic Data Processing has a valuation score of 4 out of 6. Next, we will walk through what that actually means across different valuation methods, before finishing with a framework that can help you put those numbers into a clearer long term context.

Approach 1: Automatic Data Processing Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth by projecting the cash it could generate in the future and then discounting those cash flows back to today using a required return.

For Automatic Data Processing, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is about $4.16b. Analysts provide free cash flow estimates out to 2028, with Simply Wall St extrapolating further to build a 10 year path. Within that, projected free cash flow in 2028 is $5.58b. The scenario includes a set of discounted cash flow estimates running through to 2035.

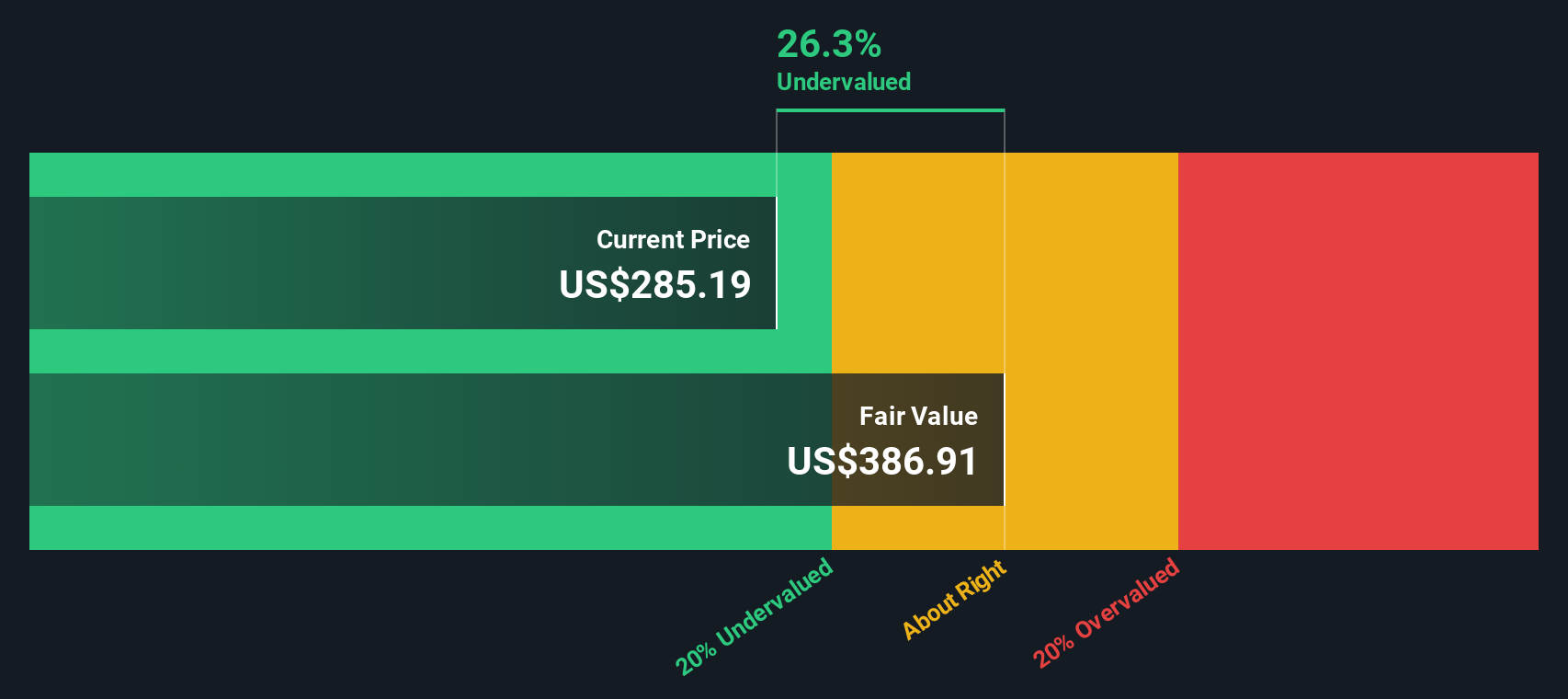

Aggregating these discounted cash flows produces an estimated intrinsic value of about US$330.65 per share. Compared with the recent share price of US$260.44, the model indicates an implied discount of around 21.2%. Under this model, the shares are currently priced below this DCF estimate.

Result: UNDERVALUED (based on this DCF model)

Our Discounted Cash Flow (DCF) analysis suggests Automatic Data Processing is undervalued by 21.2%. Track this in your watchlist or portfolio, or discover 863 more undervalued stocks based on cash flows.

