- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Does Surprise US Jobs Slowdown And New Debt Facilities Shift The Bull Case for Automatic Data Processing (ADP)?

- Automatic Data Processing, Inc. secured new debt facilities with lenders, comprising a US$4.55 billion 364-day credit agreement and a US$2.5 billion five-year credit agreement featuring a US$500 million accordion option, replacing its prior facilities and enhancing financial flexibility for near- and long-term funding needs.

- The unexpected contraction in U.S. private sector employment, revealed by ADP’s June report, may influence investor perceptions of macroeconomic resilience and cause heightened scrutiny of ADP’s near-term growth assumptions.

- We'll examine how growing concerns over weaker U.S. job growth reshape ADP's investment narrative and analyst expectations for earnings.

Automatic Data Processing Investment Narrative Recap

To own ADP, an investor typically needs to believe in the ongoing demand for cloud-based HR and payroll solutions and the company’s resilience in shifting economic cycles. The latest report of private-sector job losses increases uncertainty around near-term earnings forecasts, making softer U.S. job growth the biggest immediate risk, while continued client retention and product innovation remain important catalysts for revenue stability; the newly-secured debt facilities have minimal direct impact on these short-term drivers.

Among recent announcements, the appointment of a new CFO stands out as highly relevant to today’s environment. A planned leadership transition can help ensure financial discipline and strategic continuity, but it introduces some execution risk just as macro conditions create questions about future demand, which is now top of mind for shareholders.

However, with increased scrutiny coming from both the market and analyst community, investors should also be aware that…

Read the full narrative on Automatic Data Processing (it's free!)

Automatic Data Processing's narrative projects $23.9 billion revenue and $4.9 billion earnings by 2028. This requires 5.8% yearly revenue growth and a 22.5% earnings increase from $4.0 billion.

Exploring Other Perspectives

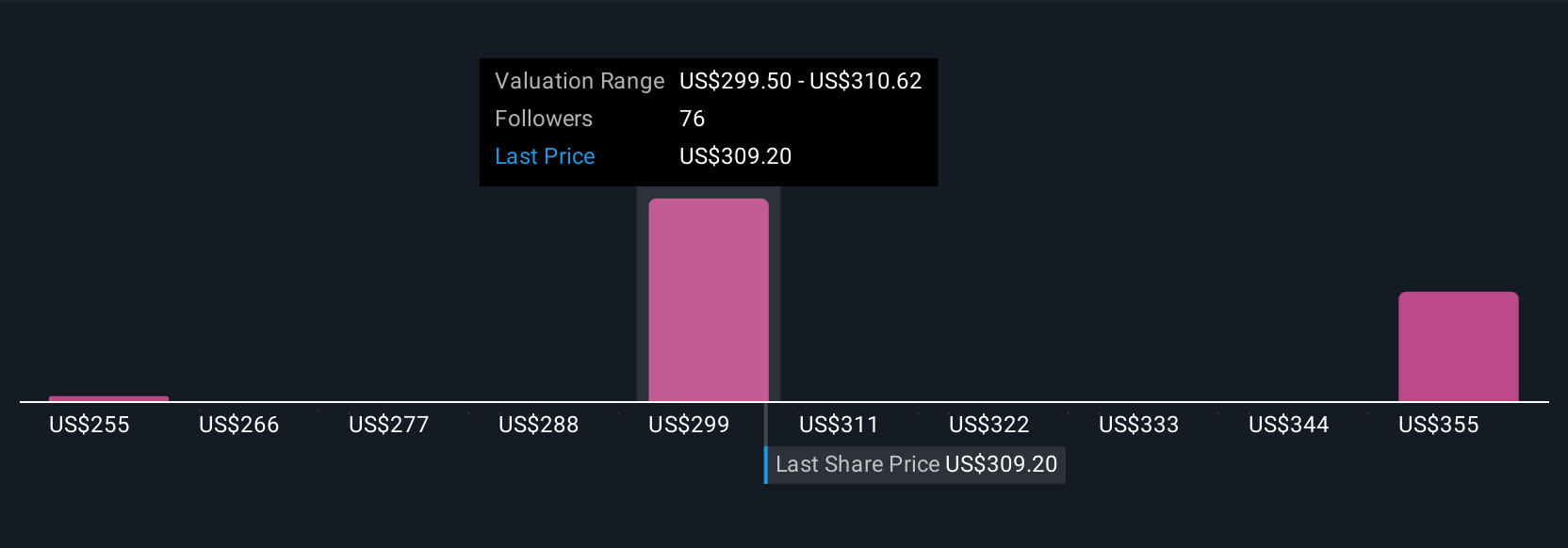

Five Simply Wall St Community fair value estimates for ADP range from US$255 to US$366 per share. In light of recent economic softness, many highlight the risk that more cautious employer hiring could pressure future revenue, opinions span the spectrum, so consider several viewpoints.

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Automatic Data Processing's overall financial health at a glance.

No Opportunity In Automatic Data Processing?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Engages in the provision of cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives