- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Here's Why Automatic Data Processing (NASDAQ:ADP) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Automatic Data Processing, Inc. (NASDAQ:ADP) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Automatic Data Processing's Debt?

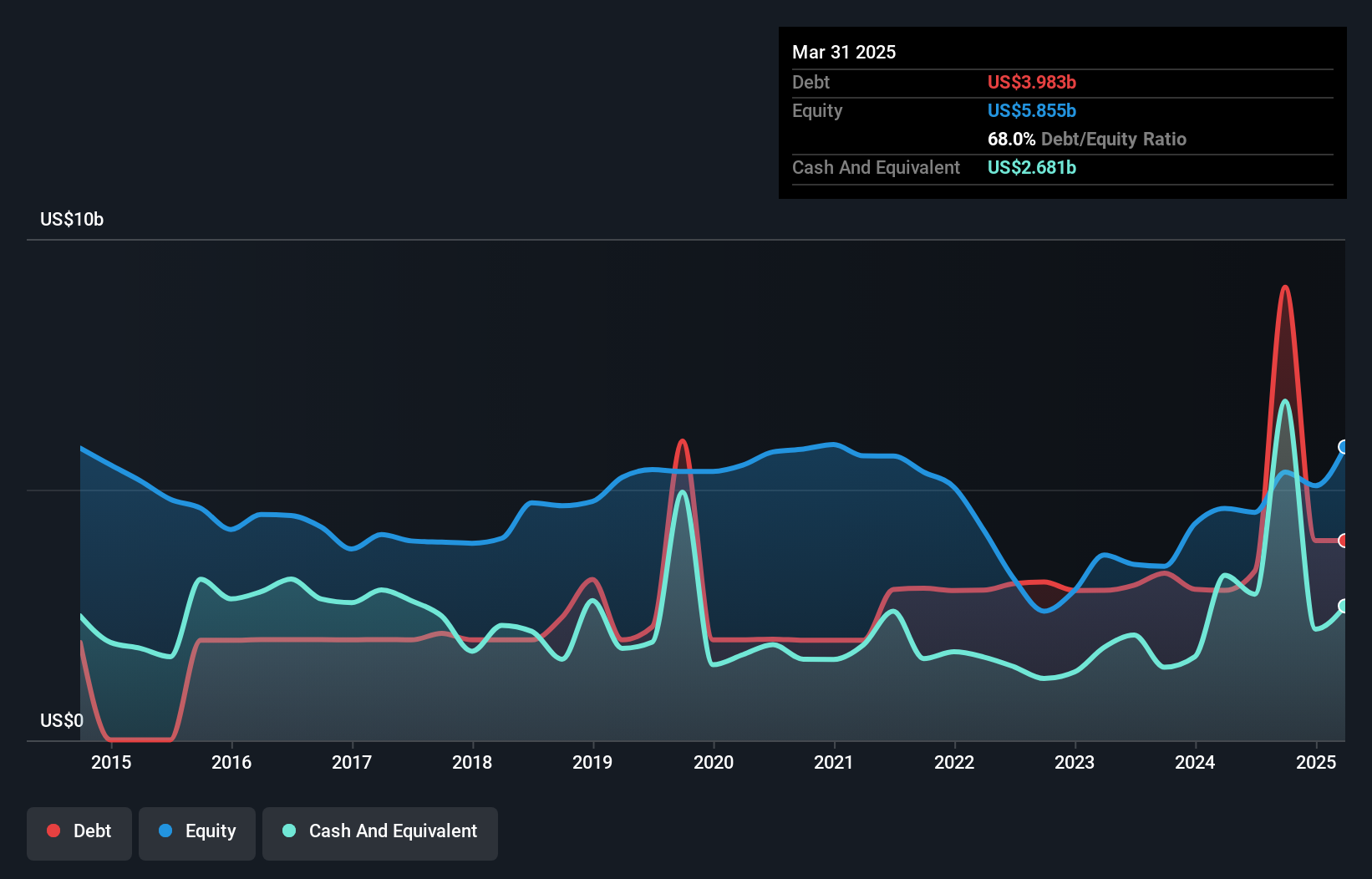

As you can see below, at the end of March 2025, Automatic Data Processing had US$3.98b of debt, up from US$2.99b a year ago. Click the image for more detail. On the flip side, it has US$2.68b in cash leading to net debt of about US$1.30b.

How Strong Is Automatic Data Processing's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Automatic Data Processing had liabilities of US$45.8b due within 12 months and liabilities of US$4.75b due beyond that. On the other hand, it had cash of US$2.68b and US$3.55b worth of receivables due within a year. So its liabilities total US$44.4b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Automatic Data Processing is worth a massive US$122.5b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Carrying virtually no net debt, Automatic Data Processing has a very light debt load indeed.

Check out our latest analysis for Automatic Data Processing

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Automatic Data Processing has a low net debt to EBITDA ratio of only 0.22. And its EBIT covers its interest expense a whopping 41.1 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The good news is that Automatic Data Processing has increased its EBIT by 9.3% over twelve months, which should ease any concerns about debt repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Automatic Data Processing can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Automatic Data Processing recorded free cash flow worth 76% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

The good news is that Automatic Data Processing's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its net debt to EBITDA also supports that impression! Looking at the bigger picture, we think Automatic Data Processing's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. Over time, share prices tend to follow earnings per share, so if you're interested in Automatic Data Processing, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Apple will shine with a 6% revenue growth in the next 5 years

NVIDIA: Durable Infrastructure in AI Leadership, but Nigh-Perfect Precision is Required

EchoStar's 43.91 fair value will redefine its market position

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026