Approach 2: Automatic Data Processing Price vs Earnings

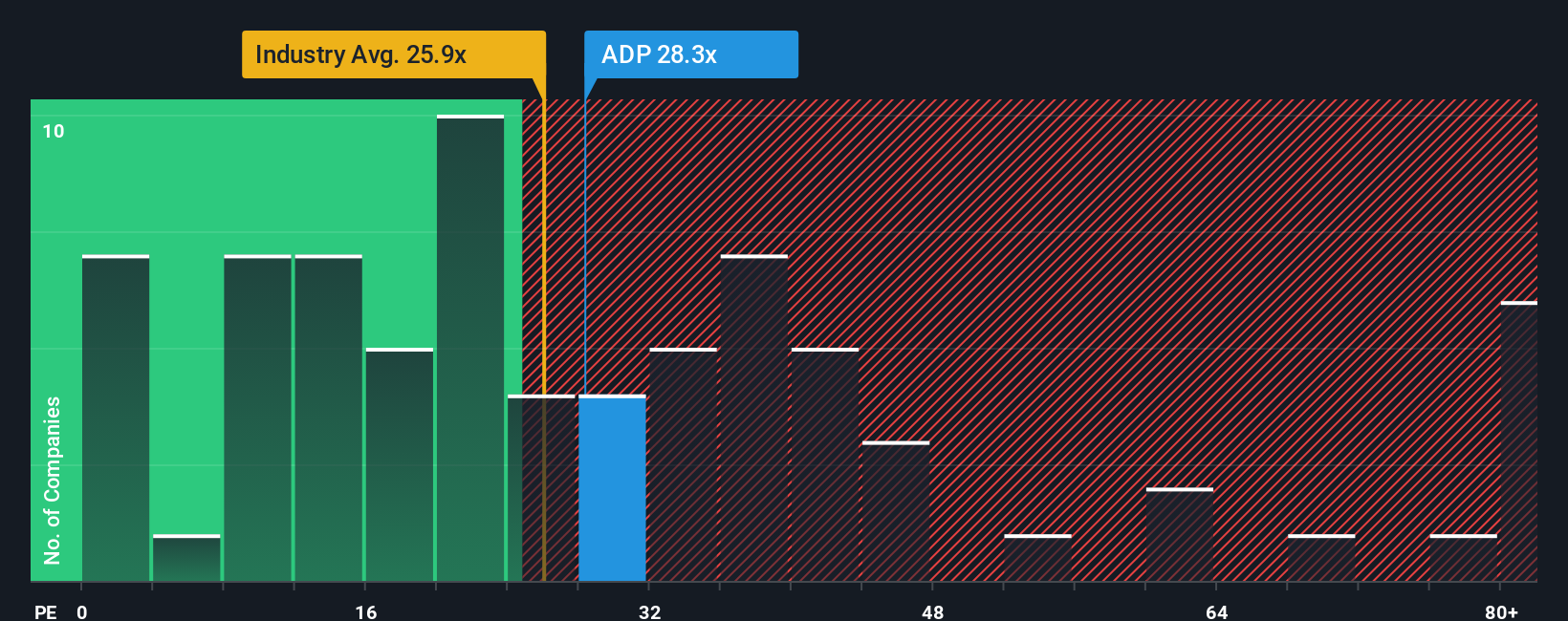

For a profitable company like Automatic Data Processing, the P/E ratio is a common way to think about what you are paying for each dollar of earnings, because it links the share price directly to the underlying profit the business is generating.

What counts as a “fair” P/E depends on how the market views a company’s growth prospects and risk profile. Higher expected growth or lower perceived risk can justify a higher multiple, while slower growth or higher risk usually points to a lower one.

Automatic Data Processing is trading on a P/E of 25.47x. That is very close to both the Professional Services industry average P/E of 24.57x and the peer average of 25.48x, so on simple comparisons the stock sits roughly in line with its sector and direct peers.

Simply Wall St’s Fair Ratio is a proprietary estimate of what P/E might make sense for this specific company, given its earnings growth profile, industry, profit margins, market cap and risk factors. This makes it more tailored than a blunt peer or industry comparison, which treats all companies in a group as if they warranted the same multiple.

For Automatic Data Processing, the Fair Ratio is 30.29x, which is higher than the current P/E of 25.47x. On this measure, the shares screen as undervalued relative to that Fair Ratio.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Automatic Data Processing Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple stories you create about Automatic Data Processing that connect your view on its business, revenue, earnings and margins to a financial forecast, a fair value and then a comparison with the current share price. All of this is done within an easy tool on Simply Wall St’s Community page that updates as new news or earnings arrive and can differ widely between investors. For example, one Narrative might anchor on a fair value near US$387.77 while another leans closer to US$289.54, giving you a clear sense of how your own view lines up against other investors’ assumptions.

Do you think there's more to the story for Automatic Data Processing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Broadcom - A Fundamental and Historical Valuation

Hims & Hers Health aims for three dimensional revenue expansion

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026